Long-term investments are a crucial part of every wealth-creation strategy. If you are young and aiming to retire rich or create a fortune in the next 2-3 decades, remember you can’t do it without long-term investments.

Who doesn’t like to be a wealthy person?

However, very few individuals know the right way to become one. People usually think that short-term investments, like trading stocks, will help them earn a lot of money. But when those short-term investments fail, they are left with nothing but disappointment.

It is essential to know that real wealth is created in the long run and with the help of long-term investments. If you are a novice investor and searching for some of the best long-term investment ideas, you are on the right page.

This article contains information useful for people beginning with long-term investments. Let’s discover the best ways to appreciate your capital in the long run.

Best Long-Term Investments for Beginners

The best approach to maximize your capital would be to identify your long-term financial objectives and invest in multiple financial instruments. Now, let’s find some of the best long-term investments for beginners.

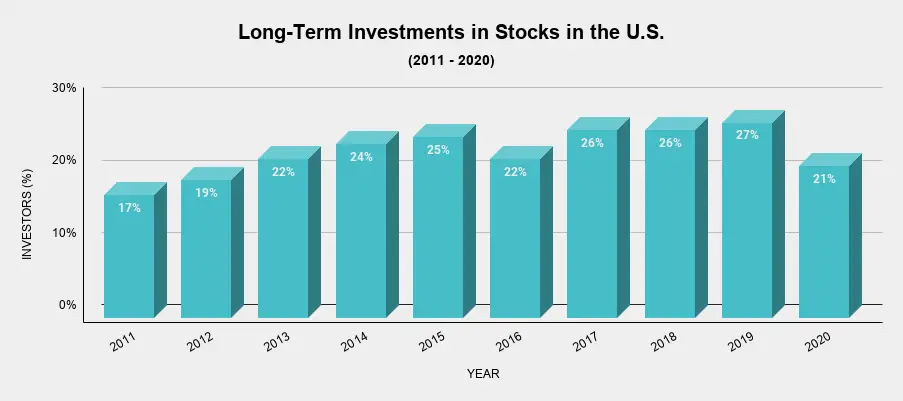

1. Stocks

When it is about expanding your capital significantly, your first step should be to invest in stocks for a long time.

The S&P 500’s average annual returns stocks have provided over the last 100 years is nearly 10-11 percent (including capital gains as well as dividends).

It means money invested in stocks, 100 years back, has grown at an average rate of 10-11 percent per year irrespective of depressions, wars, recessions, and stock market crashes. This is one of the prime reasons why stocks should be a part of every long-term investment portfolio.

Source: Statista.com

In stocks, you can choose from these categories for long-term growth:

• High-Yield Dividend Stocks

High-yield dividend stocks belong to companies that give back a significant amount of earnings to shareholders.

Investments made in high-yielding dividend stocks for the long-term fetch higher returns compared to fixed-income instruments. To verify, you can compare the returns of high-yield dividend stocks with those of a 10-year US Treasury Note. You’ll find the dividend yield is higher.

Another advantage of investing in high-yield dividend stocks is additional returns from capital appreciation. For example, a 5% annual dividend yield of your stock plus 6-7 percent of capital appreciation every year will inflate your investment a lot in the long run.

• Growth Stocks

These stocks don’t pay high dividends but grow significantly over time. Companies of these stocks do not distribute profits among shareholders because they reinvest it to attain higher growth.

However, investment in growth stocks is risky. They are often the first to lose value quickly during steep downfalls, bear markets, or recessions.

But this risk can’t deny the fact that growth stocks are one of the biggest wealth creators. If you evaluate past performances, technology stocks have proved to be the perfect growth stocks.

• Small-cap Stocks

The stocks/shares of small companies are called small-cap stocks. You can add some of them (after thoroughly analyzing) to your long-term portfolio because several small-cap stocks have the potential to become large-cap stocks over time.

If you remember, Amazon was a small-cap stock in the starting. The investors who bought it at that time and kept it for a long duration became very rich.

Many experts won’t suggest investing in small-cap stocks because of the risk associated with them. As smaller companies lack sufficient financial resources, brand recognition, and approach to capital markets, the risk of failure/underperformance is more.

But if you invest in small-cap stocks after thorough evaluation and apt prediction, your investment could make you super-rich.

