Save money for rainy days.

The habit of savings improves your present and future financial life.

The right amount of savings every month keeps you financially secure throughout life.

Such wise quotes inspire people to develop a habit of saving money. But most of them don’t know about the right amount to save each month. Do you know how much of your income should you save every month?

Not sure? No problem, this article is going to reveal how much amount you should save each month. It also contains some of the most frequently asked questions that’ll help you understand the concept of savings in a better way.

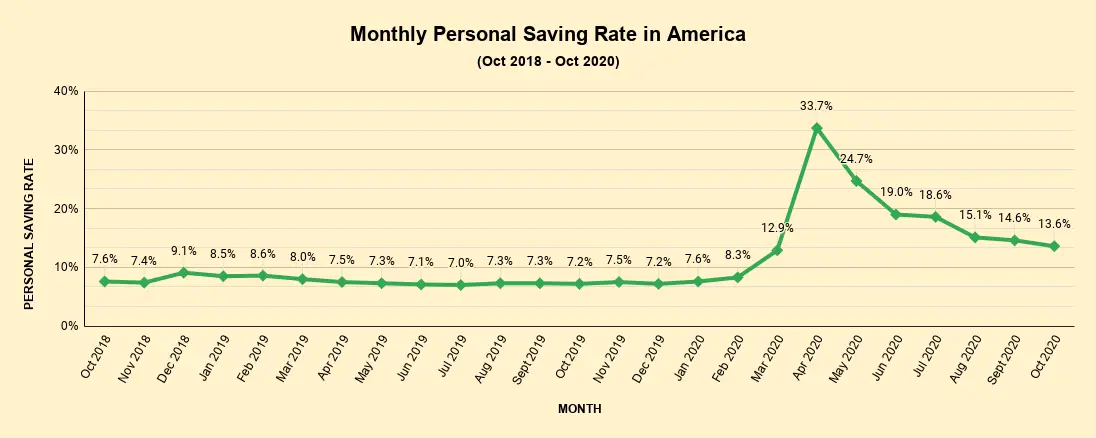

Source: Statista.com

Reasons to Save Money

Do you decide to save money after reading some inspirational quotes?

It’s right, but it shouldn’t be the only reason to get into the habit of savings. You should have your objectives to save money. Some common reasons for which most people save money are:

- Striving for financial independence.

- Aspiring to own a car or home in the future.

- Clearing debts for financial freedom.

- To cover annual expenses like vehicle maintenance, buying gifts, fixing appliances, minor repairs at home, and others.

- Being prepared for unforeseen and unexpected expenses such as job loss or sudden home repairs.

- Safeguarding against sudden medical emergencies.

- To live a better life.

The purposes of saving money usually vary from individual to individual. Don’t worry if your reasons are not present in the above list, instead focus on learning about the right amount of income to save every month.

What’s the Right Amount of Income to Save Every Month?

The upfront answer is that you should save 20% of your monthly income. However, it doesn’t apply to all individuals because the right amount of savings rate depends upon your income, expenses, and short as well as long-term financial goals.

Suppose that your monthly income is only sufficient to cover your expenses per month. In this case, you won’t be able to save 20% of your income.

Let’s consider another scenario where you earn a lot more than your monthly expenses. In this case, you can save more than 20% of your monthly income.

Then why 20% is presented as the ideal savings rate?

To understand this, you should first understand the 50-30-20 budgeting rule.

What is the 50/30/20 Budgeting Rule?

This rule gained popularity after Elizabeth Warren’s book, All Your Worth: The Ultimate Lifetime Money Plan. According to this rule, your income after tax must get divided into three proportions – 50%, 30%, and 20%. It means individuals should:

- Spend 50% of their income on living expenses, such as bills, rents, mortgages, groceries, transportation costs, and others.

- Spend 30% of their income on non-essential expenses (lifestyle choices and wants), such as dining out, buying a new handbag, purchasing an advanced gadget, and others.

- Distribute 20% of their income among saving and investment products, such as funding a savings bank account, contributing towards IRA, investing in mutual funds, and others.

Why Save 20% of the Income?

After learning about the 50/30/20 budgeting rule, you might be curious to know whether it is appropriate to save 20% of your income.

Well, nobody can force you to save 20% each month. Depending on your financial condition and circumstances, your savings rate can be higher, lower, or zero. The objective should be to get into the habit of savings.

Are you still wondering whether the 20% rule is feasible?

Yes, it works most of the time, especially in the long run. Many experts also favor this rule and say that if you consistently save 20% of your income every month, you’ll achieve financial independence at the right time.

