Despite tons of information/data available today, finding the right stock is still the prime challenge most investors face. In financial instruments such as bonds, considering only the credit quality can work. But everything is not so easy in the case of stocks.

If you have decided to earn a lot of money by investing in stocks, it’s time to learn about the factors to be considered while buying a stock.

Whether you are a new investor or waiting to make it big through stocks, your aim should be to pick a value and invest in it. So, start reviewing the available data and determine whether a particular stock is suitable for investment.

What? It’s arduous, not your cup of tea.

In this case, the best you can do is explore this guide and learn about factors essential for buying value stocks. It also answers a few frequently asked questions helpful in selecting the right investment stocks.

Key Factors to Consider When Buying A Stock

You may come across many people asking – what information should you research before you invest? However, it was not the case some time back.

If you go back a few decades, the biggest problem individual investors used to face was the scarcity of information/data. To access information about a stock, subscriptions to costly services was the only option.

However, the situation is different nowadays. Thanks to technology and the internet, today’s investors can access free and real-time data/information by just clicking a mouse button.

But, correct evaluation of this information is also a big hurdle in identifying the right investment. Here are certain key factors you can consider when buying a stock:

1. Nature of Business

Before investing in a company, check the nature of its business. Find what the company is into and whether its current projects and policies will ignite growth in the coming time.

Evaluate the industry outlook and research thoroughly before making the final decision. In simple words, invest if you are sighting the potential.

2. Business Model

A company with a profit-generating, unique business model is nothing less than a gem for investors. You can also prefer companies with a diversified commercial base and less cyclical.

Some company’s business model makes sure the company performs well during economic booms as well as recession. You can aim to find such companies and invest in them.

3. Management

The management of a company matters a lot in predicting how its stock will perform in the future. Find:

- Whether the people in charge are managing it effectively?

- Are higher officials competent and have innovative minds?

- Was the company involved in any scandal in the past? If yes, will it affect its future growth?

Note that some scandals do not harm companies in the long run. If you’re sure that the company will overcome it in the future, its current share price will be a great buying opportunity.

4. Earnings

You should look for companies showing earnings growth year on year. You can avoid infrequent hiccups caused because of a recession, pandemics like COVID-19 recession, and others.

When you look at the company’s growth, compare it with the major competitors. Also, make sure it is in harmony with the industry trend. If the company is growing steadily and consistently over time, you can expect it to perform better in the future also.

5. Stability

Every company faces good times and bad times. It may underperform sometimes, and its stock might lose value. Such incidents are natural and most common during economic difficulties.

You should evaluate its overall stability concerning the economic environment. Does its share price fluctuate a lot whenever any economy-related news surface? If yes, beware of its stock. But you can consider stocks of a company that loses stability because of economic conditions.

6. Price-to-Earnings Ratio

When your aim is value investing, Price-to-Earnings (P/E) ratio holds utmost importance. It reveals how well the price of a stock is doing with respect to the company’s earnings. In other words, it is the comparison of the current share price of a company with its per-share earnings.

It is easy to calculate the P/E ratio on your own. Just divide the current share price of a company by its Earnings Per Share (EPS).

Suppose that the share of a company is currently trading at $50 and its EPS (Earnings Per Share) is $5. Then, the P/E ratio of this company will be 10.

When the P/E ratio is higher, you can expect the stock to outperform in the coming times. However, it shouldn’t be the only deciding factor before buying a stock. You can also compare the P/E ratio of a company with its peers.

7. Return on Asset (ROA)

Return on Assets (ROA) shows the profitability of a company in relation to its overall assets. Evaluation of ROA tells you whether the company’s management is utilizing its assets efficiently (to generate earnings) or not.

If you want to calculate the ROA of any company, divide its net profit with total assets. When buying a stock, compare the company’s ROA with its peers. If the ROA of the company you are planning to invest in is higher, go for it.

8. Debt-to-Equity Ratio

Almost every company carry debt on their balance sheet. Even the most successful and wealthiest companies have certain liabilities. It doesn’t mean every company with debt is good. An investor should always avoid those with large amounts of debt.

Before buying a stock, you must explore the balance sheet of a company. Look at its assets, liabilities, and debt-to-equity ratio. Usually, stocks of companies with a debt-to-equity ratio lower than the industry’s average are considered less risky.

If you want to be more specific, consider your risk-tolerance capacity. When your risk tolerance capacity is low, you must go for a company with 0.30 or less as the debt-to-equity ratio. If you can take higher risks, invest in companies with a high debt-to-equity ratio.

9. Net Margins

Net Margins (Net Profit Margins) of a company reveal how efficiently it can squeeze profits from sales. You can calculate it by dividing the company’s net income by sales.

There are companies with low net margins (engaged in the grocery business, etc.) and high net margins (engaged in the software business, etc.). Those with low net margins generate profits by driving a lot of revenue, whereas those with high net margins generate more profits.

As an investor, you should look for stocks of companies having net margins higher than their competitors and industry average.

10. Return on Equity (ROE)

Return on Equity (ROE) helps you measure the financial performance of a company. When evaluated carefully, it lets investors identify whether a company is a profit creator or burner. You can calculate ROE by dividing the Net Income of a company by Shareholder’s Equity.

If the ROE of a company is growing steadily over time, it means the company is generating profits without adding extra equity capital to the business. However, look for underlying reasons if you find a company’s ROE significantly higher than its peers.

Suppose that the current ROE of a company is 10%. It indicates the company’s annual earnings can’t go beyond 10% without borrowing additional capital.

