In the business world, two types of people are quite common:

- Potential/ Future Entrepreneurs: Those who have great business ideas but lack enough money to bring their concepts to life.

- Investors/ Venture Capitalists: Those who have a lot of money but lack successful business ideas to make the most of their wealth.

When these two types of people come together, great businesses are born. They not only improve lives but also solve problems in a better way.

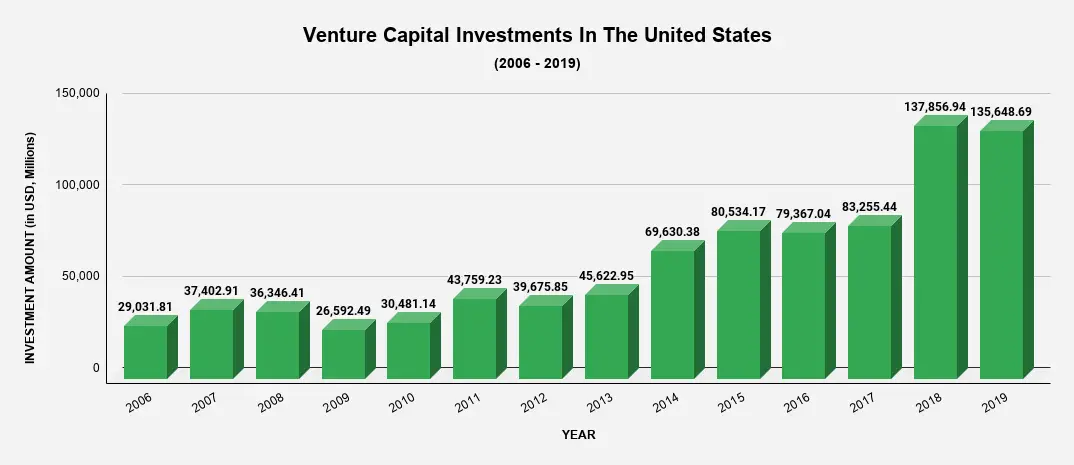

Source: OCED.Stat

If you are on this page, you might be the one with a great business idea and looking for someone to invest in it. So, continue exploring this article and discover some of the best suggestions to attract investors to your idea.

How to Get Someone to Invest in Your Idea?

Here are some of the best concepts you can utilize to make a strategy ensuring that your startup/ business idea appears as a lucrative investment.

1. Introduce Yourself

The first thing you can do is introduce yourself, your partners, and your team to the potential investor. Stats reveal that Venture Capitalists and Angel Investors are often attracted to a group of talented people.

Remember that starting a venture alone is not easy. If you team up with the wrong people, they can spoil your plans.

On the other hand, attracting investors will become a lot easier when you have perfect people in your team.

2. Demonstrate the Result Potential of Your Business Idea

You look for key factors when investing in stocks or any financial instrument. The same thing is with investors. If they invest in your idea, they’ll expect you to prove that your idea is going to work.

Create a plan and convince them that your concept is feasible. Show that your business can get more customers without much dependency on external borrowings.

If possible, get some potential customers before meeting investors. This move will increase your chances to grab the deal. It’ll be proof that your idea is going to work in real.

3. Attract them Through Networking

Networking is one of the best ways to attract investors. Most newbie entrepreneurs get success via networking only.

You must actively participate in gatherings, seminars, meetings, and other events. Make sure potential investors in such events learn about your business idea.

The soft sell strategy is what you should follow while approaching investors through networking. The best thing about this strategy is that your business idea gets promoted without the use of any aggressive sales language.

If a business idea is promoted the right way through networking, you may get a potential investor much before your expectations.

4. Join Startup Accelerators

Many first-time entrepreneurs don’t have access to a network of investors or venture capitalists. There are startup accelerators/ seed accelerators for all such people.

You can join a startup accelerator and utilize the opportunities provided by them. Their credibility and network will maximize your chances to find a suitable investor for your business idea.

There isn’t any guarantee that a startup accelerator will help you get someone to invest in your company/ business idea/ startup, but it’ll surely make your concept more appealing.

5. Let Investors Guide You

Sometimes a different tactic is all you need. Instead of asking them to invest in your idea, you can ask for their guidance.

This kind of approach provides multiple benefits. For example, you get an opportunity to build and develop relationships with big names. It’ll help them better understand your business idea, which eventually might direct them to fund your business.

When you ask investors for advice, they’ll bring potential flaws to your notice. Their valuable input will help in improvising your idea and bring you closer to crack the deal.

6. Prioritize Return On Investment

In addition to believing in your business idea, one thing investors expect to know about is the amount of return their investment will bring.

When you present your idea, make sure you prioritize the return on investment. Let investors know how long will it take their investment to bring returns. ROI (Return On Investment) information is often the most important thing for investors.

Make sure when you inform them about the expected return on their investment, you present realistic goals. Goals that are imaginary and almost impossible to achieve shouldn’t be a part of your presentation.

7. Let Data Back Your Plan

When you have to attract others to invest in your idea, make sure you provide them with ample information. Research a bit, collect relevant information/data and add it to your plan.

For this, you can take the help of news articles, web-world, and economic reports. Gather enough stats to prove that many people use similar products, and there will be substantial demand in the future.