Let’s understand the rule of 20% with the help of an example:

Suppose that you are 20 years old and earn $1,000 per month. Inspired by the 20% rule, you decide to save 20% of your income ($200) every month. And the duration you have in mind is 40 years. It means you are planning to save $200 per month for the next 40 years. Let the return you get on your savings is 5%.

| 40 | $2,400.00 | $14,862.69 | $96,000.00 | $210,475.71 | $306,475.71 |

| YEAR | YEARLY DEPOSITS | YEARLY INTEREST | TOTAL DEPOSITS | TOTAL INTEREST | BALANCE |

|---|---|---|---|---|---|

| 1 | $2,400.00 | $66.00 | $2,400.00 | $66.00 | $2,466.00 |

| 2 | $2,400.00 | $192.17 | $4,800.00 | $258.17 | $5,058.17 |

| 3 | $2,400.00 | $324.79 | $7,200.00 | $582.96 | $7,782.96 |

| 4 | $2,400.00 | $464.19 | $9,600.00 | $1,047.16 | $10,647.16 |

| 5 | $2,400.00 | $610.73 | $12,000.00 | $1,657.89 | $13,657.89 |

| 6 | $2,400.00 | $764.77 | $14,400.00 | $2,422.66 | $16,822.66 |

| 7 | $2,400.00 | $926.68 | $16,800.00 | $3,349.34 | $20,149.34 |

| 8 | $2,400.00 | $1,096.88 | $19,200.00 | $4,446.22 | $23,646.22 |

| 9 | $2,400.00 | $1,275.79 | $21,600.00 | $5,722.01 | $27,322.01 |

| 10 | $2,400.00 | $1,463.85 | $24,000.00 | $7,185.86 | $31,185.86 |

| 11 | $2,400.00 | $1,661.53 | $26,400.00 | $8,847.39 | $35,247.39 |

| 12 | $2,400.00 | $1,869.33 | $28,800.00 | $10,716.72 | $39,516.72 |

| 13 | $2,400.00 | $2,087.75 | $31,200.00 | $12,804.47 | $44,004.47 |

| 14 | $2,400.00 | $2,317.36 | $33,600.00 | $15,121.83 | $48,721.83 |

| 15 | $2,400.00 | $2,558.70 | $36,000.00 | $17,680.53 | $53,680.53 |

| 16 | $2,400.00 | $2,812.40 | $38,400.00 | $20,492.93 | $58,892.93 |

| 17 | $2,400.00 | $3,079.08 | $40,800.00 | $23,572.01 | $64,372.01 |

| 18 | $2,400.00 | $3,359.40 | $43,200.00 | $26,931.41 | $70,131.41 |

| 19 | $2,400.00 | $3,654.06 | $45,600.00 | $30,585.47 | $76,185.47 |

| 20 | $2,400.00 | $3,963.80 | $48,000.00 | $34,549.26 | $82,549.26 |

| 21 | $2,400.00 | $4,289.38 | $50,400.00 | $38,838.64 | $89,238.64 |

| 22 | $2,400.00 | $4,631.62 | $52,800.00 | $43,470.26 | $96,270.26 |

| 23 | $2,400.00 | $4,991.37 | $55,200.00 | $48,461.64 | $103,661.64 |

| 24 | $2,400.00 | $5,369.53 | $57,600.00 | $53,831.17 | $111,431.17 |

| 25 | $2,400.00 | $5,767.03 | $60,000.00 | $59,598.20 | $119,598.20 |

| 26 | $2,400.00 | $6,184.87 | $62,400.00 | $65,783.07 | $128,183.07 |

| 27 | $2,400.00 | $6,624.09 | $64,800.00 | $72,407.17 | $137,207.17 |

| 28 | $2,400.00 | $7,085.78 | $67,200.00 | $79,492.95 | $146,692.95 |

| 29 | $2,400.00 | $7,571.09 | $69,600.00 | $87,064.04 | $156,664.04 |

| 30 | $2,400.00 | $8,081.23 | $72,000.00 | $95,145.28 | $167,145.28 |

| 31 | $2,400.00 | $8,617.47 | $74,400.00 | $103,762.75 | $178,162.75 |

| 32 | $2,400.00 | $9,181.15 | $76,800.00 | $112,943.90 | $189,743.90 |

| 33 | $2,400.00 | $9,773.66 | $79,200.00 | $122,717.56 | $201,917.56 |

| 34 | $2,400.00 | $10,396.49 | $81,600.00 | $133,114.05 | $214,714.05 |

| 35 | $2,400.00 | $11,051.18 | $84,000.00 | $144,165.23 | $228,165.23 |

| 36 | $2,400.00 | $11,739.37 | $86,400.00 | $155,904.60 | $242,304.60 |

| 37 | $2,400.00 | $12,462.77 | $88,800.00 | $168,367.36 | $257,167.36 |

| 38 | $2,400.00 | $13,223.17 | $91,200.00 | $181,590.54 | $272,790.54 |

| 39 | $2,400.00 | $14,022.49 | $93,600.00 | $195,613.02 | $289,213.02 |

Your total monthly deposits in 40 years will be $96,000. If you earn an interest of 5% per year, your savings will grow to around $306,475.71 by the time you reach 60 years. It means the interest earned on your savings will be $210,475.71. Thanks to the power of compound interest for making it so big.

