In a financial business, a crisis is a situation where something unexpected and severe happens that disrupts the normal functioning of the business. It could be a sudden sales drop, a significant expense increase, or a financial crisis in business.

Like the wave that destroys the sandcastle, a financial crisis can greatly impact a business, causing financial instability and uncertainty. The key is to recognize the signs of a crisis and take immediate action to address the issues, rebuild, and get your business back on track.

Facing a financial crisis in your business can be a daunting challenge, but it’s crucial to address it head-on. Financial crises can feel overwhelming, whether it’s cash flow issues, declining sales, or mounting debts.

But fear not!

We’re here to guide you through this journey and show you how to transform these challenges into opportunities for growth and resilience. So, buckle up and get ready to navigate the choppy waters of financial crises as we dive into actionable strategies and expert advice.

Identifying the Financial Crisis

Recognizing the signs and symptoms

Regarding financial crises in business, it’s important to spot the warning signs. Let’s find out some of these signs:

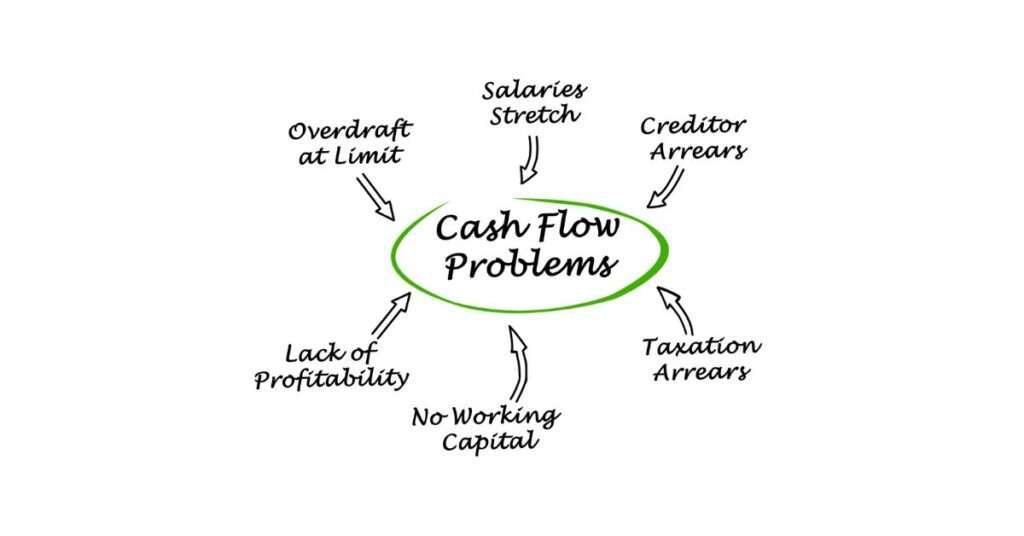

Cash flow problems:

When you have cash flow problems, you don’t have enough money to cover your expenses. It’s like trying to fill a bucket with a hole at the bottom – no matter how hard you work to pour water in, it keeps leaking out.

This can make it challenging to pay your bills, buy new supplies, or even pay your hardworking lemonade stand employees.

For example, Company XYZ, a well-known retail chain, experienced cash flow problems due to increased competition and changing consumer preferences. As a result, their cash reserves decreased, and they could not meet their financial obligations. This led to delayed supplier payments, employee layoffs, and, ultimately, a decline in customer satisfaction.

According to their financial reports, Company XYZ’s cash flow from operations decreased by 30% in the last quarter, causing a significant strain on their day-to-day operations.

They had to take immediate action by negotiating payment terms with suppliers, implementing cost-cutting measures, and developing a strategic plan to boost sales and cash flow.

This example highlights the importance of closely monitoring cash flow and proactively addressing issues before they escalate into a full-blown financial crisis. Remember, a leaky boat can sink if not repaired in time, and the same applies to cash flow problems in business.

- Declining sales or revenue:

Declining sales or revenue is like when your business starts experiencing a drop in the number of customers or the amount of money coming in. It’s as if your sales are disappearing, leaving you scratching your head and wondering where all the customers went.

But don’t worry, just like a magician who learns new tricks, and you can find innovative ways to attract more customers and boost your revenue. With a little magic (and maybe a sprinkle of marketing), those sales will multiply like rabbits in no time!

