For a usual person, investing in a company reflects his or her belief in its business, management, work culture, the products or services it offers, and its plans to achieve growth in the future.

But for a winner, investing in a company means thoroughly analyzing the key factors/things and only then putting his or her money to buy the stocks of that company. Buying stocks is also the simplest way to not only invest in a company but also become one of its owners.

What things do I need to look for while investing?

You, probably, might be having the same question in your mind. Well, its answer and other crucial things regarding investment in a company are available in this guide.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/what-things-do-you-need-to-look-for-when-investing-in-a-company/

Why Invest in A Company?

When it comes to investing in a company, there can be many reasons. Some of them are:

- To earn a handsome return on your investments

- To get dividend which will also act as a passive income

- To enjoy ownership rights given to the shareholders of a company

- Because you think that diversifying your money into multiple financial instruments will keep you financially safe during a recession or economic downturn

- Because you have confidence in the management/leadership and support their ideas to do/operate the business

- Because you find that a company’s stock price is undervalued and expect it to grow in the future

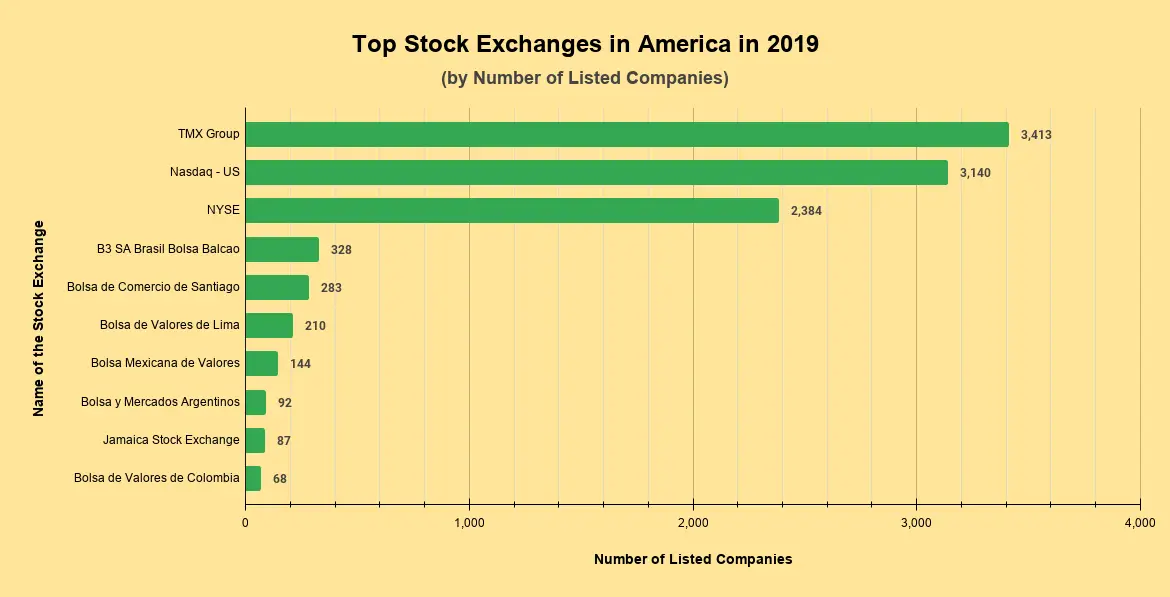

Source: www.statista.com

Before Investing in A Company

There are certain things you must consider before investing in a company. Being sure about them means you are ready to make an investment and benefit from it. These should be your considerations:

What Financial Goals Do You Want to Achieve?

You need to be aware of your financial goals before investing in a company. Experts say that your investment should meet your financial goals, not others’.

Are you investing because you want to purchase a new car after three years, buy a house/property after ten years, pay for your child’s college fees after 15 years, or you just want to retire rich? Whatever be the reason, make sure your financial goals are clear and achievable. The best you should do is resolve all your financial goals-related concerns first and then invest.

How Much Can You Risk?

If the risk capacity of your friend is $100,000, it doesn’t mean you should also risk that much amount. Find out what is your risk capacity, how much loss you can bear.

Investments in a company depend a lot on the risk-bearing capacity of investors. If you can risk more, you’ll go for companies categorized as high-risk investments. If you tend to risk less, you’ll put your money in companies falling under the low-risk investments category.

What Exists in Your Current Portfolio?

When you invest in a company, you can be a first-time investor or someone already exposed to the stock market. If you are not new to investing, relook your portfolio.

What kind of investments exist in your current portfolio? Are they low-risk investments, risky ones, or a mix of both? The best portfolio is the one that helps you achieve your financial goals. Make sure you are one of those investors who know the importance of diversification and practice it.

What to Look for When Investing in A Company?

After assessing your financial goals, risk capacity, and current portfolio, you’ll better understand the things to look for when investing in a company.

Let’s look at some of the most crucial ones:

The Business: Key Factors to Look for

It should be your first step while doing any sort of investment. Experts say that until you don’t know about the business a company does and how it makes money, do not put your money in it.

When you put your money without being aware of a company’s business, you are not investing but speculating. The risk of losing all your investment amount is maximum in such cases.

So, learning about a company’s business should be the first thing on your mind. Try to get answers to questions like:

- What product does it manufacture?

- What services does it offer?

- In which country/countries does it operate?

Learning about a company’s business is very easy. Just search its name on Google or any other search engine, visit its website, and discover everything you want to know about it. When you get satisfactory answers to your queries, you are on the correct path.