This example shows that saving 20% of your income every month can make you financially secure when you are 60.

How to Make the Most of Your 20% Income?

The above information might have helped you understand what percent of income to save each month and why this figure makes sense. Now, let’s find out how to make the most of your savings (or 20% income).

Make a Budget and Follow It

When people don’t plan their expenses, saving 20% of the income looks like a dream. But savings become a lot easier if they make a budget and follow it.

You can evaluate your credit card and bank records to identify your expenses. You’ll be able to find the essential and non-essential ones. Based on your findings, make a budget and follow it. This way, you can cut back on non-essential expenses and boost savings.

Remain Away from High-Interest Debt

It is widely known that high-interest debt wipes away a big slice of earnings. Most of these debts require monthly repayments, which means sacrificing your savings plans.

You must remain away from high-interest debt, such as credit card debts and other short-term loans. The best you can do is pledge not to borrow more than your risk-taking capacity. Your objective should be to keep debt repayments on the lower side.

Make an Emergency Fund

One of the best ways to start with the habit of savings is by allocating a small part of your income to an emergency fund. An emergency fund not only helps you remain calm in financially-tense situations but also protects your investments.

In addition to your daily or monthly expenditures, some expenses are unexpected and unwanted. For example, medical emergencies and sudden car repairs can occur anytime in life. Make sure that a small part of your income goes to an emergency fund every month.

Contribute to Retirement Savings

As people don’t have to pay taxes on retirement savings, they love contributing to retirement saving schemes like 401 (k) and IRA. Experts say that you can achieve your financial goals quite easily by maximizing retirement savings.

You must make the best retirement strategy according to your age. If you are an employee somewhere and have access to a 401 (k) plan, use it to your advantage. If not, you can save for retirement via IRA (Individual Retirement Account).

Invest in the Stock Market

Investing a part of your savings into the right Stocks, Mutual Funds, or/and ETFs enhances your financial status. You can look forward to investing in the stock market.

You can make a lot of money in stocks but before buying stocks, make sure you understand the key factors to consider while buying a stock and research thoroughly. If you have never invested directly in Stocks before, investing in Mutual Funds/ Index Funds/ ETFs would be a better idea.

Frequently Asked Questions

Let’s explore some of the frequently asked questions related to savings:

1. How can I start with savings?

The following steps can help you to start with savings:

- Evaluate your current financial condition. Find out how much you earn and what expenses consume your monthly income the most. You can also make a list of your essential as well as non-essential monthly expenditures.

- Based on your evaluation, decide the amount of money you can save each month. It must be an amount you can save comfortably.

- Make sure you set saving goals. For example, I’ll be amassing this much money in the next 11 years to purchase an electric car or start a business.

- If you remain busy or forget things often, automate savings. It would be advantageous if your savings get deducted before expenses.

- Stick to the savings commitment you made to yourself.

These are some general steps. You can increase or decrease according to your circumstances and financial responsibilities.

2. What to do if my expenditures exceed my monthly income?

When your expenditures exceed your monthly income, you can look forward to these options:

- Increase your income

- Decrease your expenses

Out of the two, decreasing your expenses is something you can achieve without difficulty. So, analyze your spending and find how you can reduce your monthly expenditures.

3. I can’t save 20% of my income every month, but I want to save. What should I do?

It’s good that you have a positive attitude towards saving money. Don’t worry if you can’t save 20% of your income because you are not alone.

In this case, you can start small and take inspiration from these:

- Whenever you get loose change after shopping for groceries and other things, throw it in a jar. Make sure you deposit it in your savings account once a year.

- Take steps to decrease your electricity and water bills by unplugging inactive appliances, turning off the tap while shaving or brushing your teeth, using cold water to wash your clothes, etc.

- Try to avoid eating outside. When you cook and eat meals at home, you not only save money but confirm that healthy food enters your body.

- Try to cut out unusable paid subscriptions, such as magazines, web services, etc.

- Automate your savings. Let the money deposit automatically per week, month, or quarter, in your savings account.

Final Words

Money Saved Is Money Earned. The habit of savings always enhances your financial capacity. There is no rule that you have to be a high earner to save a part, or 20%, of your income. The only thing you need is a commitment to save money and take positive steps toward achieving it.

If you have doubts about your current saving habits, get in touch with a certified financial expert. He or she will help you find your ideal savings rate based on your current income and financial goals.

Disclaimer: All information on this page is general. It might not be suitable for every person looking forward to saving money. You can use this information as guidance to get into the habit of saving money and becoming financially sound. We suggest consulting your financial advisor before making the final decision.