To better understand, suppose Company ABC, a technology company, faced declining revenue as its flagship product became outdated and faced fierce competition from new market entrants. Their revenue declined by 35% within a year, causing financial strain.

To turn things around, they shifted their focus to research and development, launching innovative products that catered to emerging market demands. This strategic shift resulted in a revenue increase of 45% over the next two years and secured its position as a market leader.

- Increasing debts or liabilities:

Think of your business as a weightlifter competing in a tough competition. Lifting and performing well becomes harder if the weights keep piling up on your shoulders. Your business needs a plan to lift those weights off your shoulders and regain financial strength.

During the COVID-19 pandemic, many businesses faced increasing debts and liabilities as they struggled to stay afloat. One such example is the airline industry, which experienced a significant decline in travel demand and revenue.

With grounded fleets and ongoing expenses, airlines accumulated massive debts to cover operating costs and manage financial obligations. Companies like American Airlines and United Airlines had to seek government assistance and borrow billions of dollars to navigate the crisis.

These challenges highlighted the importance of financial management and strategic planning in times of uncertainty, as businesses worked tirelessly to overcome the financial strains caused by the pandemic.

Knowing these signs and symptoms, you can quickly identify when your business is facing a financial crisis. Remember, taking action immediately is important to prevent further damage.

Sure, let’s break down conducting a thorough financial assessment into bite-sized, easily digestible chunks!

Conducting a Thorough Financial Assessment

- Reviewing Financial Statements

Imagine you’re the detective Sherlock Holmes, but instead of solving crimes, you’re solving the mystery of a company’s financial health. Financial statements are like your clues. They include the balance sheet, income statement, and cash flow statement.

Think of a balance sheet as the company’s selfie at a specific moment in time. It shows what the company owns (assets) and owes (liabilities), with the difference being the company’s net worth or equity.

Suppose you’re a part of the beloved animated TV show, “The Simpsons.” You’ve earned some extra dough (no pun intended) delivering newspapers and decide to invest $500 in Microsoft in 1986, the year of its initial public offering (IPO).

Fast forward to 2023, your $500 would be worth around $1.5 million, given the stock splits and price growth. Now, that’s a lot of doughnuts!

Microsoft’s balance sheets show that its assets swell over time, especially in intellectual property and technology infrastructure. This asset growth has helped increase the company’s equity, making your initial investment incredibly valuable.

Isn’t it amazing? Like Bart Simpson’s prank calls to Moe’s Tavern, investing can have surprising outcomes. You just need to know where to look!

- Analyzing Key Performance Indicators (KPIs)

KPIs are quantifiable measurements, agreed upon beforehand, that reflect the critical success factors of an organization. They differ depending on the organization and industry. For example, a KPI for a social media company might be the number of monthly active users, while a KPI for a retail store might be the sales per square foot.

Now, let’s dive deeper into your example of Return on Investment (ROI).

ROI is a performance measure used to evaluate the efficiency or profitability of an investment or to compare the efficiency of several different investments. It’s expressed as a percentage and is calculated by dividing the net profit from an investment by the cost of the investment.

If you had invested $2000 in Tesla in 2013 and by 2023, your investment is worth $136,000, your ROI would be:

1. Calculate the gain from the investment: $136,000 – $2000 = $134,000

2. Divide the gain by the cost of the investment: $134,000 / $2000 = 67

3. To express this as a percentage, multiply by 100: 67 * 100 = 6,700%

This means that for every dollar you invested in Tesla in 2013, you got back about $67 by 2023 – a very successful investment.

This is an impressive ROI, but it’s also important to remember that investing in stocks always carries risk. Tesla’s success was far from guaranteed in 2013, and other investments might not have performed as well.

This is why it’s important to diversify your investments and not put all your eggs in one basket.

In a business context, KPIs such as ROI are critical for decision-making. They allow a company to evaluate its investments, projects, or other business activities to see if they are profitable and worth continuing. It’s like a report card for business activities, showing where the company is doing well and where there is room for improvement.

To conclude, KPIs are vital tools that provide insight into a company’s performance. They help evaluate an organization’s success concerning its vision and strategic goals, providing a navigational tool to guide companies toward sustainable success.

- Identifying Areas of Financial Weakness

Financial weakness in a company can be revealed by several key indicators, often reflected in their financial statements. These include declining revenues, rising expenses, increasing inventory levels, high debt levels, negative cash flow, and poor return on investment.