Evaluating the Company’s Background

Next, you should look for is the history and business model of a company. Find out things like:

- For how long the company exists?

- How has it performed over the years?

Companies that exist for a long time tend to provide more steady growth compared to new entrants in the corporate world. When evaluating the corporate history of a company, remember that the past performance is not a guarantee of bright returns in the future.

Thus, you should always look at the business model also. Suppose that the company you are looking to invest in is manufacturing only one item since inception. Their product is a hit and has helped numerous people over the years.

When you find that company is old and providing steady returns since the beginning, you may want to invest in it. But after seeing its business model, you’ll find that the company has always been manufacturing one product only.

It shows that the company has not evolved, still manufacturing the same old product. If another company comes with a better and cheap replacement, they’ll be out of business. Do you want to invest in a company that can sink anytime?

Economic Moat

No competitors. It is almost impossible in today’s time. Competitors exist – some businesses have less, and some have more. What you should do is find whether the company you are planning to invest in has a unique competitive advantage or economic moat over its peers or not.

For example, look at Apple. It manufactures the best smartphones in the world. Numerous people line-up to get the latest iPhone whenever it launches.

Look at Walmart, the retail giant that offers products at super-low prices. No other retail player offers products at such low prices.

Try to get answers to questions like:

- Are products or services offered by this company better than its competitors?

- What is this company’s market share?

- Does this company use advanced technology?

If you find the company has a strong competitive advantage, invest in it. You’ll get good returns in the long run.

P/E (Price-to-Earnings) Ratio

Let’s imagine a situation before understanding the P/E ratio.

Suppose that there are two advisors – Harris and Chris – ready to help you invest in the stock market.

Harris has helped many people earn handsome returns. After learning about his experience and working style, you don’t find any reason to reject him. Coming to his service fee, he charges 40 cents for every dollar of profit you make through him.

Chris is a new advisor but promises huge returns on your investment. He is inexperienced and hasn’t helped many people make money. The biggest advantage with him is that he charges only 20 cents for every dollar of profit made through him.

What if Chris doesn’t help you make as much money as Harris?

If you comprehend this situation, you understand the P/E (Price-to-Earnings) ratio. A P/E ratio is the process to measure the current share price of a company concerning its earnings per share.

When you see the P/E ratio of a company is 15, it means investors are ready to pay $15 for every $1 of earnings. You can compare the P/E ratios of different companies and find which one will be a better investment option.

Usually, companies with a P/E ratio of 14-20 are considered good for investment. When the P/E ratio is low, investors sense something is wrong and avoid investing in it. If the P/E ratio is higher, the company’s share price might be overvalued or it is growing rapidly.

If you can find a company with low P/E but quickly growing, invest in it.

Dividend

A dividend is a part of the company’s earnings distributed to shareholders. The board of directors decides how much and in which form (cash or additional securities) should stockholders get the dividend.

You can assume dividends as the interest received on a savings account. When you deposit money in a savings account, the bank gives interest on it, and you are paid a dividend for investing in a company.

Often the large companies, having predictable profits, issue the best dividends. In this case, new companies or startups might disappoint you because they don’t make so much profit to issue dividends.

If you are expecting a regular income from your investment, look for companies that issue high dividends. You can also consider the dividend rate of a company before buying its stocks.

Debt-to-Equity Ratio

The next thing to look for is the debt-to-equity ratio. It reveals the debt involved in a business with respect to the capital (equity) of promoters/shareholders.

Debt is not a bad thing always, especially when the interest on the borrowed money is less than the returns provided by a company. And, investors lose money when it is the opposite.

Facing tough times because of debt obligations is a common thing in the business world. By evaluating the debt-to-equity ratio of a company, you learn whether it can repay its debt in times of financial trouble.

Experts also suggest that companies with a low debt-to-equity ratio are the right choice for investment. The reason they give is that when this ratio is low, companies always have room for expansion and don’t face difficulties in raising funds. Well, they are right.

When you are investing in a company, make sure its debt-to-equity ratio is either 1:1 or less than that.

The Chart

You might be knowing that usually two types of analysts advise buying or selling stocks. Yes, fundamental and technical analysts.

Fundamental analysis, done by fundamental analysts, is based on the factors influencing an asset’s value in the future. On the other hand, the technical analysis includes studying the historical price charts of stocks along with market statistics to predict the future price movement.

You may come across different types of charts, such as bar charts, line charts, candlestick charts, etc. Both fundamental and technical analysts use charts to analyze a stock.

When you are investing in a company, don’t avoid reading its chart. If not, go through the technical analysis and analyst’s advice about its stock.

Top 10 Investment Questions

If you are busy, the least you can do is ask yourself the following questions before investing in a company:

- What business is the company doing?

- For how long is the company in this business?

- Has it ever been involved in a scam or fraud?

- Is the company making profits or going through a tough phase?

- Does it have a competitive advantage in the market?

- Does it pay a dividend?

- What is the price-to-earnings ratio of this company?

- What is its debt-to-equity ratio?

- Is the stock of this company overvalued or undervalued?

- What is indicated by the stock price chart of this company?

People who are investing for the first time might have to learn/research a bit to get answers to some of these questions.

Final Words

There are a lot of things to look for when investing in a company. But knowing about them all might confuse you, and in the worst case, deter you from investing in a company.

The best you can do to prevent yourself from falling into such situations is to make a gradual approach. It will lead you to learn the correct way of investing in a company and earn better returns on your investment.

You can start with basics and remain consistent in learning more about investing. It will help you develop your winning strategy and pick fruitful investments easily.