Let’s understand it better with the help of an example:

Suppose that you want someone to give you funds for starting a car hiring business. You can research the internet and collect data like how many people use cabs every day to go to their workplace, how your competitors are achieving growth, how much average distance taxis in your city cover each day, etc.

When you present this data to investors, they’ll understand the current fundamentals of a car hiring business and get an idea of potential demand in the future. When they see that your business can be an opportunity to grow their money, they’ll invest.

8. Summarize the Functioning of Your Business

Without going much into details, tell your potential investor how you are expecting the business to function. Give the investor an idea of how you’ll arrange your products or services, how they’ll reach customers, and how you’ll take care of customers after the sale.

For example, if your business is about a physical product, brief your investor about its production, storage, delivery, and other things. If you are going to sell a service, let your investor know how you will be providing that service and how you’ll handle customers.

9. Disclose Your Plans to Market the Business

In your presentation, disclose plans to market the business. Let them know how you are planning to advertise your product or service. Tell them which marketing channels you’ll use for promotion and give them the reasons for its efficacy.

If possible, you can run some preliminary test campaign and prove that your marketing plan will bring results. Make sure you give clear information about which marketing channels can be successful initially and which ones later.

When you present the marketing plan, add real facts and figures to it. Include the pros and cons of the marketing efforts made by your competitors. You can also tell investors if your competitors’ marketing plans can work in your favor.

10. Prepare a Budget

Based on the collected facts and figures, prepare a budget for every month of the initial year and annual budgets for the subsequent two years. Do not forget to include the amount the investor will get and how.

Sometimes you may approach known people and ask them to fund your business. In such cases, you can use creativity and make meetings more persuasive.

Here’s how you can do it:

Suppose that your business idea is about opening multiple coffee shops in your city. To raise capital for this business, you approach a former colleague. In your budget, you included facts and figures to prove that this business has the potential to flourish in the future.

But, as an investor, he has doubts. In this situation, the best you can do is show him the real picture. Take him on a ride around your city. Visit different locations already having coffee shops.

Talk to their employees, learn about how long the coffee shop is in existence and why it is popular. Point out loopholes and state that avoiding them will be advantageous for your business.

After this trip, most chances are that you’ll succeed in convincing your potential investor. When the investor himself sees the functioning of other coffee shops, learn about their positives, and understand that avoiding their loopholes can be fruitful in your business, he’ll give you the capital required.

11. Impress them with Your Strengths

When you are with investors, let them know about your strengths. Tell them about your experience regarding this kind of business. If you don’t have such experience, tell them about your other experience and how it will be advantageous for this business.

Let them know about your educational qualifications, prior achievements, and things you think can help in convincing them to pour money into your idea.

12. Take the Online Route

For the last few years, the world is shifting online. Whether you need a product, service, or a piece of information, the internet can make things easy for you.

Today, you can take the online route to find an investor for your concept. It can help you get investors from different parts of the world.

Fundraising platforms like AngelList, CircleUp, and Gust have helped several entrepreneurs set up their businesses. You, too, can get essential support from such sources.

Questions Frequently Asked by Potential Investors

When investors fund a business idea, they expect the money gets utilized in the right way. For this, they might ask you different types of questions.

Below are a few questions asked often by investors. Your investor may or may not ask the same questions, but it’s better to remain prepared.

1. Which entrepreneur is your biggest inspiration?

There might be some entrepreneur whose success journey inspired you to take this route. It’s better to do a little research about him/her and prepare an answer.

2. What is the current trend in your industry, and how do you track changes?

Things change quickly, especially in the fashion and technology industries. The answer to this question should reveal how much you know your industry. Your investor also wants to know the data sources you’ll be using to top the industry trends.

So, don’t limit yourself to just a verbal answer. If your investor asks this question, be ready to present relevant statistics about your industry and customers. Also, tell where and how you found and will utilize it.

3. Do others believe in your business idea? If yes, how to contact them?

The purpose of asking this question is to know about your advisors and mentors. Reveal the information about people believing in your concept and potential.

4. What impact your product or service will bring to the market in the next five (5) years?

This question is an additional opportunity to impress your investors. Its answer will help investors realize that you have a vision and can make an estimation of your product or service’s performance over time.

You should be ready with a compelling picture of your product or service’s performance over the next five years. Tell them how it will simplify the lives of people.

5. Have you ever worked somewhere? Were you fired or left on your own? Tell us more about it.

This question makes most applicants nervous but tells investors a lot about you. It helps them learn about your attitude in challenging situations.

Be prepared with an answer which makes them feel that you have leadership qualities and can successfully overcome challenges.

Final Words

Finding someone to invest in your business idea is not a big deal. A little research and the right approach will help you succeed.

Whatever plan/strategy you make to attract investors, remember your belief in your business idea will work the most in your favor. Almost all investors expect to see your idea’s true potential, and it can happen when you believe in your idea. So, believe in your concept and approach an investor confidently.

Disclaimer: All information on this page is general. It might not be suitable for every person looking for someone to invest in his/her idea. You can use this information as guidance to make a strategy for attracting an investor. We suggest consulting an expert or your mentor before finalizing the approach.