Declining Revenues: A company’s revenue, or sales, is the money it makes from selling its products or services. If revenues are declining, it clearly indicates that the company’s core business is not performing well. This could be due to various reasons, such as increased competition, loss of market share, or decreased demand for the product or service.

For instance, BlackBerry, once a dominant player in the smartphone industry, experienced a dramatic decline in revenues as it lost market share to competitors like Apple and Samsung. Despite its early success, BlackBerry needed to innovate and adapt to the changing market demands, leading to its downfall.

Rising Expenses: If a company’s costs increase faster than its revenues, this can decrease profit margins. This could be a sign of operational inefficiencies or other problems.

Increasing Inventory Levels: High inventory levels indicate that a company cannot sell its products due to decreased demand or outdated products. In Kodak’s case, the company was left with many unsold inventories as consumers shifted from film to digital photography.

High Debt Levels: While some debt is normal and can be used effectively to finance growth, excessive debt can signify financial distress. Companies with high levels of debt may need help to make interest payments and may be at risk of bankruptcy if they cannot manage their debt effectively.

For instance, According to The New York Times, Toys “R” Us filed for bankruptcy in 2017, struggling under a significant debt load for many years. The company could not invest in improvements and adaptations due to its substantial debt payments, ultimately leading to its downfall.

Negative Cash Flow: Cash flow is the money moving in and out of business. Negative cash flow means the company is spending more money than it’s bringing in, which can be a significant red flag. A company can only survive long-term with positive cash flow.

Poor Return on Investment: A low ROI means that the company’s investments need to generate more profit. This could be due to poor management decisions or unprofitable projects.

Lastly, financial literacy is the magnifying glass that helps identify these potential issues. Understanding and interpreting financial statements is vital for any investor or business leader. It allows them to spot problems early and make informed decisions, whether investing in a promising company or turning around a struggling business.

Immediate Actions to Take

Cash Flow Management

- Cutting Unnecessary Expenses:

Imagine your business is like a ship sailing through stormy seas. You’re the captain, and your ship is taking on water (losing cash). The first step you’d take is to throw overboard the things you don’t need to keep your ship from sinking, right?

Cutting unnecessary expenses is the business equivalent of tossing the non-essentials overboard to keep your ship afloat. You’d need to look at your company’s expenses and identify which ones are not directly contributing to creating value or generating revenue.

For example, say you’re a proud owner of a fledgling bakery. Amid a financial crunch, you examine your expenses and find that your business spends a significant amount on fancy, gourmet coffee for your employees every month. While it’s a nice perk, it’s not essential, and temporarily switching to a more affordable coffee option could save your bakery some much-needed dough (pun intended).

- Improving Invoicing and Collections Processes:

Ever been to a magic show where the magician pulls a rabbit out of an empty hat? Optimizing your invoicing and collections processes can sometimes feel just as magical when trying to improve cash flow!

You can accelerate your cash inflow by invoicing promptly, offering incentives for early payments, and actively pursuing overdue accounts.

Suppose you’re a photographer. You could implement an invoicing system that automatically sends reminders to clients with pending payments. You might also offer a small discount for those who pay their invoices within a week.

This approach could bring in cash faster and help keep your photography business in focus even during tough times.

- Negotiating Favorable Payment Terms with Suppliers:

Think of your relationship with your suppliers as a dance. The rhythm of your cash flow is the music you’re dancing to. Sometimes, when the music changes (like during a financial crisis), you might need to adjust your dance moves (or payment terms) to keep in step.

For instance, if you’re running a boutique clothing store and facing a cash crunch, you might negotiate with your suppliers to extend the payment terms from 30 to 60 or 90 days. This change would give you more time to sell your inventory and collect customer payments before paying your suppliers. It’s like adding a few extra beats to your cash flow dance to ensure you don’t miss a step!

Seeking Additional Financing or Funding Options

- Exploring Loans or Credit Lines:

Sometimes, overcoming a financial crisis is like climbing a mountain. It’s steep, challenging, and you might need help reaching the top. This help can come in the form of loans or credit lines, which can provide the necessary funds to cover your costs while you work to increase your revenue.

Consider a company like Uber. In its early days, the ride-hailing giant navigated several financial crises, with expenses far outstripping its revenue.

To fuel its ambitious expansion plans, Uber turned to debt financing and raised billions through loans and the sale of convertible notes. This funding allowed Uber to continue its journey up the mountain, despite the steep path.

