One of the most joyous moments of life is when you start earning money during your teenage years. The happiness that your first paycheck brings makes other happy moments of that time inferior.

Teenagers usually spend the first few of their paychecks. After some time, most of them realize that investing, not spending, money is a better idea. When it comes to guidance about investing, they can look forward to their parents or go through some guiding articles, like this one, over the internet.

Before moving forward, note that no one pressurizes you to become a multi-millionaire or billionaire at this young age (if you become, no one will stop you as well). Guiding you to invest your money is more about helping you learn about investing.

Things you’ll learn now are going to support your financial growth in the future. Let’s look at some of the best investment opportunities you can look forward to as a teenager.

Best Investment Opportunities for Teenagers

Some of the best investment opportunities for teenagers are:

1. High-Yielding Savings Account

The first step you can take is to open a high-yielding savings account. This way, your money will not only remain liquid but also earn higher interest until you invest it somewhere else. It will also be an opportunity for you to learn the way interest rates work.

In saving accounts paying higher interest, the best ones for you can be online accounts. In addition to high-interest rates, they also offer an app to help you operate the account from anywhere using a smartphone.

Most of these accounts don’t allow withdrawing money from ATMs or writing checks. This step works in favor of teens as it prevents them from spending impulsively. Parents like this feature of online savings account a lot.

2. Checking Account

Opening a checking account can be your next step after learning and earning from a high-yielding savings account, or you can straightway go for a checking account.

The objective should be to learn, not earn, more. As a teenager, you will learn to be financially responsible with the help of a checking account. These accounts do not restrict you from checks and debit cards, so you’ll learn how to be disciplined while managing funds.

A checking account is essential when someone has to earn big through investments. If you become familiar with it at an early age, it’ll be advantageous for you only. As a beginner, you can open a checking account that doesn’t charge anything for maintenance, insufficient balance, and an overdraft.

Your parents will be happy if you open a checking account with transaction limits in cash or on a check/debit card.

3. Roth IRA

If you are earning money by working somewhere, investment via Roth IRA will be beneficial for you. It is essential to be on a roll because, in Roth IRA, you are allowed to invest income after tax.

The jobs most teens do attract low tax, so it makes Roth IRA the right investment vehicle. Moreover, you’ll learn why it is vital to start investing for retirement at an early age. It’ll also put you in the habit of savings.

As most teenagers earn low, they can go for a Roth IRA account requiring $1,000 as the minimum investment. When you start early with Roth IRA, you’ll have a lot of money at the time of retirement.

4. Certificates of Deposits (CDs)

CDs are another less risky investment option for teens. Compared to other safe investments, it attracts teens the most. However, you can’t ignore returns and being FDIC (Federal Deposit Insurance Corporation) insured.

This way, CDs make teens stress-free when they worry about the right investment choice. Another benefit that Certificates of Deposit provide is the freedom of selecting the duration of the investment. Teens can invest for a short-term or long-term.

When you invest for the long-term, you’ll get good returns on your investment. But if you withdraw early, you’ll be penalized. Overall, this investment option will teach you a lot about investments.

5. Index Funds

If, like many other teens, you are also not satisfied by just learning about the ways to invest, try out index funds. Index funds are considered a better investment option for teens.

As gains from the stock market attract people of all age groups, entering it without proper knowledge can lead to losses. But when you invest via index funds, you get exposure to the stock market without putting your capital at maximum risk.

You benefit from the diversified nature of index funds. If you buy stocks of a company, every happening in it affects the stock’s price. You may become nervous and sell your stocks at a loss.

But an index fund contains many companies, including your favorite. When you purchase it, you won’t be affected much by everything big or small happening in a particular company.

6. Mutual Funds

You can consider investments in mutual funds as a step ahead of investments in index funds. Yes, in terms of returns as well as risk.

It’ll be a good investment option for you because experienced fund managers are in charge of mutual funds. They modify the fund’s portfolio and book profit/loss at the right time. In short, they are a safe investment option for teens and everyone not familiar with the stock market.

Every mutual fund is a portfolio of different assets, such as stocks, bonds, debentures, and more. When you invest in a mutual fund, you won’t need to depend on a single asset for gains. Remember, if the prices of assets in a fund declines, the value of that mutual fund also declines.

In addition to returns, liquidity is another factor that attracts teens to invest in mutual funds. They give you the freedom to withdraw either all or part of your investment whenever you want.

7. Stocks

Investing in stocks is riskier as compared to investing in a mutual fund or index fund. This option will work in your favor if you research before investing.

This investment option is also better for increasing your knowledge about the economy surrounding you. When people use their money to purchase a company’s stock, they keep themselves updated with almost all the latest news surrounding it.

Another factor that goes in favor of teens is not requiring a large capital. It’ll be good to buy a few stocks initially and understand how the stock market works. Remember, learning is more important at this age than earning.

Top 10 Tips Teens Can Consider While Investing

When you are a teenager, most things happen for the first time in your life. As you’ll be investing for the first time, a little guidance can benefit you big.

