When people get a sizable amount of money or acquire wealth, they often look for ways to grow it. One of the smartest ways to evolve financially is to invest in a business and grow with its growth.

Yes, investment in a business can bring you exponential financial returns and at the same time help budding entrepreneurs prove their mettle. As an investor, you can either invest in an established venture or a startup.

However, those who invest in startups are called Angel Investors. “Angel” because these investors believe in innovative ideas of startups and provide them with financial support when other lenders hesitate to support them financially.

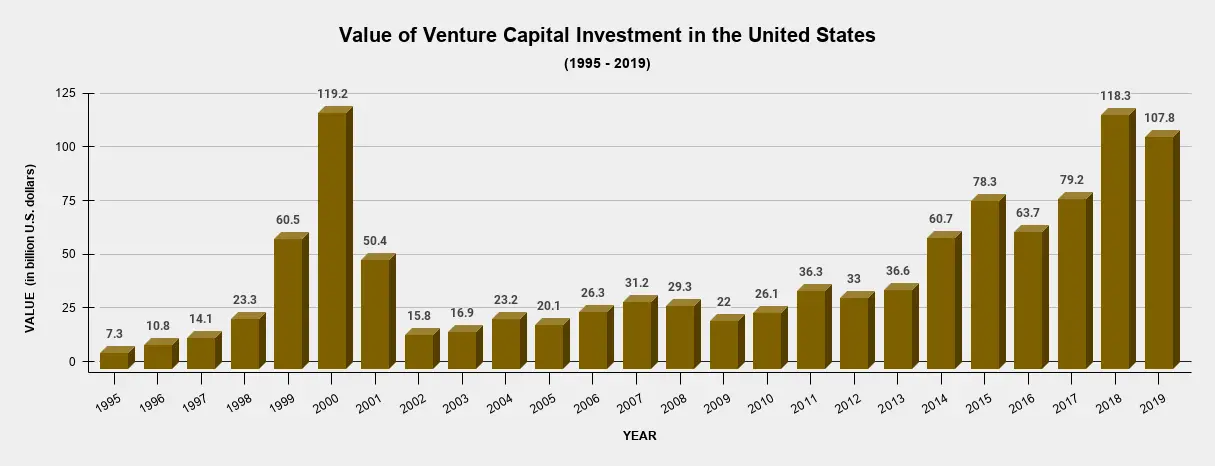

Source: Statista.com

Do you know how to become an investor in a business?

If you don’t, this article contains information that can help you learn how to invest in the right business.

Why Become an Investor in A Business?

Some reasons why it makes sense to become an investor in a business are:

- The returns earned by investing in the right business can be much greater than the returns provided by other asset classes.

- Mostly, businesses are young when investors infuse money into them. By the time they mature or get ready to list on the bourses, investors have already gained the maximum.

- By being an investor, you utilize your knowledge, experience, and money to help startups grow and create job opportunities. In short, you contribute to the nation’s development.

- It helps you remain updated with the latest technologies and latest happenings in your industry.

How to Become an Investor in A Business?

The following suggestions will simplify your way to become an investor in a business:

1. Check Whether You are Eligible to be An Investor

Depending upon your region and its laws, you should meet specific standards to be an investor in a company. For example, many regions in the United States allow individuals earning at least $200,000 annually or with a net worth of $1 million (excluding their primary house) to invest in companies.

You should check whether regulators in your region have any such demand. If yes, make sure you fulfill it before investing in a business.

2. Make Sure You Understand the Associated Risks

Some kinds of risks are associated with every investment. People fund businesses attracted by higher returns, but they must remember that instruments providing high returns carry higher risks.

If you do not want to lose your invested money, make sure you understand all the risks associated with that investment. Also, you must be sure about how much money you can afford to lose. If your risk profile doesn’t fit that investment, it might not be the right choice for you.

3. Gain Sufficient Knowledge

In recent times, many angel investors have succeeded in increasing their wealth. They are using their experience and skills to educate others seeking to make successful investments in businesses.

You can reach Angel Capital Association and its partner websites to access different blogs, articles, books, and videos useful in developing and growing angel skills. Another thing you can do is attend events and workshops blessed with successful entrepreneurs.

All this will help you gain the knowledge essential for becoming an investor. You’ll learn about things like pitches, expected returns, questions to ask, risky investments, and much more.

4. Get Advice from Experienced Investors

First-time investors often need guidance to make fruitful investments and get their doubts clarified. It is best if people experienced in this field shows them the right path.

Before making any move, you should seek advice from knowledgeable investors and settle down the questions emerging in your mind. This way, you’ll get practical suggestions and can prepare yourself to face challenges in the future.

5. Join a Group, Network, or Community of Investors

Joining a group, community, or network of investors is another way to start your journey as an investor and learn about the positives and negatives of investing in a business.

The first thing you’ll learn from this step is whether being an investor is the right thing for you or not. You’ll get practical suggestions directly from experienced and knowledgeable investors.

Another benefit of being a part of the community is that you can ask questions or share your views/experiences with other group members. This kind of communication helps a lot to develop relationships and build networks.

6. Join an Angel Platform

It looks somewhat similar to the above step but is different. Joining an Angel platform means you’ll get access to all the knowledge and support required to become an investor in a business.

You’ll be able to watch other investors and learn about their success or failure journeys. This way, you can avoid mistakes that led to others’ failures and choose the right path, the path that leads to success.

