People wish to do this and that if they get large amounts of money. But when they acquire this money in real, their priorities usually change.

After receiving large amounts of money, most of them prefer investing it first and then fulfill their wishes with returns received from that investment. Experts also say that it is the smartest thing to do with your money – make more money with the accumulated money.

If you have also received a lot of money recently and now looking for the best way to invest it, this article is for you. All the information and suggestions available in this guiding article will help you find the best ways to invest your money and gain maximum benefits from it.

Lastly, you’ll come across some frequently asked questions related to investing a large sum of money. All this will clarify most of your doubts and put you in a position to make the right investment decision.

Before You Invest

There are certain things you need to take care of before investing a lump-sum amount. You must:

• Make Yourself Ready to Receive Money

You are going to get a large amount, but are you prepared to receive it? You must decide, in advance, in which bank account you would like it to be credited. Later you’ll be investing that amount, so make sure the bank rules don’t cause any problem while withdrawing.

• Consult A Financial Advisor

If you are not good at researching and finding ways to invest a large sum of money, it makes sense to consult a Certified Financial Planner (CPE). He may charge you a small fee, but his advice will be much better than that of bankers, stockbrokers, and insurance advisors. All these get a commission when you make any investment through them, which means their advice might not be in your favor.

• Determine Your Goals

It would be a good idea to determine your financial goals before making a lump-sum investment. This process involves answers to questions about the money. For example:

- How do you want to utilize that amount?

- Do you require it sooner or later?

- How much return are you expecting?

- What is your risk-taking capacity?

When you are aware of your financial goals, making a lump-sum investment becomes easy.

• Spend Some of It (If You Want)

Investing is a wise decision, but nobody forces, or can force, you to invest all of it. You can spend some of it. For example:

- If any of your appliances are not working, use the money to buy a new one.

- If you want to upgrade your wardrobe, go for it.

- If you want to go on a vacation, spend some of your money.

Top 5 Ways to Invest Large Amounts of Money

As the financial needs of each person are diverse, one investment strategy might not fit all. That’s why we are introducing you to different options to park your large payment. You can go through them and decide which one suits you and your financial needs the most.

1. Pay Off the Mortgage/Debt

When you receive a lump-sum payment, you can use it to pay off the mortgage or any other long-term debt that involves interest. Doing so will free you from debt and give more money in your hand. Let’s understand this with an example:

Suppose that Mary has borrowed an amount of $25,000 at 5% per annum, which she must repay in the next six years. This year she is going to receive a bonus of $37,000 from her company. If she uses $25,000 from the bonus to pay off the debt, she can save around $8,300 in interest.

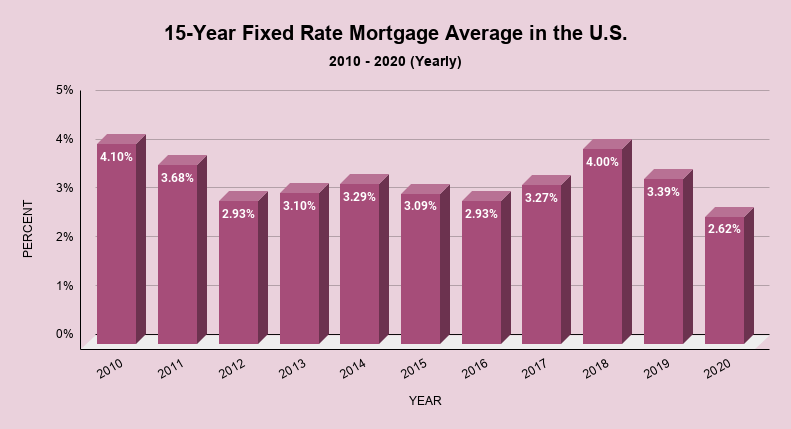

Source: Freddie Mac

When it comes to paying off the long-term debt, decide after evaluating the interest rate. Make sure you find answers to the following questions:

- Are you charged a fixed or floating rate of interest?

- If the interest rates are floating, do you expect them to rise in the future?

- Is it affordable or more than your capacity?

- Will you benefit by repaying the debt?

Depending on your debt type and financial situation, the number of questions may vary.

2. Create an Emergency Fund

In today’s time of uncertainty, most people create and maintain an emergency fund. You can deposit a certain amount of cash in a bank savings account and decide not to use it unless any financial emergency occurs.

Make sure you research a little and select a savings account offering the highest interest on deposits. The amount you can deposit in an emergency fund depends upon your earnings and expenses per month. Usually, it is the amount that can easily cover your expenses for 2-6 months.

It is never a good idea to use the money in your emergency fund to upgrade your wardrobe, buy new appliances, fund a vacation, and others. Instead, keep it in the form of readily-available cash for overcoming situations like injuries, serious illnesses, being without a job, loss in business, etc.

3. Invest in the Stock Market

You can also decide to invest that amount in the stock market. In the list of highest return providing instruments, stocks rank quite higher. If stocks are poised to show sustainable growth and expected returns look attractive, invest in them.

Make sure you are aware of, at least, the basic things to look for when investing in a company. Some people do not like approaching the stock market directly, so other attractive options for them can be Bonds, Mutual Funds, and Exchange Traded Funds.

