A common belief is that earning in 6-figures, or more than that, is enough to live a life free from financial worries or problems. It may seem right, but handsome earnings are not enough to diminish such concerns. People need to have and follow a robust financial plan to avoid any finance-related hurdles throughout life.

If you are one of those persons who like to handle financial matters on their own, this guiding article is for you. The information it contains will improve your knowledge about personal financial planning.

By the time you reach the end of this article, you’ll be knowing about the importance and steps involved in personal financial planning. It also includes answers to some of the most frequently asked questions about the process of personal financial planning.

Why Personal Financial Planning?

Before learning about the crucial steps involved in personal financial planning, let’s first try to understand why planning your finances is essential. Here are some reasons:

• To Achieve Goals

Almost every person sets goals and takes steps to achieve them. However, goals like buying a larger house, a new car, financing the child’s education, vacation with loved ones, saving for retirement, and others require a feasible financial plan.

• To Manage Money

Financial planning, when used for managing the inflow and outflow of money at a personal level, gives satisfaction and helps in setting priorities.

• To Reduce Future Uncertainties

By following a robust financial plan, you can minimize future uncertainties that might occur because of the lack of income and other financial resources.

• To Prevent Debt

An effective personal financial plan keeps you protected throughout life. As it gives you more control over your financial matters, you remain protected from debts, bankruptcies, and dependency on excessive economic resources.

• To Gain Financial Freedom

A financial plan helps you manage expenses and achieve future finance-related goals by analyzing your current financial situation. As it waives-off your worries related to money, you gain a sense of financial freedom.

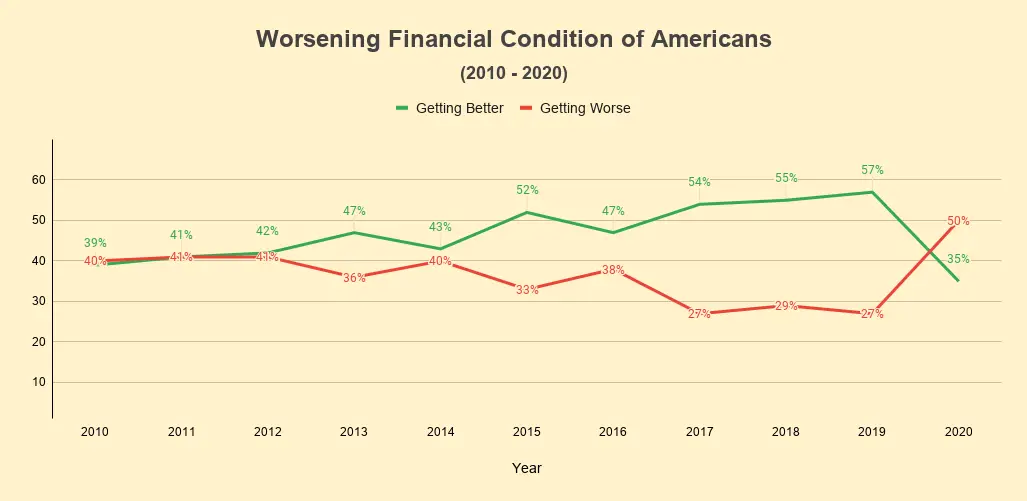

• Worsening Financial Conditions

In America, the financial condition of individuals is worsening. According to the “Gallup Poll Social Series: Economy & Personal Finance” report for the past decade, 50% of Americans say that their financial situation is worsening.

Source: https://news.gallup.com/file/poll/308942/200421Finances.pdf

These are just a few. Depending upon the preferences and economic conditions of individuals, there can be many more reasons proving the necessity of a personal financial plan.

7 Steps Involved in Personal Financial Planning

By following these seven steps, you’ll not only succeed in making a robust personal financial plan but also get freedom from finance-related worries of the future.

Step 1: Evaluate Your Present Financial Situation

The first step for developing an effective personal financial plan is to evaluate your present financial situation. Most of you might be wondering how to do it. Well, start with making a list of your income, expenses, savings, and debts.

By doing so, you’ll better understand your relationship with money. Also, you will be able to identify any trend or area demanding thoughtfulness. There are chances that you will do the needful after finding the areas requiring attention.

Step 2: Set Financial Goals (Short Term and Long Term)

When it comes to goal setting, a common practice is to set goals and work towards achieving them. You must follow the same procedure to plan your finances for the future, i.e., set up short-term as well as long-term goals.

By setting up short-term and long-term financial goals, you get a clear understanding of what they are and how to achieve them.

When you set finance-related goals, consider the following:

- Make sure they are realistic and achievable within the expected timeframe.

- Your short-term financial goals must encourage you to make continuous progress.

- Your long-term financial goals must focus on enhancing your financial future.

- Both your short as well as long-term financial goals must complement each other and support your financial decisions.

- You must regularly, every 2-3 months, analyze your financial goals to verify whether you are moving in the right direction or not.

If there is no surety about how your short-term and long-term financial goals should be, look at these examples:

Short-term Financial Goals Examples:

- I am taking the no-spend challenge under which I won’t spend anything for a whole month.

- I am going to create a household budget and stick to it.

- I will create an emergency fund that would cover my three month’s expenses.

Long-term Financial Goals Examples:

- I will make a retirement investment strategy that would help me retire rich and ignore all finance-related worries at that time.

- In the next eight years, I’ll free myself from the mortgage on my home.

- I will revamp my investments to achieve a net worth of $10 million in the next 25 years.

Step 3: Plan to Reduce Your Current Debts and Avoid Future Ones

Debt not only affects your current financial life but also stagnates your future financial plans. So, it becomes necessary to plan to get rid of your current financial obligations and avoid getting any in the future.