- Attracting Investors or Partners:

Attracting investors or partners is like adding more fuel to your business engine. It can provide the capital needed to maintain operations, invest in growth opportunities, and weather the storm of a financial crisis.

Look at Airbnb, for example. During the COVID-19 pandemic, travel restrictions caused a severe drop in bookings. This financial crisis could have been the end for Airbnb, but instead, they attracted additional investment, raising $1 billion in debt and equity from private equity companies.

This capital infusion enabled Airbnb to survive the crisis and bounce back stronger when the travel industry began to recover.

Attracting investors or partners isn’t just about getting an injection of cash. It also brings new perspectives, expertise, and connections, which can be invaluable during a crisis. Imagine getting a new co-pilot on your flight, someone who can help you navigate the stormy skies and reach your destination safely.

- Considering Government Assistance Programs:

Remember that classic scene in ‘Indiana Jones and the Last Crusade’ when Indiana Jones steps off a cliff, hoping for a miracle, and a bridge appears under his feet? Government assistance programs can sometimes feel like that miraculous bridge in a financial crisis.

These programs offer various forms of assistance, such as loans, grants, tax relief, and advisory services, to help businesses weather financial crises.

Take, for example, the Paycheck Protection Program (PPP) introduced in the U.S. during the COVID-19 pandemic. This program provided loans to help small businesses keep their workforce employed during the crisis.

Suppose you’re running a small restaurant and are hit hard by the pandemic. With lockdowns and social distancing measures in place, your customers have dwindled, and you need help to pay your staff.

Applying for a loan through the PPP could provide the funds needed to keep your staff on the payroll until you can fully reopen and welcome your customers back.

In conclusion, overcoming a financial crisis in business often requires quick action, careful planning, and strategic thinking. It can be challenging, but with the right steps, you can steer your business through the storm and come out stronger on the other side.

Remember, just like Indiana Jones, you need courage, resourcefulness, and a bit of faith. So, tighten your hat, whip out your financial plan, and face the adventure head-on. Your business’s financial stability is the Holy Grail you’re seeking, and you’ll find it with perseverance.

Strategic Measures for Long-term Recovery

Restructuring and Cost Optimization

- Reevaluating Business Operations and Processes:

Just as a gardener prunes a tree to stimulate healthy growth, sometimes a business needs to trim back its operations to become more efficient and productive. This might involve reevaluating business operations and processes to identify areas of waste or inefficiency.

Imagine you’re a restaurant owner and notice a lot of food waste at the end of each day. After evaluating your operations, you discover that your portions need to be bigger, leading to much uneaten food. By reducing portion sizes, you can reduce food waste, save money, and get approval from health-conscious customers!

- Implementing Cost-Saving Measures:

Just as Scrooge McDuck is always looking for ways to add to his wealth, a business in a financial crisis needs to find ways to save money. This could involve implementing cost-saving measures like streamlining operations, automating processes, or negotiating better supplier deals.

Suppose you’re running a delivery company and struggling with high fuel costs. By implementing route optimization software, you can plan the most efficient routes for your drivers, reducing fuel consumption and saving money in the process. It’s like finding a shortcut on a treasure map, leading you straight to the gold!

- Exploring Opportunities for Efficiency and Productivity Improvements:

It’s like a scene from a superhero movie where the hero discovers a new superpower they never knew they had. Similarly, businesses can discover new efficiencies and improvements that propel them forward, even in tough times.

For example, when digitalization and piracy hit the music industry hard, Universal Music Group, one of the largest music corporations globally, started to explore efficiency and productivity improvements.

They turned to data analytics to understand consumers’ music preferences better, optimize their artist portfolio, and personalize marketing efforts. It was like developing a new superpower of foresight, enabling them to stay ahead of market trends and consumer demands.

Revenue Generation and Diversification

- Analyzing Market Trends and Customer Needs:

In the business world, the ability to understand market trends and customer needs is like having a crystal ball. It allows you to predict future demand and stay ahead of the competition.

Let’s say you’re running a tech company in the early 2000s, and you notice the increasing popularity of mobile devices. Seeing this trend, you decide to develop a smartphone, betting consumers will prefer a device that combines a phone, camera, and music player. If your name was Steve Jobs, and your company was Apple, you’d be on your way to becoming a trillion-dollar company.