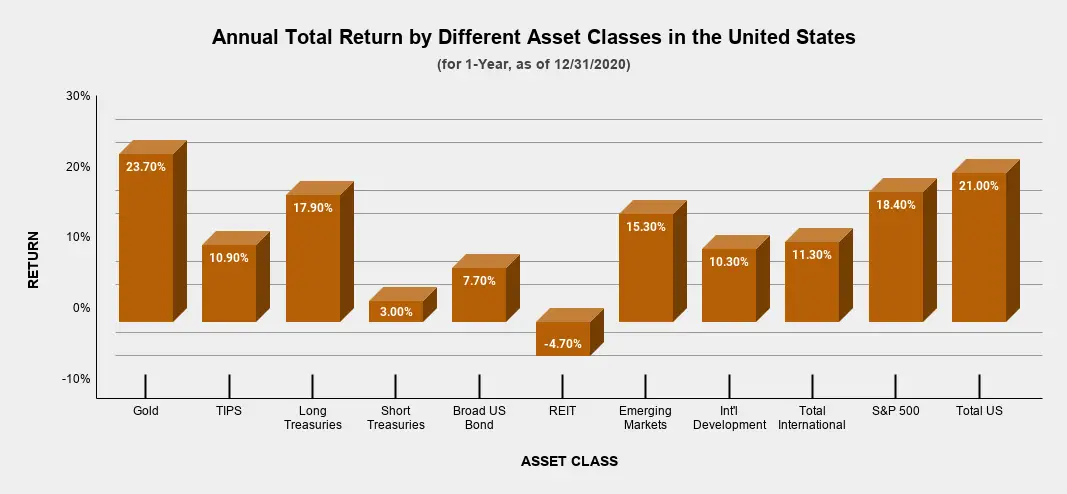

Source: My Money Blog

Here are some tips to help you make sounder investment decisions:

- Take a look at your finances. Find out how much you want to invest and how much you can risk.

- Do not make investments with borrowed money and invest only the amount you have.

- Don’t stress about investing as it may lead you to make wrong investments. If confused, ask your parents to guide you or research over the internet.

- Whether you invest big or small, make sure you invest early. You’ll benefit from the power of compound interest.

- If researching about investments is not your thing, go for Robo-advisors.

- Choose safer options when you invest for the first time. Risky investments may lead to loss which is not advantageous for your confidence.

- Invest for the long-term, and try to avoid short-term investments. It is because short-term investments give low returns and often lead to impulsive buying and selling or losses.

- If you are making the first investment in stocks, create a virtual trading account and trade with virtual money. You can also practice through paper trading.

- Try to develop a habit of researching before investing. The knowledge you gain now will continue helping you later.

- Do not blindly follow anybody’s advice or recommendation. Research on your own and have a little patience to enjoy fruitful results.

Frequently Asked Questions

As you’ll be investing for the first time, several questions might be emerging in your mind. In this section, we are providing you answers to some investment-related questions asked frequently by teenagers. Let’s explore:

1. I am below 18 and want to invest in the stock market. How can I start?

Your age below 18 years means (most probably) that you’ll be investing in the stock market for the first time. Here are the steps you can follow:

- Gain Basic Investment Knowledge: Explore the resources that help teens gain basic knowledge about investing.

- Start with Your Favorite Companies: In the beginning, invest in your favorite companies. They’ll keep you busy and help in learning about stock investment. Later, you can expand your portfolio.

- Find what Business they do: Before investing in companies/buying their stocks, find out the source of their earnings.

- Gather and Understand the Basic Financial Measures: With the help of the internet or your elders, collect the most basic financial measures. Try to understand them as they’ll prevent you avoid investment mistakes.

- Experiment/Learn with Virtual Trading: Many companies and brokerages offer a virtual trading platform to help their clients become familiar with stock trading. It can be beneficial for you also as you’ll learn trading without risking real money.

- Open a Custodial Account with A Reliable Online Broker: Many online brokers offer custodial accounts either for free or at minimal fees. Find a trustworthy online brokerage company, and open a custodial account with it.

- Do not Fall for Scams: Once you are in the market, you’ll come across different lucrative schemes, calls, and pieces of advice promising unbelievably higher returns. Note that they are scams, and you should not fall for them.

If you follow the above steps, your journey in the stock market will start smoothly.

2. What’s the biggest hurdle teens face while investing?

Teens below 18 years of age are not eligible to open a brokerage account. Today, numerous apps are there to help kids with investing, but this hurdle prevents them from having their separate accounts. However, they can anytime enter and invest or trade the market by opening a custodial account.

3. What are some reliable sources that can help me learn to invest?

The most reliable source will be your parents or a certified financial advisor. Moreover, you can research over the internet and try to get answers to all your questions. This way, you’ll gain a lot of information related to investments, directly or indirectly.

You can also explore the following online sources to start with investing:

- https://www.finra.org/investors/learn-to-invest/young-adults-and-investing

- https://www.sec.gov/fast-answers

- https://www.fool.com/

- https://finance.yahoo.com/

- https://www.investopedia.com/

- https://moneytreepodcast.com/

4. How can I figure out my risk tolerance capacity?

Identifying your risk tolerance capacity is quite simple. You can search the internet for quizzes and questionnaires to help you find your risk tolerance and right investments. You can access one such quiz by clicking here.

5. I am a teenager and have started working part-time. Am I eligible to open an IRA?

As you have started earning, you are eligible to open an IRA. Your decision to go for an IRA is appreciable. Starting at an early age means you’ll achieve your financial goals earlier.

However, there are two kinds of IRA – traditional IRA (tax-deductible) and Roth IRA. Research a bit and find the one suitable for you.

Final Words

Your money should go into instruments that provide positive returns and encourage, not discourage, you to invest. All the investment options in this article are going to increase your knowledge about investing. If you become familiar with them in your teenage, you won’t be worrying about making the right investments during your adulthood.

Disclaimer: All information on this page is general. It might not be suitable for every teenager looking to invest his/her money either for the first time or recurrently. You can use this article as a guiding tool to get help in exploring the best investment options for teenagers. We suggest consulting your parents or a certified financial advisor before deciding where to invest your money.