To find what amount of your monthly income is going towards reducing debt, calculate your Total Debt Service (TDS) Ratio. If you get a higher number, it means a major portion of your income is being used for reducing the debt, and you are left with less financial resources to build an emergency or retirement fund.

Some common types of debts are:

- Personal Loans

- Credit Cards

- Auto Loans

- Student Loans

- Mortgage Loans

- Line of Credits

If any such debts are a part of your current financial life, plan to manage and reduce it. You can do the following:

- Find out and make a list of your current debts. You can include the kind of debt, current balance, monthly payment, interest rate, and the time remaining to clear it up at the current speed.

- In that list, now highlight the debts blocking your financial goals. You’ll find that they are high-risk and recurring debts, like credit card payments.

- As you are now aware of what’s in your way, it’s time to act. Research, find ways to reduce your financial obligations, and do the needful.

If some of you are debt-free presently, make sure you know how to deal with any debts occurring in the future.

Step 4: Get Insured to Avoid Future Financial Risks

Life insurance is used to serve many purposes. Still, it’s not a regular part of personal financial plans. Do you know the reason?

Because most people are not aware of the fact that insurance can also help them to avoid financial risks. You should never forget the primary purpose of insurance – to give you and your family protection against undesirable financial risks.

An insurance policy of the right amount can help in increasing your bank balance/ savings remarkably and provide financial assistance when required. For a safe and secure financial future, you can consider the following types of insurance:

- Term Life Insurance

- Health Insurance

- Disability Insurance

- Homeowners/ Rental Insurance

Step 5: Make Investments to Build Wealth

If you have followed the previous steps, you are aware of your current financial situation, debts, short-term as well as long-term financial goals. You also know how to handle debts and might have purchased the right insurance to safeguard your financial future.

Now is the time to focus on building wealth, increasing savings, and making investments that give handsome returns. The wealth made this way helps in accomplishing long-term financial goals.

While making investments to build wealth or achieve long-term financial goals pay attention to the following:

- Decide When and How You’ll Utilize It. When making investments for the long-term, you must know when and how exactly you’ll utilize it. For example, Kate invests $50,000 in a corporate bond for 12 years so that she can come closer to her dream of buying a villa.

- Your Health. Our health plays a crucial role in building or destroying our wealth. If you are healthy and expect to be like this in the future, you’ll face little-to-no hurdles in building wealth. If there is something to worry about your health, take necessary steps, like changing your lifestyle or buying health insurance. This way, investments you make won’t get utilized for covering your health-related expenses.

- Your Savings Rate. It is not the rate of interest you get on your savings account, but your frequency of saving money. It’ll help in determining whether you are on the right track to building wealth. If you’re not, start saving more.

To make wealth-building investments, you must be knowing the following:

- The best investment accounts that’ll help you in building wealth or achieve long-term financial goals. For example, Individual/ Joint Brokerage Account, Individual Retirement Account (IRA), College Savings Account, 401K, or any other account.

- The types of financial instruments where you’ll park your money. For example, Mutual Funds, ETFs, Stocks, Index Funds, Bonds, etc.

- The frequency at which you’ll contribute to those investments.

- Depending on your needs, the risk you can tolerate on your investments.

- Will setting up automatic contributions to those investments be right for you?

Step 6: Build an Emergency Fund

After making wealth-building investments, it’s time to work towards building an emergency fund. Such a fund will keep you financially protected during times of unexpected and sudden financial emergencies.

Financial emergencies can hurt you anytime in life. For example:

- When you lose a job unexpectedly

- When appliances at your home malfunction and require repair

- When your car suddenly breaks down

- When you need to pay large medical bills

Whatever be your current income, it becomes almost mandatory to build an emergency fund if any of the following applies to you:

- Your monthly savings are almost nil. In other words, you usually spend all your earnings per month.

- Your income is not consistent.

- You have a bad credit score.

- Your spouse, children, or/and parents depend on you.

Example: How to Build an Emergency Fund?

You can start building an emergency fund with an amount suitable to you, let’s say $500. Deposit this money in a separate savings account that provides a higher rate of interest. Make sure this account remains untouched, and you use its amount during financial emergencies only.

Once you succeed in saving $500 for financial emergencies, your next target should be to increase its size. Depending on your financial condition, an emergency fund can be twice, thrice, five times, or more than that of your pre-tax income.

With such an emergency fund, you’ll not only overcome financial difficulties but also succeed in remaining calm during rough financial situations.

Step 7: Monitor and Maintain/ Update Your Plan from Time to Time

Most people think that building and implementing a personal financial plan is everything they need to do. Well, monitoring and maintaining it from time to time is also essential.

To gain maximum from your plan, make sure you monitor and update (if necessary) it every 3-4 months. It is because things happen quickly in the financial world. If the investments you made a few weeks back don’t move as expected, do necessary modifications.

Also, note that the personal financial plan you create should be flexible. Yes, it should be modifiable according to life events. Some life events when people usually update their financial plans are:

- After paying off a personal, education, or/ and automotive loan

- After buying a new home

- After terminating your credit card

- After getting married

- After becoming a parent

All these life events affect your savings, risk management, expenses, and other things related to your current and future financial health. That’s why it is crucial to update your financial plan regularly.

Bottom Line

As you are now aware of seven (7) steps of personal financial planning, use them to secure and enhance your current as well as future financial life. A personal financial plan, according to these steps, safeguards financial security.

Most people make and track their financial plans, whereas some take professional help. If you are unsure about anything, don’t hesitate to take help from professionals. This approach will ensure that you not only get rid of finance-related worries but also secure your financial future.