- Developing New Products or Services:

Picture yourself as a chef in a fancy restaurant. You must keep your menu fresh and exciting to keep customers coming back. Developing new products or services is similar to creating new recipes in the business world. It can attract new customers, satisfy existing ones, and generate additional revenue.

Suppose your company is Netflix, and you see the trend of consumers shifting from traditional cable TV to on-demand streaming. To capitalize on this trend, you decide to develop your own original content. Shows like “Stranger Things” and “The Crown” become huge hits, bringing in millions of new subscribers and making Netflix a dominant player in the entertainment industry.

- Expanding into New Markets or Customer Segments:

Expanding into new markets or customer segments is like exploring new territories on a map. It can open up new opportunities for growth and diversification.

For instance, suppose your company is Lego, the beloved toy manufacturer. After years of catering primarily to children, you see an opportunity in the adult market.

Adults are looking for stress-relieving activities and nostalgic experiences, so you decide to launch complex Lego sets specifically designed for adults. You’ve essentially discovered a new island of customers on your map, opening up a new revenue stream and making your business more resilient.

For example, Lego introduced the Botanical Collection, including intricate flower bouquets and bonsai tree sets, aimed specifically at the adult demographic. The product line was highly successful, diversifying Lego’s customer base and boosting sales.

Not only did Lego attract a new market segment, but it also managed to turn plastic blocks into a form of art, a stress reliever, and a nostalgic trip down memory lane.

In conclusion, overcoming a business financial crisis requires immediate action and strategic long-term planning. It’s about understanding your financial situation, making tough decisions, and finding creative ways to save money, increase revenue, and improve efficiency.

The journey might be challenging, like scaling a steep mountain, but reaching the summit and restoring your business to financial health is a rewarding achievement worth striving for.

Just remember, every crisis also presents an opportunity for growth and innovation, so keep your eyes open and your spirits high. You’ll be ready to turn any financial crisis into a business success story.

Communication and Stakeholder Management

In the grand theater of business, communication is the script that keeps all actors aligned and the performance smooth. During a financial crisis, this script becomes even more critical.

It’s the glue that holds together the various pieces of your business puzzle – employees, customers, suppliers, and other stakeholders. And as the director of this show, it’s your job to ensure that the lines of communication remain open and transparent.

Open and Transparent Communication

- Engaging with Employees, Customers, and Suppliers

Imagine you’re the captain of a pirate ship sailing through stormy seas. Your crew is scared and uncertain – the winds are strong, the waves are high, and the ship is taking on water. In this moment, silence is not golden.

As the captain, you need to rally your crew, explain the situation, and outline the plan to navigate the storm. Similarly, during a financial crisis, your employees, customers, and suppliers may be worried about what’s happening. Open and transparent communication can help alleviate these fears.

For example, during the 2008 financial crisis, Ford Motor Company faced a significant challenge. However, instead of hiding the problem, then-CEO Alan Mulally openly communicated with employees, explaining the company’s financial situation and the strategies they would implement to navigate the crisis.

This transparency helped build trust among employees and contributed to the successful turnaround of Ford.

- Providing Regular Updates on the Financial Situation

Keeping your stakeholders informed about your financial situation is like updating your travel blog as you journey through different countries. Your stakeholders are eagerly following your journey, and they want to know about the highs and the lows, the successes and the challenges.

Let’s suppose you’re the CEO of a company called “Tech Titans”, and you’ve hit a financial rough patch. You decide to send out monthly newsletters to your stakeholders, providing updates on your financial health, the steps you’re taking to resolve the crisis, and how they can support the recovery process.

This keeps everyone in the loop and maintains their trust and confidence in your leadership.

- Building Trust and Maintaining Relationships

Trust is the golden key that unlocks the treasure chest of long-term business success. By being transparent about your financial situation and regularly communicating with your stakeholders, you’re not just building trust, but also maintaining and strengthening your business relationships.

Seeking Professional Advice and Support

- Consulting with Financial Experts or Business Advisors

Dealing with a financial crisis can sometimes feel like being lost in a dense, dark forest. It’s easy to lose your way and wander around in circles. But what if you had a guide to help you navigate through the forest and find a way out?

Financial experts and business advisors are like those knowledgeable guides. They can provide valuable advice, help you understand your financial situation better, and suggest effective strategies to overcome the crisis.

For example, suppose you own a popular restaurant chain, “The Spicy Chef,” that’s facing a financial crisis due to a sudden downturn in the economy.