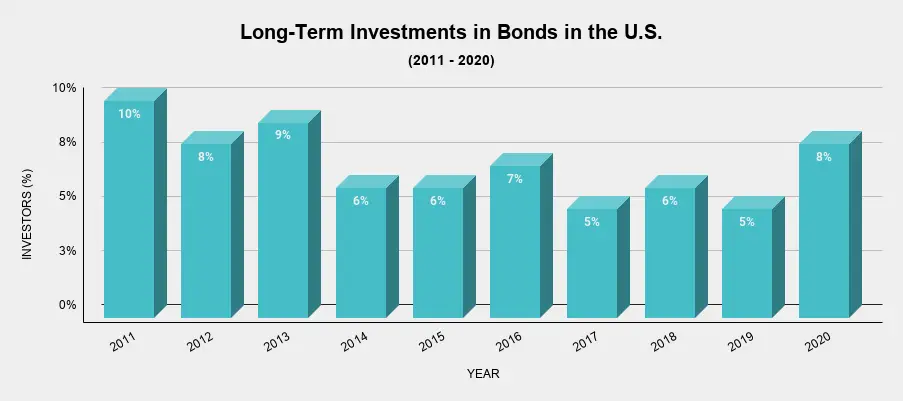

2. Bonds

When you’re investing for the long-term, make sure bonds are in your portfolio. Bonds are long-term and interest-bearing financial instruments.

There are different types of bonds, such as government, corporate, international, and municipal, to invest. It depends upon the investor where he wants to park his/her money.

Source: Statista.com

The most attractive feature of bonds is the interest rate. When you purchase a bond, the issuer will pay you annual interest. You can also benefit when the value of bonds increases. Yes, just like stocks.

3. Bond Funds

When you don’t want to make a direct investment in bonds, invest via bond funds. A Bond Fund (ETFs or Mutual Funds) contains several bonds from different issuers.

The categorization of bond funds depends upon the types of bonds included in them. For example, a corporate bond fund is a portfolio of several corporate bonds. A municipal bond fund’s portfolio contains many municipal bonds.

Bonds are considered safe, but bond funds are safer because a bond fund is the portfolio of several bonds from different issuers. Moreover, they are a great example of diversification and risk-minimization when a bond in the portfolio defaults.

4. Stock Funds

Stock Funds prevent you from making direct investments in stocks. Stock Funds, the collection of multiple stocks, are most useful when you don’t have the time or knowledge to analyze individual stocks. A Stock Fund can be in the form of a Mutual Fund or ETF.

Like bond funds, there are different categories of stock funds also. For example, a stock fund based on the infrastructure sector contains most stocks belonging to infrastructure-related companies.

These funds are most useful when you want to appreciate your capital aggressively. The biggest advantages of a stock fund are diversification and risk-minimization.

As every fund is a collection of many stocks, the return it gives is the weighted average return of all stocks present in that fund. Moreover, stock funds don’t fall like individual stocks during recessions, economic slowdowns, crashes, and other adverse situations.

5. Real Estate

Investment in Real Estate is another best long-term investment. It is because the long-term returns produced by real estate are somewhat like those of stocks.

If you keep returns aside, there are other reasons also to invest in real estate:

- You can borrow money from a bank, use it to invest in real estate, and repay it slowly over time.

- The interest rates on borrowings are low.

Source: Statista.com

Some people don’t borrow money while investing in real estate but make the entire payment in cash. Experts don’t favor such approaches because this way, you tie large amounts of money in a single asset.

It implies you don’t have a diversified portfolio. There can be problems if something unexpected happens to your asset. But these risks can’t avoid the fact that real estate investments give extreme returns in the long run.

Here are some best ways to invest in real estate:

- Purchase your own house.

- Start Investing in Residential Rental Property.

- Invest in Real Estate Investment Trust (REIT).

- Diversify Your Investments through Real Estate Crowdfunding.

Whatever way you choose to invest in real estate, make sure you remain invested for a long time.

6. Tax-Sheltered Annuity (TSA) or Retirement Plan

Every person concerned about his/her retirement makes a retirement investment strategy and invests accordingly. Savings for retirement should also be on your list of long-term investments.

When you invest in a retirement plan, make sure it provides crucial tax benefits. This way, you won’t be paying taxes on your investment for retirement. It will continue to grow without any tax deductions. However, there will be tax obligations at the time of withdrawal.

