Stock Market is a familiar term to most people. But if you ask them about its basics or relevant terms, most of them won’t be able to provide a satisfactory answer.

You often come across several terms while reading financial news or discussing the stock market. One of them is security. If you, like many, also keep wondering about this term and why the entire stock market revolves around it, this article is for you.

This guide contains information that will help you learn about and understand a lot about security in the stock market.

Security in the Stock Market

First, we should know what security, in the world of finance, means. It is a financial instrument with some monetary value and used to raise money in public or/and private markets.

Securities in the stock market is another name of shares or stocks of a company. Have you heard of the term equity? It also refers to the same.

A ‘security’ represents ownership rights in a corporation and a proportional claim on its earnings as well as assets. The person owning securities/stocks is known as the shareholder because he/she holds a part of the company’s total shares.

Suppose there is a company with one million outstanding shares, and a person or entity buys 100,000 shares of this company. Then, that person or entity is called its shareholder with an ownership stake of 10% in it.

Note that most companies have millions or billions of shares as the total number of outstanding shares.

Why Companies Issue Securities/Shares?

Companies issue shares/securities when they require money to grow, expand, and function efficiently. Let’s see some common reasons companies give while issuing securities:

- To research and develop new products

- To buy equipment

- For increasing inventory

- To prepare for an acquisition or merger

- To purchase new offices or buildings

- For reducing debt

- To enhance the company’s value

The most usual ways a company fulfills its money requirements are through private placements or launching its IPO (Initial Public Offering).

Let’s understand this better with the help of an example:

Suppose there is a startup, AABB Corp. It is performing well right now but requires money to continue growing like this. It has two partners, each one owns 50% of the company, and neither have enough cash to invest in the company’s future. So, they are looking for other ways to fund growth.

Upon researching, they found that diluting 10% of their company’s value (selling 10% of the company’s securities/shares) will provide them enough capital to run it successfully in the future. And they come across the following two suitable methods for raising money:

- Launch an IPO

- A private placement

In both cases, the stake of owners will dilute, and shares will get distributed among investors. The entity or individual (investor) buying shares/securities issued by a company gets a part of ownership in that company.

Depending on the investment amount and some other factors, the investor might now own 10%, and the original two might own only 45% each. It also means the investor is entitled to a slice or % of profits and voting rights in the company.

The process of issuing securities is also known as equity financing because shareholders give capital to companies. The money raised this way neither carry any interest nor needs to be paid back. Moreover, companies can utilize such borrowed money more freely.

Buying securities is not always a beneficial deal for investors. The risk that a company’s value may not increase and the investor might lose the amount used for purchasing its shares can’t be avoided.

Types of Securities Companies Issue

Primarily, companies issue three types of securities:

- Equity Securities: They are shares of a company, trust, or partnership. People who invest in them are called shareholders, and they don’t receive any regular payments. Yes, they receive dividends (if issued) and voting rights in AGMs (Annual General Meetings).

- Debt Securities: These are borrowed money and need to be repaid when a fixed period ends. The easiest to remember examples of debt securities are bonds issued by the government and corporates.

- Hybrid Securities: When you combine the features of equity and debt securities, you get hybrid securities. Convertible bonds and equity warrants describe hybrid securities the best.

In addition to these primary ones, you may come across other types of securities. Some of them are:

- Cabinet Securities

- Bearer Securities

- Certificated Securities

- Letter Securities

- MBS (Mortgage-backed Securities)

- Residual Securities

- Registered Securities

Securities Concerning the Stock Market

When it is about the stock market, you need to concentrate on equity securities. You can classify them further into two types:

Common Stocks

Commonly talked about shares/securities of a company are called common stocks. When you buy them, you become a shareholder of the company. In other words, you become one of the owners of the company but remember that shareholders’ rights are limited.

Owning common stocks give you the right to vote for vital corporate matters, such as selecting members of the board and approving or disapproving crucial decisions.

