Do you have any idea of how you are going to retire – rich or like a mediocre person with loads of debt?

Have you made any investments that will help you retire rich, without any financial worries?

If your answer to such questions is NO, it’s time to convert them into YES and start making investment plans for your retirement.

A retirement investment strategy looking fruitful for a 20-year-old individual won’t be equally effective for some 40-year-old person. So, while making such a strategy, confirm that it is according to your age.

Whatever be your current age, make sure you have a retirement investment strategy and are following it rigorously. You should always remember that a successful one will take all the financial burden off your shoulders when you are old and not working.

Today, with the help of this guide, you are going to learn some of the best retirement strategies by age. But before learning about them, we must know which assets are most suitable for this purpose.

![What are the Best Retirement Investment Strategies? [By Age] What are the Best Retirement Investment Strategies? [By Age]](https://thefinancesection.com/wp-content/uploads/2020/12/What-are-the-Best-Retirement-Investment-Strategies-new.jpg)

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/what-are-the-best-retirement-investment-strategies-by-age/

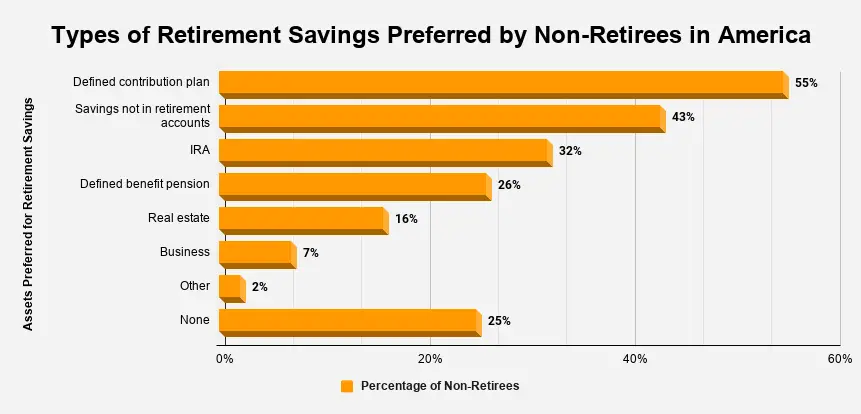

Best Assets for Retirement Investment Strategies

To make a retirement investment strategy, you must be knowing about the assets most suitable to park your money. Let’s see which asset classes you can consider:

There are many more asset classes, but these are the best to include in a retirement investment strategy.

Source: Report on the Economic Well-Being of U.S. Households in 2017 – May 2018

The risks and returns associated with one asset class are usually different from another. It is because of their nature and the overall performance of the economy. Let’s understand it with the following examples:

Example 1: There is positivity in times of economic growth. Investors are very confident. They pull money out from the bond market and put it into equities.

Stocks/equities provide higher returns when the economy grows.

Example 2: When economic growth slows, investors start losing confidence. Negativity and fear lead them to pull the money out of stocks and invest it in bonds.

Whenever the economy slows, the bond market act as a haven for investors.

Why Invest in Different Asset Classes?

It is a common question asked by most people before making an investment strategy.

Do you know why?

There are often reports that XYZ asset has given a massive return, or ABC has made millions from investing in this stock. Such reports and news lead people to think that instead of investing in multiple asset classes, investment in a single asset will provide them with huge returns.

It’s not right to think like this. Suppose that an asset class has given double-digit returns in the past ten years. Expecting that it will perform like this in the future, you place all your money in it.

Because of some awkward economic circumstances, that asset class tanks. Instead of getting massive returns, you will lose your capital also. This investment will make sure that you retire poor. Do you want this?

Nobody wants this. That’s why the best investment strategy should include investments in multiple asset classes. The process of investing your money in such a way is called diversification, and it helps you not to lose all your capital if one asset class tumbles.

Best Retirement Strategies by Age

Below are some retirement strategies for people belonging to different age groups. Whether you are in your 20s, 30s, 40s, or 50s, they might help you achieve your retirement goals.

If You’re in your 20s

When people are in their 20s, most of them think that it’s too early to plan for retirement. Many of you have graduated and might be busy repaying your education loan. It also becomes one of the circumstances that stop you from making retirement-related investments.

If you are working and have access to a 401(k) plan, make use of it. You can also set up an Individual Retirement Account (IRA) and start adding some amount to it regularly. The governing body, IRA, has established a maximum limit of $6,000 per year (for the current year) on contributions made via IRAs.

Presently, the maximum amount you can contribute to a 401(k) plan is $19,500 per year. In some 401(k) plans, the employer also contributes a certain percentage of the employee’s salary.

Assets to Look For

It’s good that you own the best life insurance policy for young adults, but it won’t cover your expenses after retirement. You’ll require more money to defeat inflation and live a financially sound life at that time.

Whether you are contributing to a retirement account or not, you can always invest in certain assets and get exceptional returns at your retirement.

Your approach can be aggressive at this time. The best will be to place your money in Stocks and Bonds. You can invest 80% – 90% of your money in Stocks and 10% – 20% of the remaining amount in Bonds.

Derivatives can also contribute to your retirement. If funds are not an issue, use a part of your capital to trade derivatives.