7. Develop an Investment Strategy

Many people have money, experience, and knowledge about an industry. Being an investor is a great way to use all this and help an entrepreneur succeed. If you are such an investor, you should develop an investment strategy and move accordingly.

Experts also advise that you should have an investment strategy before investing in a business because it’ll help both of you win and overcome challenges. You can include investment amount, business to finance, duration of the investment, and other such things in your strategy.

8. Organize a Question & Answer Session

The next you can do is organize a questions and answers session with owners of businesses. It’ll help you learn more about their business, management, skills, plans to run it successfully, how you’ll get returns, and other things.

This session will also give another party the chance to know about you and your expectations. If you don’t know what questions to ask as an investor, get in touch with members of the investor community you joined earlier.

9. Issue the First Check

After learning about the business and an investment strategy successfully, you might be ready to invest in a business.

When you feel that you are well aware of the pros & cons of investing in a business and all your doubts are clarified, you can issue the first check. On average, it takes around 5-7 months from the time you decide to be an investor until you issue the first check.

Things to Consider Before Investing in A Business

After learning how to become an investor in a business, you might be ready to make your first investment. But, there are certain things you must consider before investing in a business:

1. Don’t Blindly Accept Any Proposal

Many times friends and family members approach you to invest in their business. They are trustworthy people, but that doesn’t mean their businesses will meet your investment criteria.

Don’t blindly accept any proposal. Make sure the business is according to your standards and will help you achieve your goals. You should go through the business plan on your own and move forward only if you’re satisfied.

2. Ask For A Business Plan

If you invest in stocks considering key factors, you have to do the same while investing in a business. Here, you should consider the business plan. Do not invest if a business plan is not present.

It is because a business plan provides sufficient details to uncover the feasibility and efficacy of that business. When you evaluate the business plan, make sure it clarifies how the business will make profits, and investors get returns on their investment.

3. Understand Tax Consequences

Get answers to questions like:

- Are there any tax consequences of investing in such a business?

- Can I get a tax benefit if my investment fails?

There can be many questions. You must be aware of and understand all tax consequences associated with your investment. Let’s understand it better with the help of examples:

- Suppose that your investment is arranged in the form of a loan. According to IRS (Internal Revenue Service), the loss on loan to a venture/business is a non-business loss.

- If the business is LLC, S corporation, or other pass-through business, the tax consequences (capital gains, profits, losses, and others) pass through the investor.

It is always better to consult a certified tax advisor who holds ample experience in handling such matters.

4. Make Sure Founders Will Also Lose Something

Before infusing money into a business, make sure founders also have something to lose. If they have nothing at stake, do not invest in that business. It is because success is not always the motivating factor. Sometimes, the fear of failure also motivates people.

5. Have a Plan to Obtain Money From the Business

Your investment may not be successful until you have a plan to obtain money from the business. These can be the ways to get money from a business:

- You can become an employee and get regular income.

- You can get a consultation fee.

- In addition to money, you can also invest ample time and justify your payment.

- You can ask for dividends.

- If the business’s status is S Corporation, you can get the profits distributed to you as well.

6. Get Everything in Writing and Keep a Copy of Documents with You

An investor in a business shouldn’t rely on general trust or oral promises. Every aspect should be in writing and kept in a safe place.

When the documents are ready, make sure you also keep a copy of all the paperwork with you. If yours is a partnership, keep a copy of the partnership deed. If it is a corporation, copies of shareholder agreements and incorporation articles/certificates should be with you.

7. Be Ready to Lose Your Investment

It doesn’t mean your investment won’t make money for you. It means you should invest only extra money, the money beyond your expenses.

It is because most business investments are illiquid. Even if the business performs well, there is no guarantee that your funds get released soon. Make sure you invest only the money not required anytime soon.

Frequently Asked Questions

Here are answers to some questions people ask frequently before investing in a business:

1. If I invest in a business, will I become a partner?

The answer to this also resolves this query – how does an investor make money from an investment?

In most cases, investors become a partner in the business. Depending upon the amount of capital infused, an investor gets a percentage of ownership.

2. How much return can I expect from an investment in a business?

There is no fixed number; returns can be positive or negative. However, returns of 5-12% per year on such investments are considered decent. You, too, can expect the same.

3. How to become an investor with no money?

There are almost no right/wise ways to become an investor without money but many ways to become an investor with little money. For example, you can:

- Rearrange your budget

- Increase your savings

- Maximize deductions from payroll

- Consult a financial advisor

These won’t give instant money in your hands, but a disciplined approach can help you become wealthy after many years. At that time, you can think of being an investor in a business.

4. How can I cash out my investment in a business?

There are many ways to cash out your investment from a business. For example:

- When another company acquires the business you’ve invested in, they’ll pay you according to your share.

- The company starts paying dividends.

- You sell all your shares to some other investor.

- The company comes up with an IPO (Initial Public Offering).

The investor and founders often discuss in advance the matters about profit distribution and cashing out the investment.

Final Words

Investing in a business looks exciting and extremely rewarding but can be stressful and challenging at the same time. Clarity about things like what to look for in a business, ways to manage the investment, and long-term expectations will help you emerge as a winner. Always remember that gains from an investment in a business can make your life a lot better.

Disclaimer: All information on this page is general. It might not be suitable for every person looking to become an investor in a business. You can use this information as guidance to make a strategy while selecting a business. We suggest consulting an experienced investor or a certified financial advisor before making your first investment.