Companies pay dividends on common stocks, but there is no guarantee that companies will always issue a dividend. However, when a company performs well, the value of its shares increases significantly.

There is also another side of common stocks. When a company/venture goes bankrupt, the owners of common stocks suffer maximum loss. They are the last to have any claim on a company’s assets. Mostly, owners of common stocks lose their total investment in a company when it goes bankrupt.

Preferred Stocks

Preferred stocks are somewhat like bonds and don’t offer voting rights (usually) to their owners. Unlike common stockholders, preferred stockholders get a fixed dividend.

They are ahead of common stockholders even when a company/venture goes bankrupt. Preferred stockholders can claim for the assets of a company before common stockholders. Of course, not before creditors.

Sometimes (not in all cases), preferred stocks are convertible to common stocks. Some investors consider it positive and some negative.

How Investors Trade Securities?

Companies who want to borrow money from public/investors get their securities listed on stock exchanges. This way, interested investors get a regulated and liquid environment where they buy and sell publicly traded shares/securities.

The first sale of equity securities to the public comes in the form of IPO (Initial Public Offering). Some companies also sell their shares privately to a specific group, and this method is called private placement. Many companies prefer to sell their shares through public and private placement.

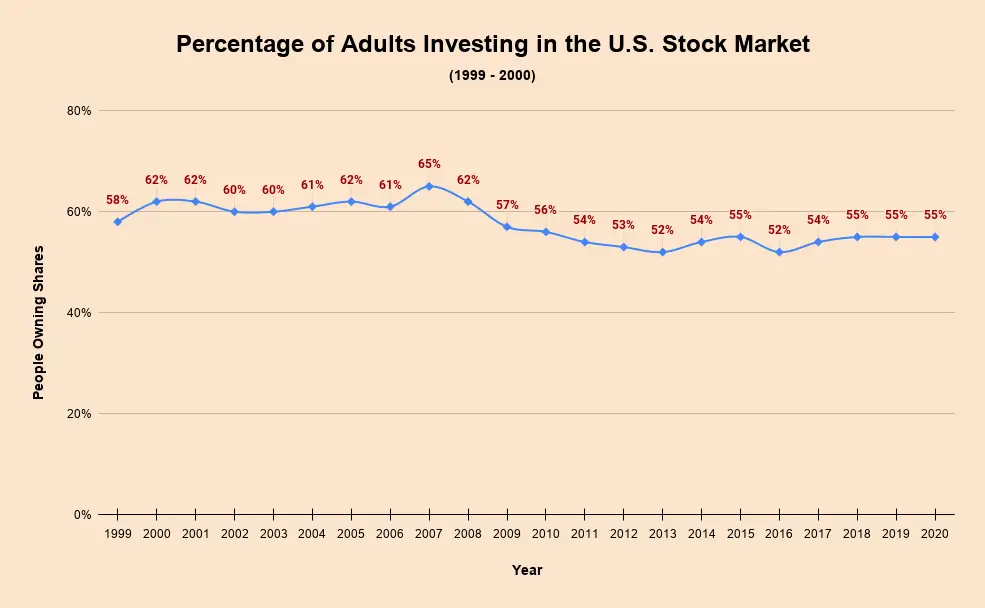

Source: Statista.com

In recent years, technological development has played a crucial role in securities trading. They often exchange hands “over-the-counter” and directly between investors via the phone or online platforms.

There is one more way investors can trade securities – through the secondary market. Also known as the aftermarket, it allows the transfer of securities amongst investors like assets. They buy or sell securities for capital gains or/and money.

If we talk only about the secondary market, it is more suitable for publicly traded securities/shares. Privately placed shares/ securities are transferrable among a specific group of investors. Secondary markets do not provide enough liquidity for them.

Positives and Negatives of Investing in Securities

When you buy a life insurance policy, you first find what life insurance is used for and evaluate its features. Similarly, there are some positives and negatives with securities investment as well.

