The internet is full of stories about people making a fortune by trading or investing in stocks. Such narratives inspire many people to earn big via the stock market.

Can you make a lot of money in stocks? This question comes, at least once, to the mind of every individual looking forward to trading the stock market or before making a fortune via stocks/ shares/ securities.

This article is going to clarify whether you can earn big via stocks. In addition to this, you’ll also gain vital information beneficial for making money through the stock market. In the last, some of the most frequently asked questions will help in clarifying your doubts.

Is It Possible to Earn Big via Stocks?

Yes, you can make a lot of money by trading/investing in stocks.

But how? How to make a lot of money in stocks?

Now, this is the real question. Well, there are ways to help you earn big via stocks, and you’ll learn some of them in this article.

Understanding the Basics

You might be knowing that before starting with anything new, it is crucial to gain basic knowledge about it. The same applies when you aim to earn a lot of money by trading/investing in stocks.

Here is the most basic information you must know before starting your money-making journey through stocks.

• What are Stocks?

Stocks, another name given to the shares, securities, or equities, represents the fractional ownership of a company/corporation. The buyer of these securities is known as the shareholder and gets ownership rights as well as profits depending on the number of shares held.

• What is the Stock Market?

Also known as the share market or equity market, it is a marketplace where buyers and sellers come together to trade different financial instruments such as shares of companies, mutual funds, bonds, derivatives, and others.

An efficiently functioning stock market creates an environment for economic development where companies can raise capital from the public/investors quickly and easily.

• What is the Stock Exchange?

A constituent of the stock market, it is the platform that facilitates you to trade stocks of companies and other financial instruments. You can buy or sell a stock or other financial instrument if it is listed on the stock exchange.

For example, the New York Stock Exchange (NYSE) is a premier stock exchange in the United States. To access the list of stock exchanges in America, click here.

• How the Stock Market Functions?

The functioning of a stock market is quite simple to understand. You can think of it as an auction market where buyers and sellers come together and negotiate the price of securities to make trades.

The stock market comprises of exchanges such as NYSE, Nasdaq, etc. Companies are allowed to list their shares on these exchanges via the IPO (Initial Public Offering) process. When interested investors purchase shares through the IPO route, companies succeed in raising money to grow.

Once stocks of a company get listed on exchanges, it becomes easy to buy or/and sell them. The role of stock exchanges is to track the supply and demand of listed securities, which eventually helps in determining the buying and selling price of each stock.

How to Make A Lot of Money in Stocks?

After recalling the basics, it’s time to find ways to make a lot of money in stocks. There is no hidden secret or rocket science to earn money through this route; being disciplined and remembering a few things is enough.

1. Research before Starting

Research should be the first thing on your mind if your goal is to make a lot of money in stocks. If you are sure of the things to look for when investing in a company, then only move forward. Remember a simple thing – If you can’t explain it, don’t put your money in it.

When it comes to researching individual stocks, start with their industry presence. Find out what the company does, whether it fits into its industry, learn about its leadership, and look for any obstacles that the company has to face in the future.

2. Invest At Regular Intervals

According to your financial capability, you should invest a specific amount of money in stocks at regular intervals. This way, you won’t remain out of the market and never miss any up-move or selling opportunity.

Yes, there will be downward movements as well, but you can look at them as buying opportunities. The best you can do is skip buying individual stocks at regular intervals and sign up for a fund comprising of stocks, funds, or other securities. In such funds, a pre-decided amount of money gets invested at a regular frequency.

Today, there are numerous funds available. You can research and chose the most suitable one. This kind of approach resembles intelligent investing and will keep you away from making emotional as well as speculative trades.

3. Give Your Investment Time to Grow

There are ways to make money in the stock market in the short-term, but the real gains come when you remain invested for a long time. In the long run, compound interest plays a crucial role in appreciating your capital significantly. If you want to earn a lot of money through the stock market, give your investment time.

Sometimes, you’ll find people suggesting to invest and forget. They are correct because you earn a lot in the long run only. When you invest for a short duration, you will suffer losses in case there are any severe market dips.

Mostly it is seen that if you invest for the long-term, even serious dips reverse with time. Moreover, short-term capital gains attract higher taxes.

4. Remain Prepared for High Risk/Reward Situations

Sometimes sudden fall or rise (because of any reason) in a stock’s price are the situations when you can make or lose money quickly. These are high risk/reward situations, and you must remain prepared to benefit from them.

The best you can do is use a small part of your capital and think that you have already lost this amount. This way, you won’t have any regrets even if the trade fails. If it goes in your favor, you can be grateful for that additional income. Remember, the trades made during risk/reward situations are highly speculative.

5. Keep Updating Yourself

The world of stocks is something where you can learn new things each day. So, it is better to keep yourself updated. You can go through the books, views, and practices of famous investors and update your investment strategies based on them.

You can follow and take note of things happening in the stock market. Do not believe anything promising immediate gains, and try to learn (seek guidance) from the mistakes made by other investors.

Why Do People Fail to Make Money In Stocks?

The stock market is a money-making machine that’ll help earn a fortune. Many people think like this and start trading/investing without any preparations, which, of course, is not the right way.

Many such missteps do not let people make money in stocks. Let’s see some of the common failure-causing mistakes investors make:

1. Letting Emotions Eclipse Judgment

Usually, people are driven by their emotions while dealing with stocks. Fear, greed, and other such emotions affect their decisions or decision-making capabilities negatively.

Some examples include investing heavily in a single stock, buying the shares of an unknown company (yes, without researching), making a risky investment with borrowed money, and so on.