Besides attractive growth and returns, there are two more things you must consider while investing in stocks:

- Risk Tolerance: Before investing in the stock market, a person must find his/her risk tolerance. People risking more may get higher returns on their investment, but they are also the ones losing maximum when the stock market dives.

- Tax: Find out the amount of tax you’ll be paying on your earnings. If your calculation is showing handsome after-tax returns, invest in stocks.

You can go further by taking account of your expenses and inflation. For this, some of you might require the help of a financial advisor.

4. Let it Grow for Retirement

Many companies help people contribute towards a 401 (k) plan, or some people themselves fund an Individual Retirement Account (IRA). If your contributions equal the maximum limit per year, it’s good. If not, you can transfer a lump-sum amount towards your retirement.

The money in a retirement fund grows fast because of the compound interest. If you are depositing a lump-sum in your retirement fund, rest assured it’ll earn higher interest than other financial instruments. In addition to this, you also get tax benefits by contributing to a retirement fund.

5. Create and Fund a Health Savings Account

One of the major concerns in the United States is rising healthcare costs. Since they are growing faster than inflation, a health savings account helps big.

HSAs provide financial advantages such as the cash you deposit in such an account is tax-free. Moreover, your withdrawal from an HSA account will also be tax-free if your spending is a qualified medical expense.

Many people avoid this type of account but realize it’s worth in times of an injury or severe illness. Health savings account with sufficient funds protects your savings and financial assets when medical emergencies occur.

How You Get Large Amounts of Money?

If someone gets a lot of cash, there must be a source. Let’s find out the most common sources people get large amounts of money from:

• Inheritance

Many people, especially millennials, get a large sum of money from an inheritance. According to the Coldwell Banker study, the number of people with inherited money will increase in the coming time. In most cases, inherited money comes from parents and sometimes from relatives.

• Bonus Received at Work

If you work in a company that cares about its employees, you’ll receive a bonus for achieving targets. The workplace bonus is often a large amount (lump-sum) of money issued once per year. Bonuses usually give people the reason to think about what to do with a large sum of money.

• Selling A Business

When people sell their business, the buyer usually settles the deal with a single payment. This amount is large and handled through an electronic transaction or a one-time check payment to the seller’s bank account.

• Investments for Retirement

When people work upon the best retirement strategy as per their age, they get a large sum at the time of retirement. Most investments give retirees the option to withdraw their money as a single large payment or in the form of installments. This scenario is the same for people working in companies/organizations and contributing a part of their income to retirement funds.

• Selling A House/ Property

Whenever you sell a house or property, the payment is often a lump-sum. If you are not interested in buying another property with that money soon, you must find ways to invest that amount.

• Insurance or Legal Claim

If you are on the receiving side of a big insurance claim, you’ll have a large amount of money in your bank account. The same happens when you win a legal battle (related to receiving money) or lottery.

Depending upon your circumstances, there can be many other sources through which you can receive a fortune.

Frequently Asked Questions

In the quest to learn the best way to invest large amounts of money, people get many doubts. Let’s discover some of the most frequently asked questions in this context.

1. Should I invest all my money at once or a little bit at a time?

Both the options are available, but which way to go mostly depends on your financial goals.

First, find what you want to achieve with the help of that money. Then, evaluate available investment options and identify whether a lump-sum investment will provide sufficient returns to help achieve your financial goals.

If not, you can park your money in a savings account and invest a part of it. After some time, when the investment scenario is right, invest more. Continue like this until you’re sure of meeting your financial goals.

Though the future is unpredictable, some studies and experts suggest that a lump-sum investment is better because the cost of waiting can, sometimes, be too high.

2. Can I invest all my money in only one financial instrument?

It is not a good idea to invest all your money in a single financial instrument as it might not provide sufficient returns to meet your financial objectives.

Suppose that you invest all your money in government securities. It is the least risky investment, but the inflation-adjusted return it provides might be insufficient for you.

On the other hand, there are many risks when you invest large amounts of money in the stock market. If the economic environment is not favorable or the companies perform poorly, you can even lose your capital.

The best is to make a portfolio consisting of different financial instruments efficient enough to help you meet your short-term and long-term financial objectives.

3. What investment options can be the best bet for me?

Again, the best investment depends upon your financial goals. However, you can look forward to the following:

- High-yielding Savings Account

- S&P Index Funds

- Money Market Account

- Nasdaq 100 Index Funds

- (Certificates of Deposit) CDs

- Treasury Bills

- Corporate Bond Funds (Short-term)

- Government Bond Funds

- Municipal Bond Funds

- Stocks

As you’ll be investing a large sum of money, most suggestive options are less risky.

Final Words

It’s good to have large amounts of money, but finding ways to invest that amount is often challenging. You should identify your financial goals and evaluate investment options currently available. After that, you can lay your money in instruments expected to enhance your financial life and brighten your financial future.

Since it is about investing a lot of money, you can get in touch with your financial advisor or, better, take the help of a reliable Certified Financial Planner (CPE).

Disclaimer: All information, including ways to invest large amounts of money, on this page is general. It might not be suitable for every person looking forward to making a lump-sum, or partial, investment. You can use this information to invest your fortune the right way. We suggest consulting your financial advisor before making the final decision.