Let’s understand why you should go for a tax-sheltered financial instrument:

Suppose that you have invested $25,000 in a taxable fund for 25 years. It promises to give an annual return of 10% on your investment. If you are someone who pays 30% income tax, your net return will be 7%.

After 25 years, your invested money will be around $135,686.

Now, let’s say you invest the same amount of money in a tax-sheltered financial instrument that also provides a 10% average annual return. There won’t be any immediate tax concerns, no matter in whichever tax bracket you fall.

In this case, your invested money will become around $270,868 after 25 years.

You’ll earn $135,182 extra just by investing in a tax-sheltered financial instrument. Decide yourself which one is better – tax-sheltered or non-tax-sheltered?

7. Robo-Advisors

Lack of knowledge and confusion often leads people to make mistakes. When you are new to investments, confusion and ignorance might affect your investment decisions.

The best you can do is leave it to skilled professional services, Robo-Advisors. You just need to deposit money in a Robo account, and the Robo-advisor will automatically invest it in different financial instruments.

Based on the financial objectives, risk tolerance, and time horizon, investment portfolios by Robo-advisors may vary from individual to individual. The portfolios usually contain stocks, bonds, low-cost ETFs (Exchange Traded Funds), and sometimes precious metals, real estate, and other instruments.

Of course, charges apply when you invest through Robo-advisors, but it turns out to be negligible compared to the returns you get in the long-term.

Frequently Asked Questions

As you are just starting with long-term investments, numerous questions might be coming to your mind. Let’s find whether answers to these frequently asked questions resolve your queries as well.

1. Everyone emphasizes so much on long-term investing. Why?

Long-term investments not only help in achieving financial goals but also minimizing the negative impact of inflation. If you compare the prices of gasoline 2-3 decades back and today, you’ll find a huge difference. That’s because of inflation.

Suppose that, 30 years back, a person stored $1,000 in his closet, and another person invested $1,000 in a fund offering an average annual return of 10%.

Today, the stored money will be $1,000 only, but the invested money would’ve become around $17,450. What’s better – $1,000 or $17,450?

Long-term investing, mostly, helps you combat inflation and achieve financial goals easily. However, it is not the same in the case of short-term investments.

The biggest drawback of short-term investing is that it might fail to protect you from the impact of rising inflation. Moreover, investments made with a short-term horizon may not prove to be sufficient to fulfill your financial objectives.

2. I am a beginner; how much should I invest?

The investment amount depends upon your earnings and financial goals. Experts say that you should invest the maximum amount you can afford comfortably after fulfilling your regular financial responsibilities, like paying-off monthly debts, daily expenses, and others.

3. Are long-term investments risky?

All kinds of investments, whether short-term or long-term, are risky when not managed. If you make an investment plan and diversify your money in different financial instruments, you’ll be more than happy in the long run.

Diversification is important because it prevents you from putting all your money into a single investment. A single investment can erase your capital during adverse economic conditions and other negative situations. Moreover, a diversified portfolio helps in minimizing the risks of capital depreciation.

4. How long should a long-term investment be?

According to the textbook definition of long-term investments, any investment kept for more than one (1) year is a long-term investment.

But, the actual duration of a long-term investment depends upon an individual’s goals. It can be different for different people. For example, the duration will be five (5) years for a person requiring money to cover his/her child’s higher education fee after five (5) years.

It can be 20 years for a person aiming to become mortgage-free in the next 20 years. It will be more different for someone expecting to retire rich.

Final Words

People new to long-term investments often get confused while selecting relevant financial instruments. Ignorant investment decisions affect your financial objectives.

The best you should do is plan a portfolio consisting of different long-term investment products. When you finish planning a diversified portfolio, bring it to life.

Diversification not only helps in investment in multiple products at a time but also minimizes risks. You can make your portfolio by consulting a certified financial advisor or considering the investments mentioned in this article.

Whatever long-term investments you choose, make sure you start at an early age. This way, you’ll have ample money in your hands to complete all your long-term financial objectives.

Disclaimer: All information regarding the best long-term investments for beginners on this page is general. It might not be suitable for every person looking forward to making long-term investments. You can use this information as guidance for making long-term investments. We suggest consulting your financial advisor before making the final decision.