2. Ignoring The Business And Focusing On The Stock Price

Focusing on the stock price and ignoring the business is another mistake people make while investing in stocks. Sometimes the price of a stock rises or falls because of temporary fluctuations. If you lose your calm and invest in such situations, there’ll be a risk of losing all your capital.

That’s why experts suggest focusing on business rather than the stock’s price. Proper understanding of business aids in:

- Enhancing your decision-making ability regarding trends

- Decreasing risks

- Identifying the correct timing to buy or sell the stock

- Predicting the future performance of the stock

Next time you invest in stocks, make sure your focus is business rather than the stock’s price.

3. Following Others

A common mistake people make in the stock market is following others. If a person (be it a friend, family member, or someone else) puts his money in something, another person follows that.

This practice is called herd mentality, and you can’t trust it in the long run. As trades made this way are influenced by others’ actions and not backed by solid research, investors often lose money.

The best you can do is evaluate your risk-bearing capacity and do/follow technical analysis and research before investing.

4. Lacking A Disciplined Approach

As investment in stocks is a risky process, you must be very careful while making a buying or selling decision. Any negligence might result in heavy losses.

A disciplined approach paves the way to success. Most investors forget (or don’t know) about this and try to ride the stock market in a casual manner. Eventually, failures and monetary losses welcome them.

When you aim to earn a lot in stocks, follow a disciplined approach in addition to researching and analyzing various factors required before investing.

5. Trying To Time The Market

When people try to time the market, they often don’t get the desired results. Most of them think the market has fallen or risen a lot, so the best time to buy or sell a stock is now.

Well, the truth is that no one can always predict the exact lows and highs in the stock market. If some people think they can time the market perfectly every time, their journey in the stock market might not be fruitful or won’t last long.

Instead of trying to time the market, you can succeed by flowing with the waves. You should do thorough research, set your buying or selling targets, and trade.

Frequently Asked Questions

When it is about earning through the stock market, people are never out of queries. Explore these FAQs and find out if you also have similar questions.

1. How much can you make from stocks in a year?

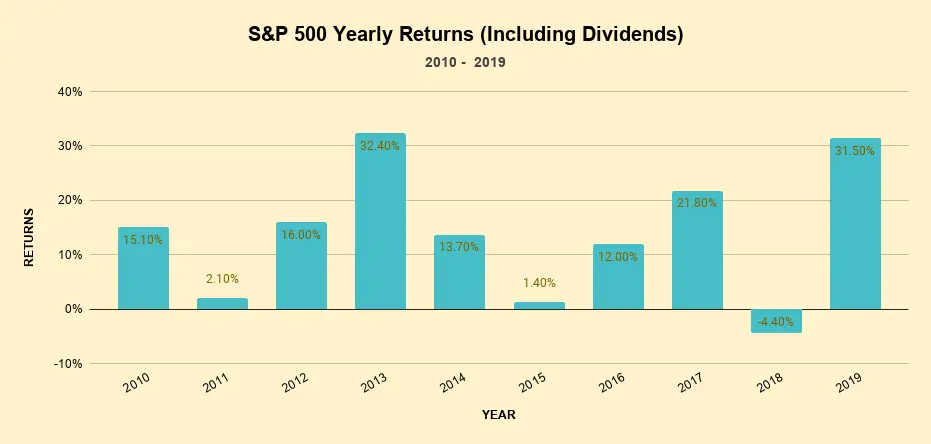

It depends upon the capital you infuse into the stock market. In the past, the average return from the stock market has been around 7% – 10%. It doesn’t mean the yearly returns from stocks are never negative.

Source: https://www.berkshirehathaway.com/letters/2019ltr.pdf

If you remember the subprime crisis or the dot-com bubble, the stock market witnessed negative yearly returns during those times. Note that the average returns in the above paragraph include negative returns as well.

2. How do you profit from stocks?

Usually, you profit from stocks in three ways – trading, capital appreciation, and dividends.

- Trading: The process of buying and selling, or vice-versa, stocks with an objective to earn money in the short-term is called trading.

- Capital Appreciation: It happens when you buy and hold stocks for a long time. Their value increases over time, and you get handsome returns on your investment.

- Dividend: It is the part of profit companies distribute among their stockholders. It is paid depending on the number of shares/stocks held by an investor. Note that all companies do not issue dividends.

In addition to these, activities like issuance of bonus shares, stock splits, and others also help you earn profit from stocks.

3. Will automating my investments benefit me?

If you follow a disciplined approach while investing in the stock market, you probably will make a lot of money without automating your investments. You may need to automate your investments if:

- you try to time the stock market

- you forget to invest regularly

Automating investments is advantageous as it often helps you earn more money.

4. Do I need to trade full-time to make money from stocks?

Unless you are a day trader, there is no need to trade full-time because a day trader monitors the stock’s moves several times during the trading session.

5. I purchased stocks of a company. At present, they are trading below my buying rate. Should I buy more?

Instead of buying more, you should give it a little more time. During this time, you can research and analyze the stock again. If you see the potential, then only buy more. And if the investment horizon is long-term, most chances are that it’ll rebound.

Conclusion

You can make any amount of money in stocks. Just remember researching, analyzing, having a disciplined approach, and avoiding common mistakes other investors make. Doing so will help you emerge as a winner and earn a lot of money in stocks.

Disclaimer: All information and ways to earn money in stocks on this page are general suggestive approaches. They might not be suitable for every person trading/investing in the stock market. You can use them as guidance for earning money in stocks. We suggest consulting your financial advisor before making the final decision.