You decide to consult a business advisor who specializes in the hospitality industry. The advisor helps you understand your current financial position, suggests cost-cutting measures, identifies new revenue opportunities, and assists you in developing a comprehensive recovery plan.

- Engaging Legal and Accounting Professionals, If Necessary

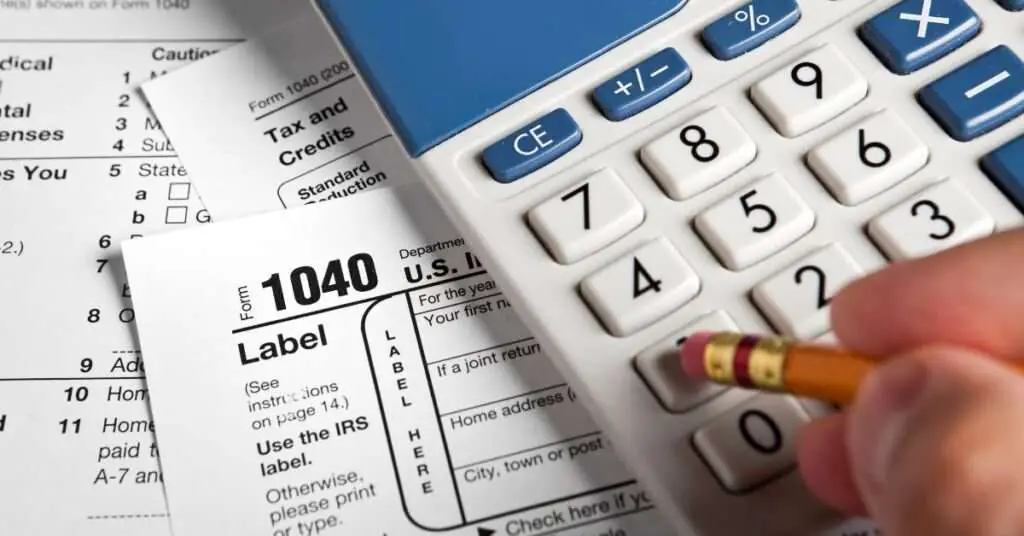

When sailing in treacherous waters, having a skilled navigator on board is crucial. Likewise, you may need to engage legal and accounting professionals during a financial crisis to help you navigate complex financial, legal, and tax issues.

Let’s say you’re the owner of a successful winery, “The Grapes of Wrath.” Due to an unforeseen natural disaster, your vineyards are destroyed, leading to a financial crisis. An accountant can help you navigate the complicated insurance claims process and identify possible tax deductions related to the disaster.

A legal professional, on the other hand, can assist you with any potential legal issues that may arise from this crisis, such as contract renegotiations with suppliers or disputes with insurance providers.

Financial Crisis in Business

Consider our winery owner in “The Grapes of Wrath” scenario. They hire an accountant to review the insurance policy, ensuring they take full advantage of potential claims. The accountant discovers a clause in the policy that allows for additional compensation for lost income during the recovery period, significantly improving the winery’s financial outlook.

At the same time, the winery owner engages a legal professional to handle a dispute with a supplier who is demanding payment for grape vines that were never delivered due to the disaster. The lawyer successfully argues that the contract was frustrated due to the unforeseen natural disaster, saving the winery from a potentially costly legal dispute.

Engaging with such professionals helps resolve immediate financial and legal issues and contributes to the long-term recovery plan. Their expertise can provide critical insights and solutions you may not have considered, helping you navigate the crisis more effectively and efficiently.

Remember, a financial crisis doesn’t signify the end of the road for your business. It’s a storm that you need to weather, and with the right strategies and support, you can navigate your way to calmer waters.

Open communication, transparency, and seeking professional advice are crucial elements of your crisis management script, helping you keep the show running and eventually leading your business towards a standing ovation.

Monitoring and Evaluation

Establishing Financial Monitoring Systems

- Tracking Key Financial Metrics and Indicators

Let’s imagine your business as a thriving bee colony. As the queen bee, you need to keep an eye on the honey production (revenue), the pollen and nectar coming in (cash flow), and the amount of honey eaten by the bees (expenses).

If something seems off – say, honey production is down or too much honey is being consumed – you would need to investigate and make changes.

In the business world, countless metrics and indicators help you keep track of your financial health. From cash flow statements to balance sheets, these are your tools to understanding your business’s financial situation.

