As there are different people in this world, so are their investment styles. Some park their money in long-term investments to achieve bigger goals, like buying their dream house, having a lot of money at the time of retirement, and others.

On the other hand, some people have smaller goals that must be achieved in the near term. For example, buying a new appliance, getting their car modified, and others. These people prefer investments that can give them good returns on their money in the short-term.

Of course, many people invest their money for the short-term as well as long-term.

When you have small amounts of money and will require it after a short period, you should look forward to short-term investments. If you don’t know about the best short-term investments, you are on the right page.

This article will inform you about some of the best investment ideas that can fetch good returns in a short period. As it also contains information essential while making short-term investments, make sure you read it till the end.

What are Short-Term Investments?

Short-term investments, also known as marketable securities or temporary investments, are investments you can easily get converted into cash, usually in less than five (5) years.

Most people sell or get their short-term investments converted into cash in just 3-12 months. Some examples are CD (Certificate of Deposit), High-Yield Savings Accounts, Government Bonds, Money Market Accounts, and Treasury Bills.

The objective of making short-term investments is to protect your capital and get good returns on it in a short period.

Experts suggest that making short-term investments in stocks or mutual funds is not a good idea because a bear market can wipe out gains. If you have a small capital and invest it in high-risk stocks or mutual funds for a short period, any decline in the market can affect you badly, both financially and emotionally.

Consider These Before Making Short-Term Investments

Before making short-term investments, you must get answers to these two questions:

- What goals do you need to achieve with these investments?

- How much risk can you tolerate?

Your goals will help you decide where to invest money. For some people, returns from short-duration investments act as passive income, whereas others make such investments to increase the money in their bank account a bit faster.

Being aware of your risk-tolerance capacity also helps in making the right decision. As none of the investments is 100% risk-free, you must be clear of how much loss you can bear.

Best Short-Term Investments for Small Amounts of Money

When it comes to investing small amounts of money for the short-term, many opportunities are available. However, some of them can be more versatile and aggressive than others. Let’s explore some of the best options:

1. Certificate of Deposit (CD)

Let’s focus first on the less risky investment opportunities. Offered by banks, credit unions, and thrift institutions, a CD (Certificate of Deposit) is a financial product that provides interest on the money customers invest for a fixed duration. Some durations people prefer are 3, 6, 9, or 12 months.

The premature withdrawal of CD attracts a penalty often equivalent to the interest income of several months. If you want to avoid the penalty, remain invested for the whole term.

There are some no-penalty CDs also in the market which allow early withdrawal without any penalty. But, the interest rates on such CDs are lower as compared to others.

2. Treasury Bills

T-Bills, or Treasury Bills, are one of the safest short-term investments because the government issues them. Many people consider T-Bills as the right short-term investment because they can purchase these bills at a discounted price.

Let’s understand it with the help of an example:

Suppose that you have to invest in treasury bills. If its face value is $100, then you’ll need to invest only $90. The $10 discount will be your return and get added at the time of maturity. It means you’ll get $100 at the time of maturity.

Usually, the minimum investment one can make in T-Bills is $100, and the maturity period varies from one week to one year from the date of purchase. If you compare them to CD (Certificate of Deposits), both risk and returns are low.

3. Government Bonds

Another less risky option will be purchasing Government bonds. These are issued by the government and pays less interest, but your investment remains safe. Government bonds are available for direct purchase, but people can also invest through government bond funds. As you have to make a small investment, the right approach would be these funds.

An advantage of government bonds that attracts most investors is that they are free from local and state taxes (foreign government bonds are not tax-free). When it comes to interest payments, many government bonds pay interest on maturity and some periodically.

When you invest in government bonds, you automatically become a contributor to the progress of your country. They are used for the development of public infrastructure projects, domestic programs, etc.

4. Corporate Bonds

Corporate bonds are similar to government bonds, but the difference is that private corporations or companies, usually large caps, issue them. You can invest in them directly or through corporate bond funds.

Corporate bonds, like government bonds, are safer investments. Your investment is at risk only if the bond-issuing company collapse. But, your money remains safe mostly because the assets of companies are often reserved as collateral. In case the company collapses, they’ll help in repaying your money.

You can also purchase corporate bond ETFs. If you actively track the market, you can get handsome returns on your ETF investments.

5. High-Yield Savings Account

As the name indicates, the interest provided by high-yield savings accounts is higher than traditional savings accounts. Most banks allow customers to open a high-yield saving account online. They are usually free and do not ask for a minimum balance.

Another advantage of high-yield saving accounts is the $250,000 FDIC insurance. In case the bank fails, there’s hope to get back up to $250,000.

You may still find people saying that these accounts provide low returns. If you compare returns with those of the stock market, they are less. But, don’t forget that stocks provide those returns in the long run, and you have to make a small, short-term investment.

If you invest your small capital in the stock market and the market is bearish, your investment may fetch negative returns.

6. Thematic Exchange Traded Funds

The constituents of a regular ETF are usually tied to an asset class or the broader market index. However, it’s not the case with thematic ETFs (Exchange Traded Funds). These funds focus on a specific investing purpose or theme.

Some examples of thematic ETFs are:

- Cyber Security

- Banking

- Consumer Staples

As the focus of these funds is on a specific theme, they are riskier than regular funds. The expense ratio of ETFs is much lower as compared to mutual funds and other securities. It helps in maximizing your returns.

Above all, you don’t need large amounts of money to invest in ETFs. Many brokers provide the option of fractional investment. It means if you have $5 to invest, they won’t disappoint you.

