As a parent, you want your children to grow up healthily and happily. Besides unconditional love, food, and shelter, what’s the best thing you can give to your baby?

Parents can give their baby a life insurance policy that covers his/ her whole life. This smart financial decision will ensure peace of mind and act as a gift offering lifetime protection to your babies.

When you search for the best life insurance for babies, you might come across different views. Some of them are encouraging, while others may discourage you so much that you will drop the whole idea of purchasing life insurance for your baby.

Experts say that the final decision is always of parents, but getting life insurance for their kids will only be a wise conclusion.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/best-life-insurance-for-babies/

Today, this article is going to help you learn some vital things parents need to know before getting a life insurance policy for kids.

What is Life Insurance for Babies?

Life insurance for babies is an insurance product that covers the life of your child/ children. By combining savings along with insurance, this kind of life insurance secures the financial future of a child.

In addition to coverage, life insurance for babies takes care of their future financial needs. It also helps them fight growing inflation. Different insurance providers in the market offer different kinds of life insurance products for babies.

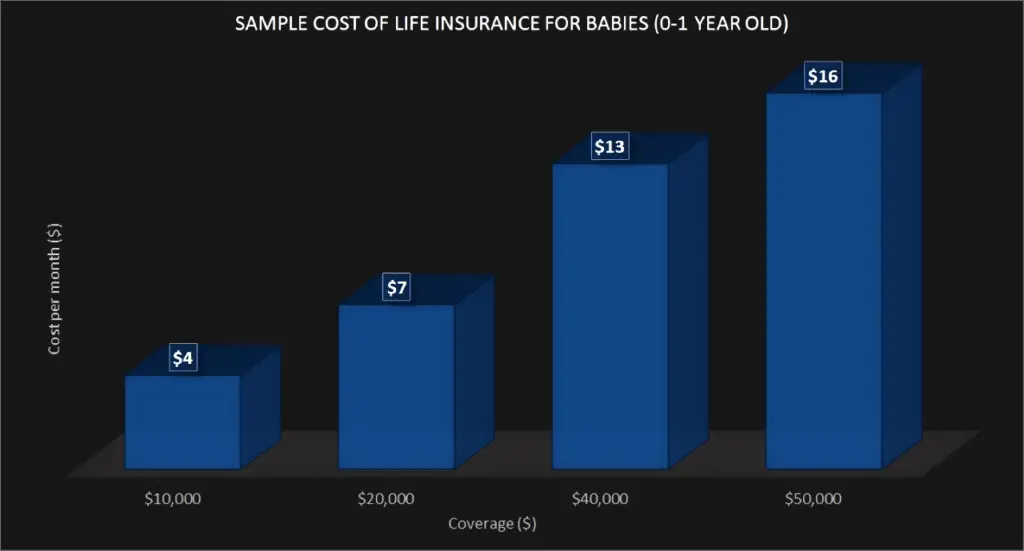

Source: https://www.choicemutual.com/child-life-insurance-cost/

Types of Life Insurance Policies for Babies

Parents can choose from three different types of life insurance policies for their children. The basis of selection is often the goals set by parents for their children. For example, some parents want the insurance policy to support their child’s college fees.

• Term Life Insurance

The features of term life insurance are the same for adults as well as children. It covers your child for a specific period, such as 15 years, 20 years, and so on. You might be knowing the premium of a term life insurance policy for adults is less than any other life insurance policy. It is even cheaper in the case of term life insurance for babies.

When your child turns 30 (suppose that you bought the insurance at the time of your child’s birth and kept the term 30 years), he/ she can make changes to it. For example, your child will have the option to extend its coverage, close the policy and buy a new one, or convert it into a new plan.

• Whole Life Insurance

A whole life insurance policy covers your child for the entire life. The premium amount is significantly low, but premium payment rules are the same as for adults. It remains in force by the time premium is paid regularly.

If you miss paying the premium, the policy may lapse. Note that the whole life insurance policy on your child remains valid until you or your child (grown-up) closes it deliberately. Experts suggest parents should research thoroughly before buying a life insurance policy on their child.

• Term Life Insurance Rider

To differentiate one policy from another, insurance providers add different kinds of features. They are called riders and are available as additional benefits to the insurance policy. If parents don’t want to purchase a separate life insurance policy for babies, they can opt for a term life insurance rider.

An advantage with term life insurance rider is that if you have three children, you don’t need to purchase separate riders for each of your children. One rider will cover all of them (if they are eligible).

Advantages of Life Insurance for Babies

When parents learn that a life insurance policy for babies provides several benefits, they often agree to get a life insurance policy on their baby’s life. Below are some of the advantages justifying why life insurance for babies is the right choice:

• It is available cheaper: When you buy a life insurance policy for your baby, its premium amount is just a minute fraction compared to adults. Most parents don’t buy a huge insurance policy for their newborns. Sometimes, the premium of such life insurance policies is even less than the price of a coffee in your nearby café.

• It protects against financial stress: No one is ever 100% sure of what is going to happen in the future. The worst thing for parents is to see the demise of their child, but sometimes such unfortunate events take place. In these cases, parents suffer a lot financially as medical bills, burial costs, and other expenses stack against them. At that time, a life insurance policy can limit or eliminate these stress-causing financial burdens.

• It can fund your child’s college fees: When parents buy a whole life insurance policy on their babies, it’s cash value grows substantially by the time their kids become ready for higher studies. Not all parents can afford the college fees of their child, but with the help of life insurance. For correct guidance on this, you can discuss your objectives with a reliable insurance advisor.