11. Dividends

Companies that pay dividends are considered better and stable. However, investors must be cautious of businesses with high dividend yields. It might be a sign of upcoming instability.

Moreover, the companies that pay higher dividends might be distributing most of the profits amongst investors. Instead of dispensing most profits, companies should reinvest in the business.

Before buying a stock, you should look for companies paying a moderate amount of dividend. Ignore the ones paying most of the earnings as dividends.

Frequently Asked Questions

After learning about the factors to consider when buying a stock, several questions might be coming to your mind. Before you, many people also had queries regarding this topic. Let’s find answers to some of the most frequently asked questions.

1. Why should I buy a stock?

Stocks/shares play a significant role in wealth creation. Whatever be your short-term or long-term financial goals, stocks can help you make a lot of money. And that money can help you comfortably achieve all your financial objectives. But you need to be cautious while buying stocks because any wrong move can condense or erode your initial capital entirely.

2. Where should you research a company before investing?

It’s a very important question because any wrong piece of information while researching a company/stock might hurt you financially. Some common sources of information are news channels (business), print media, and the internet.

If you have an account with a brokerage firm, it’ll provide you with relevant tools to fetch genuine information about a company/stock. You can use them to research a company before investing. Most brokerage firms research companies and prepare detailed reports for their clients. If you are a registered client, you’ll get those reports directly to your email.

If you don’t have access to tools from a brokerage firm, you can visit the websites of companies, exchanges, brokerage firms, or stock research sites and access the information you need. You can also initiate a direct search on Google. Mostly, the top results will contain what you need.

3. How to research a stock before you buy?

Depending upon the financial goals, the ways to research a stock might be different for different investors. After determining your financial goals, you can research a stock considering the factors mentioned in this article.

4. Is investing in the stock market worth it?

You may come across many people asking questions like:

- Whether investing in the stock market will be advantageous?

- Is investing in the stock market a good idea?

- Is it safe to invest in the stock market?

When people jump into the stock market without preparations and research, they often lose money. Their miserable journeys make others, especially newbies, scared of the stock market. That’s why you come across such doubts.

Well, investing in the stock market is worthwhile if you make informed decisions and invest your money in the right stock at the right time. Research thoroughly, consider crucial factors, and consult your financial advisor (if necessary) when buying stocks.

5. Can stocks help me in retiring rich?

Yes, investments in the stock market can help you retire rich. In fact, stocks are a crucial part of the best retirement investment strategies. Your money invested in fundamentally-sound stocks at an early age can grow enormously by the time of retirement.

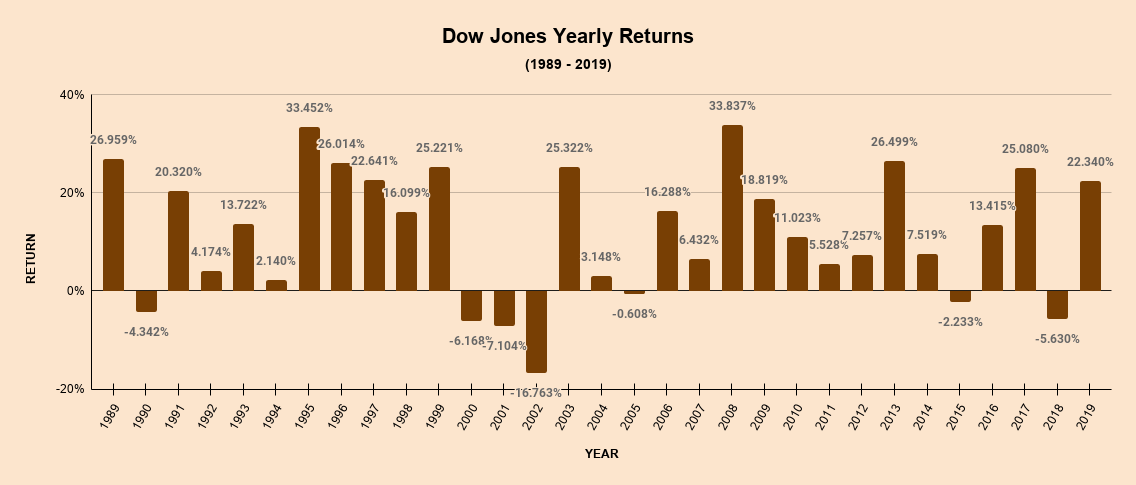

Source: Yahoo Finance

6. Can I invest in index funds?

Entering the stock market through index funds or mutual funds is a wise idea if you are new and want to profit from the stock market.

The returns will be less than what you can get through direct investments in stocks. However, being less risky than stocks, investment in index funds can be a better option for novice investors.

You must remember the following:

- Investors can lose their entire capital if they invest in stocks, index funds, or other market-related instruments without researching.

- Gather, and go through as much information as you can about the index fund you are looking to purchase.

- Do not invest your entire capital in a single financial instrument, even if it is an index fund.

Final Words

Whether your objective is to make money in the short-term or create a significant amount of wealth in the long run, stocks can help you achieve it. For that, you must consider certain factors and research thoroughly before buying stocks.

Chances of becoming super-rich via stocks maximize when you research thoroughly, make a strategy (considering your financial objectives), and invest accordingly. If you feel the need to consult your financial advisor, don’t hesitate.

Disclaimer: All information, including factors to consider when buying a stock, on this page is general. It might not be suitable for every person looking forward to buying a stock. Investors should not buy any stock considering only one factor. You can use these factors as guidelines for finding a suitable stock. We suggest consulting your financial advisor before making the final decision.