Consider Amazon, for example. In their early years, they consistently monitored their Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC).

By ensuring that the value each customer brought in was higher than the cost to acquire them, Amazon was able to effectively monitor and adjust its strategies, leading to its exponential growth.

- Conducting Regular Financial Reviews and Assessments

Regular financial reviews and assessments involve routinely analyzing financial statements and performance metrics to evaluate a business’s financial health and inform strategic decision-making.

Imagine your business as a bustling train station. As the stationmaster, you must regularly check the timetable, inspect the tracks, and maintain the locomotives. Similarly, in business, you must conduct regular financial reviews to ensure everything runs smoothly.

For instance, Apple conducts regular financial reviews and assessments. They closely examine their revenue, expenses, and net income. By doing this, they can identify any potential problems early and take corrective action, allowing them to maintain their position as one of the most valuable companies in the world.

Adjusting Strategies and Plans as Needed

- Adapting to Market Conditions and Changing Circumstances

Adapting to market conditions and changing circumstances is the process of adjusting business strategies and operations in response to shifts in the business environment, consumer trends, or economic conditions.

Imagine your business as a chameleon, a creature known for its remarkable ability to change its color to match its surroundings. Just as the chameleon adapts to its environment to thrive, your business must also adapt to the changing market conditions and circumstances.

Netflix is a prime example of a company continuously adapting its strategies to market conditions. Initially, it started as a DVD rental service, but as technology advanced and market trends shifted, it adapted and transitioned into streaming.

Then they took it a step further and began creating original content, evolving from a simple content distributor to a major player in the entertainment industry.

- Continuously Improving Financial Management Practices

It refers to enhancing a company’s financial strategies, processes, and systems to optimize financial performance and ensure sustainable growth.

Think of your business as a professional athlete. You must continuously train, learn, and improve to stay at the top of your game. Similarly, businesses must continuously refine their financial management practices to stay competitive and financially healthy.

For example, Google, a giant in the tech industry, continuously improves its financial management practices. They consistently invest in research and development, which leads to the creation of innovative products and services. This continuous improvement helps them remain competitive and improves their financial health by creating new revenue streams.

In conclusion, monitoring and evaluation are crucial to overcoming a financial crisis in business. By closely monitoring your business’s financial health and adapting as necessary, you can steer your business ship through any storm and towards success.

Conclusion

Navigating the rough waters of a financial crisis in business can be daunting. It requires keen observation, quick decision-making, and strategic planning. However, as we’ve journeyed through this guide, we’ve equipped ourselves with vital tools and strategies that can help us survive the storm and thrive in its aftermath.

We began our journey by identifying the financial crisis, recognizing signs like cash flow problems, declining sales or revenue, and increasing debts or liabilities.

Our Sherlock Holmes-like investigative skills allowed us to conduct a thorough financial assessment, analyze Key Performance Indicators (KPIs), and identify areas of financial weakness.

Our survival kit included immediate actions like expert cash flow management, cutting unnecessary expenses, improving invoicing and collections processes, and negotiating favorable payment terms with suppliers.

We also sought additional financing or funding options, considering loans, attracting investors, or even exploring government assistance programs.

Our long-term recovery strategy consisted of strategic measures such as restructuring and cost optimization, revenue generation, and diversification. Like a phoenix rising from the ashes, we found ways to reevaluate business operations, implement cost-saving measures, and explore opportunities for efficiency.

We also learned to analyze market trends, develop new products or services, and expand into new markets or customer segments.

We recognized the importance of open and transparent communication, engaging with employees, customers, and suppliers while providing regular updates on the financial situation.

We also understood the necessity of seeking professional advice and support, consulting with financial experts or business advisors, and engaging legal and accounting professionals, if necessary.

Finally, we understood the significance of continuous monitoring and evaluation. We learned to establish financial monitoring systems, conduct regular financial reviews, and adapt strategies and plans as needed, continuously improving our financial management practices.

Our journey through this financial crisis may have been challenging, but remember, the best views come after the hardest climb. You now have a roadmap to navigate your way through. Remember. It’s okay to seek help. You’re not alone, and professional advice can be a game-changer.

The financial health of your business is in your hands. It’s time to step up, make those tough decisions, and lead your business back to prosperity. We believe in you, and soon, you will overcome this crisis, emerging stronger and more resilient than ever. Onwards and upwards!