If You’re in your 30s

Reaching 30s for most people means no need to care about graduating, beginning a career, and repaying the student loan. But it doesn’t mean the end of worries.

The United States Census Bureau reveals that the average age of marriage in America is 28-29 years. It means domestic concerns, like buying a house, raising kids, funding their education, and others will start surrounding you now.

Despite these concerns/responsibilities, make sure you contribute at least 10% – 15% of your income towards retirement. If you have access to a 401(k) plan, make the maximum use of it. It would be better if you contribute maximum to your IRAs as well.

Assets to Look For

You need to start looking for safe investment options. So, the best retirement investment strategy for people in their 30s would be to invest 70% – 80% of their money in Stocks and the remaining 20% – 30% in Bonds.

If you have sufficient funds or your income is high, Real Estate can be a good investment option for you. In addition to this, you can also look forward to trading Commodities.

If You’re in your 40s

When people do not make investments for retirement till the age of 40, it usually means either their earnings have been less or expenses more. If you have not started yet, it’s time to be serious about making an investment portfolio for retirement.

Being in your 40s means you are at your career’s midpoint and full of responsibilities at the workplace as well as home. Whether you are saving money for your child’s college or paying the mortgage, make sure investing for retirement is your priority.

If your previous investments are providing good returns, stick with them. It is also the time to make maximum use of your IRAs and 401(k) plan.

Remember, it is not the time to mess with your money. If you are unsure about anything, consult your financial advisor and discover which assets can be most helpful to you.

Assets to Look For

In the 40s, it won’t be a good idea to have an aggressive approach equivalent to that of someone in his/her 20s. But you can still look for instruments that can help you beat inflation.

The best you can do is invest 60% – 70% of your capital in Stocks and the remaining 30% – 40% in Bonds. As you grow old, your investment in safe assets should increase.

If You’re in your 50s

Once you reach the age of 50, retirement is not too far, and being serious about your investments for retirement is the only option left.

You can also see this age as the time to evaluate what you have and what could be the best time for retirement. If you can solve this, things would be a lot easier when you retire. Consulting a professional to seek the right time for retirement will also be a good step.

If you have been an aggressive investor in the past, it’s time to focus on more stable and conservative investments. It would be better if you make a shift towards money markets and bonds.

To help you get maximum at the time of retirement, the Internal Revenue Service (IRS) allows adding more funds to the 401(k) plan and IRAs for individuals aged 50 and above. According to the latest information (available in 2020), you can contribute an extra $6,500 to your 401(k) plan.

It means the total amount you can contribute in a financial year is $19,500 + $6,500 = $26,000. And for IRAs (traditional as well as Roth IRA), this amount is $7,000.

Assets to Look For

Now, it’s too late for an aggressive approach. Make sure you place most of your money in safe and risk-free assets.

In your 50s, take a 50-50 approach. It means invest 50% of your capital in Stocks and the remaining 50% in Bonds. In stocks also, avoid the aggressive ones and put your money only in the low-risk opportunities.

If You’re in your 60s or 70s

By this time, most of you might have retired or might be retiring soon. It’s the time to shift your attention from investments and returns to income. If you have been making aggressive investments in the past, stop that and make sure most assets in your current portfolio provide you a regular income.

It is also the time to check and start taking RMD (Required Minimum Distribution) from the retirement accounts. If you delay withdrawing eligible RMDs, you might have to face a 50% penalty on the withdrawable amount.

When individuals with an IRA account don’t require money, they can retain their contribution and let it grow for their heirs.

Assets to Look For

Reaching the age of 60 or 70 doesn’t mean you must separate yourself from Stocks. It means you must minimize your investment in stocks.

The best investment strategy at this age would be to put 30% – 40% of your money in dividend-paying Stocks and 60% – 70% in Bonds.

Things to Consider for a Stress-Free Retirement

Whether you’re in your 20s or 50s, you always have a chance to retire happily. To ensure a stress-free retirement, you must consider the following things:

- Retirement Age: Depending upon your preference and the bank balance/money you have, decide at what age you should retire.

- Financially Sound at Retirement: Recheck your investments and make sure that you’ll be financially sound at the time of your retirement.

- Age of Retirement Savings: It needs a bit of calculation. Take your time and try to find out the age of your retirement savings. In other words, find how long will your retirement savings last.

- Lifestyle after Retirement: You might be living in a hi-tech city at present, with access to all the latest gadgets, but want to shift to a peaceful town after retirement and free yourself from digital addiction. Decide what kind of lifestyle you would like to live after retirement.

Final Words

A financially sound retirement is the dream of every individual, but only a few succeed. Those who make retirement investment strategies and follow them rigorously often retire rich. Also, those who start retirement savings early gain more than those beginning late.

A good thing with retirement investment strategies is that you can prepare them at any age, whether you are in your 20s, 30s, 40s, or more. If you face difficulty in creating a strategy, get the help of a financial advisor. He or she will help place your money in the right assets at the right time.

Disclaimer: The information and retirement investment strategies on this page are general suggestive approaches. They might not be suitable for every person of every age. You can use them as guidance for creating retirement investment strategies according to your risk profile, circumstances, and expectations. We suggest consulting your financial advisor before making the final decision.