If you remember, the stock market doesn’t move in a single direction. Sometimes it goes up and sometimes down. It means when the market goes up, it grows the money of investors and helps them beat inflation.

Conversely, investors lose their money when the stock market crashes or declines. Here are a few positives and negatives of investing in securities:

PROS

- Buying and selling securities via the stock market is easy.

- Securities are sound, long-term hedging options against inflation.

- When the economy grows, the value of securities also surges.

- With dividends, bonus shares, and share splits associated with securities, the value of an investment can enhance in multiple ways.

CONS

- A lot of research is an essential requirement before investing in stock market securities.

- There is always a possibility of losing the entire investment.

- Being affected by the ups and downs of the stock market, securities usually test the patience of investors.

After evaluating the positives and negatives of investing in securities, we can infer that they can inflate our investment and are a vital hedging option against inflation.

But you shouldn’t avoid the risk associated with them – the risk of losing all your investment.

Frequently Asked Questions

When the topic is securities in the stock market, questions can be unlimited. We collected some frequently asked questions regarding this topic. Here are the answers to them:

1. Who regulates securities in the United States?

Securities in the United States are regulated by the U.S. SEC (Securities and Exchange Commission). It includes initial public offering, sales of shares/securities, and trading.

2. The stock market reflects the economy. Is it true?

The stock market, being a part of the economy, affects it significantly. When it collapses and shares fall drastically, you can witness widespread economic disturbances.

However, every fall in the stock market doesn’t mean that the economy is performing poorly. Sometimes, the fall in share prices is just to bring back the over-valued stocks to their real valuation.

It means the stock market is not the exact reflection of the economy. You might have heard of the great depression of the 1930s, the dot-com bubble burst of early 2000, and the great recession of 2008. They all jolted global economies and wiped-off billions of dollars of investors’ wealth.

But if you see the stock market crash of 1987, it didn’t affect economies badly. It influenced the monetary policy, and interest rates came down, fearing a recession. Eventually, low-interest rates sparked an economic boom and led to rapid economic growth.

So, the statement that stock markets reflect the economy is not 100% true.

3. Are securities/stocks a good investment opportunity for beginners?

Not only beginners, but stocks/securities are also a good investment opportunity for every person expecting to get handsome returns in 5-years or more. Experts give this timeframe because stock market downturns rarely last for more than five years.

If you are a beginner, avoid direct investment in the stock market. Instead, enter the market via mutual funds. They not only invest your money in multiple stocks at a time but also make sure your investment is managed by experts.

4. Which factors affect stock prices in the United States?

The following macro factors are responsible for affecting the price of stocks in the U.S most:

Economy

The first one is the economy. When there is economic growth, you can see more employment opportunities, higher consumer spending, and higher profits for businesses.

In such an environment, investors usually put their money in companies gaining more profits. This action of investors pushes the stock price of such companies higher.

The economic data investors pay more attention to is:

- Inflation reports

- Central Bank policies regarding interest rates

- Employment and unemployment numbers

- Consumer spending, retail sales, and other figures

Such economic indicators give investors an idea of how the economy is performing and how it can perform in the future.

Government

Setting tax policies and controlling overall spending are the duties of the United States government. Any changes (positive or negative) in them affect the stock market significantly.

You can witness it at the time of elections when presidential candidates try to sell their plans/ policies to consumers and big businesses.

5. Can investments in the stock market improve the financial future of individuals?

Yes, investing in stock markets can improve the financial future of individuals. When you invest in securities, you:

- Can beat inflation in the long run

- Can grow your investment multifold by the time of retirement (most applicable to people investing at an early age)

- Can be proud of being a part of growing businesses

Final Words

Everyone interested in the financial world should know what security in the stock market means. When you dive deep into securities, you’ll also learn many other things, such as the right time to invest in securities and different factors affecting their price. In short, your knowledge about securities can brighten your financial future.