• It provides maximum time for growth: Most people don’t get good returns on their investment because of the lack of sufficient time. Financial experts say that investments give higher returns when you remain invested for a long time.

When adults invest in a whole life insurance policy for themselves, they don’t get good returns. But when parents buy life insurance for babies, the returns are significantly higher than other investment products. Of course, in addition to life coverage.

Which is the Best Life Insurance for Babies?

As you are now aware of the reasons to buy and types of life insurance for babies, it is time to understand which life insurance product is the best.

According to experts, the best option for babies is a Whole Life Insurance Policy. It is cost-effective and remains in force until you are regular with premium payments or closes it knowingly. When your child grows over 18 years (becomes eligible), you can transfer the ownership. Once your child becomes the owner, he/ she gets the power to modify or even close that life insurance policy.

If you see the rising cost of funerals nowadays, you may agree that parents must buy life insurance for their babies. In the most unfortunate case of a child’s demise, the whole life insurance policy will give parents money to cover expenses related to that sad incident.

Besides these features, the prime advantage associated with whole life insurance policies is the cash value associated with them. It is the investment that often grows simultaneously with your child. Mostly, parents who buy a whole life insurance policy for their children don’t worry about college fees and other expenses because the life insurance policy takes care of them.

Some parents prefer a whole life insurance policy because they don’t want their child (when they become adults) to pay a higher premium for an insurance policy. Moreover, buying a completely new life insurance policy is always expensive compared to continuing with an existing one.

Things to Consider

To research or learn about is something people often do before purchasing anything. Your attitude should also be the same before buying a life insurance policy for your child. Below are a few things you should consider to get the best life insurance for babies.

• Premium

The first thing you need to consider is the premium amount and premium payment frequency. Almost all such life insurance policies are available at low premiums, but you may still see variations. Yes, because of the presence of different insurance companies.

Experts suggest that you should finalize only that policy whose premium suits your budget. Some insurance companies offer riders for newborn babies on the life insurance policy of parents. These riders are available cheaply or free of cost. If you are low on budget, consider adding such a rider on your life insurance policy instead of purchasing a new one for your child.

Another thing you should consider is the frequency of premium. It can be monthly, quarterly, half-yearly, or yearly. The premium frequency may depend on companies or plans. So, choose a frequency that suits you best.

• Coverage

The next thing you should consider is the amount of coverage. If you have some amount or feature in mind, evaluate different plans offered by insurance providers. Go for the one matching your requirements. If you are a novice, consult a reliable and experienced insurance advisor.

Sometimes parents make impulsive decisions. They opt for a sizeable amount of coverage without considering its premium and self budget. After paying two or three premiums, they realize that it was a mistake. You should avoid making such mistakes.

• Customization

You might be knowing that different insurance companies in the market offer different kinds of life insurance policies and plans. To emerge as the best, some companies offer customized services as per your needs. If you want the insurance policy to have some distinctive feature or add some clause to it, look for the insurance companies that allow customized services.

• Terms and Conditions

Whenever you purchase a life insurance policy for your baby, make sure you have read all terms and conditions. Not only this, make sure you understand and agree to them. Sometimes, parents do not pay much attention to the terms and conditions which hurt them or their children later.

Frequently Asked Questions

This article has covered many important things, but not all. Some of your queries might still be unanswered. Let’s see if these frequently asked questions settle your doubts.

1. Can I purchase a life insurance policy on my grandchild?

Yes, you are eligible. Parents, grandparents, step-parent, great grandparents, and legal guardians (permanent) can purchase life insurance on little ones.

2. I want to buy a life insurance policy for my baby. What is the minimum age required?

The minimum age to purchase a life insurance policy varies from insurer to insurer. Some allow parents to buy it as soon as their child is born, some want your baby to be at least 14-days old, and some three months.

3. What is the maximum age limit to insure a child?

The maximum age set by most insurance companies is 18 years. After this age, a child falls into the category of adults. The insurance companies want adults to purchase the life insurance policy on their own.

4. Some people advise not to buy life insurance for babies. Why?

People advising not to buy life insurance for babies often consider it an expense. Yes, it is an expense for families not getting sufficient income to cover their monthly expenditures. For them, the policy’s premium is an additional financial burden.

The availability of investment products with higher returns also gives them the strength to vote against life insurance for babies. You might be knowing that higher return investments depend on the market’s performance. If the market performs better, your investment will earn handsome returns. And if the market performs worse, your returns will be nil or negative.

5. How can I purchase a life insurance policy for my baby?

Purchasing a life insurance policy for babies is quite simple. After finalizing the insurance company, you can go to their website and compare different plans for children. Then, fill a simple online form to initiate the process. Many insurance companies allow parents to make online as well as offline purchases.

If you can’t finalize the insurance company, search life insurance for babies quote comparison tools over the internet. These tools will help you to compare the offers by different companies and finalize the one most suitable according to your needs.

Final Words

Life insurance for babies is an insurance product to protect against unexpected life events and act as an investment vehicle. Many people believe buying life insurance for babies is not a good idea. However, there are not enough reasons to prove them 100% correct.

When parents see the positive side and advantages of having a life insurance policy for babies, they go for it. Out of the many options, parents can choose a whole life insurance policy for kids. When your child grows old, he or she may realize that it is one of their best gifts.