7. Index Funds (Commission-Free)

Another way to get good returns on your small capital in the short-term is to invest in commission-free index funds. Experts say that it is one of the cheapest and easiest ways to benefit from the stock market. Well, they are correct.

The assets of these funds and their benchmark index are the same. Yes, the returns are also almost similar. Unlike mutual funds, index funds are passive and thus, attract low brokerage as well as tax.

You can make your short-term investments in these types of index funds:

- S&P 500

- Government Bonds

- Small-cap stocks

- Large-cap stocks

- Corporate Bonds

- Emerging Markets

Another advantage with index funds is that they provide higher exposure for low amounts of money. For example, you can’t get exposure to each company in the S&P 500 for $100. But, an exchange fund can provide you exposure to all S&P 500 stocks for just $100.

8. Stocks

Stocks of high-performing companies provide better returns and avert complete dependency on low-risk options. Today, many brokerage firms allow people to make small investments in stocks either for free or with very little commission.

However, investment in stocks is riskier as compared to other short-term investments. If you are new to the stock market, it’s better to avoid investing in stocks or take the help of a reliable financial advisor.

When it comes to maximizing your returns through short-term investments in stocks, you can consider the following:

- Only invest in large-cap companies whose prices have risen in history. Try to avoid new and hot stocks.

- When you invest via discount brokerages, you can save brokerage costs. It will eventually maximize your short-term profits.

- Find out your risk-tolerance capacity and trade according to that only.

There can be several other things to consider, but they may vary from individual to individual. It’s better to do your homework and have a strategy before entering the stock market.

9. Individual-to-Individual Lending

Also known as social lending, crowdlending, or peer-to-peer (P2P) lending, it happens when a person borrows money from another person promising to pay interest on it. The highlighting point of this type of lending is that there is no involvement of a middleman.

This investment opportunity is relatively new and didn’t exist (formally) before 2005. Today, several websites facilitate individual-to-individual lending. These websites have accounts of loan applicants and lenders (people like you). The loan applicants are assigned a “risk rating” to help lenders identify the best applicants.

It is a risky investment opportunity but allows you to get a higher interest on your lendings. As your investment horizon is short-term, you must grant loans maturing in less than five (5) years.

10. Cashback on Credit Cards

If you have control over your spending habits, you can earn some extra bucks in the short-term. The returns can be more than any other short-term investment option. Let’s find how it is possible:

Many credit cards provide a sign-up bonus to users. It is usually in the form of points or cash and given when your spendings meet a certain limit within a specific period. After adding figures, the offer would look something like this:

Get $250 back if you spend $750 in the first three months of purchasing the card. That’s a whopping 33.33% return. Which short-term investments promise that?

But, it doesn’t mean you should shop the things you don’t even need, rather spend smartly. Use the credit card to cover your monthly expenses, like cellphone bills, utility bills, insurance premiums, payments for groceries, etc.

When you spend like this, your target gets achieved, and you earn reward points also. This cashback you can earn even after the offer ends. So, you can assume these cashback rewards as returns on your short-term investment.

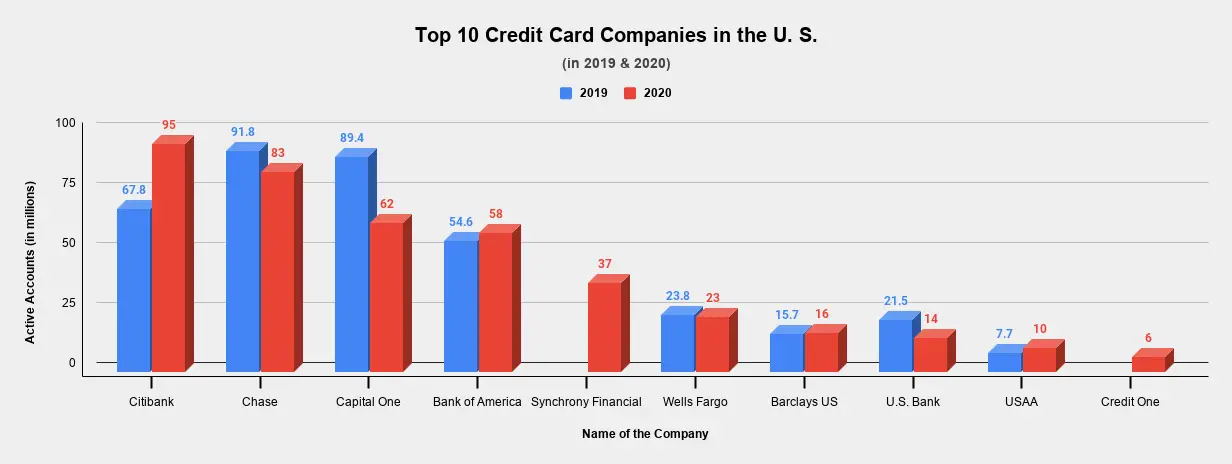

Source: Statista.com

One thing you need to be cautious about is the annual fees of your credit card. Cards with great sign-up offers usually charge hefty annual fees. But, if you spend smartly, your rewards can make those fees small.

Bottom Line

Investing small amounts of money for the short-term can help you in many ways. Such investments can help you achieve your short-term financial goals, such as making down payments for your car loan or mortgage.

While making short-term investments, make sure thoughts like “high risk = higher reward” don’t come to your mind. To achieve your short-term financial goals, choose the investments having minimal risk and provide modest returns.

Disclaimer: All information on this page is general. It might not be suitable for every person looking for the best short-term investments for small amounts of money. You can use this article as a suggestion tool that helps decide the best investments for the short-term. We suggest consulting a certified financial advisor before deciding where to place your money.