People buy a life insurance policy so that beneficiaries remain unaffected financially in case of the premature death of the policyholder. Well, there can be many other reasons to buy a life insurance policy.

To pay off the debts, pay for the college education of children, for estate planning, and others can also be the reasons for purchasing a life insurance policy. When you hear about the insurance policy from someone, it looks simple. But, confusion arises when you start looking into the details.

However, a little awareness about life insurance products may prevent you from being confused. One question most people ask is – who should be the owner of a life insurance policy?

Today, this article is going to help you learn a lot of things about and related to the ownership of a life insurance policy.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/who-should-be-the-owner-of-a-life-insurance-policy/

Who All Are Involved In A Life Insurance Policy?

In every life insurance policy, there is an involvement of three parties. They are:

- The Insured: An individual having his/ her life covered.

- The Beneficiary: An individual who receives the death benefit or face value when the policyholder dies. People receiving the death benefit can be one (beneficiary) or more than one individual (beneficiaries).

- The Owner: An individual who owns as well as controls the insurance policy. This person is also known as the policyholder.

The roles of these parties lead to the following inferences:

- The insured person might also be the policyholder. For example, a husband takes a life insurance policy on his name so that his spouse and children remain financially protected in the event of his untimely death. Here, that husband is the insured and also the policy owner.

- The policyholder/ owner can also be the beneficiary. For example, a husband buys a life insurance policy on the life of his wife and names himself as the beneficiary. If she dies, he and his family are not affected financially. Here, the husband is not only the policy owner but the beneficiary as well.

Who Is The Owner Of A Life Insurance Policy?

The owner of a life insurance policy can be the person insured, beneficiary, or any other party. Mostly, the insured person is also the owner of an insurance policy. The policy owner can also be the spouse or parent of the insured person.

Sometimes, the policy owner can be a party not related to the insured person. Suppose that you start a partnership business, you can purchase an insurance policy on your partner’s life to cover the value of his/ her share in the establishment.

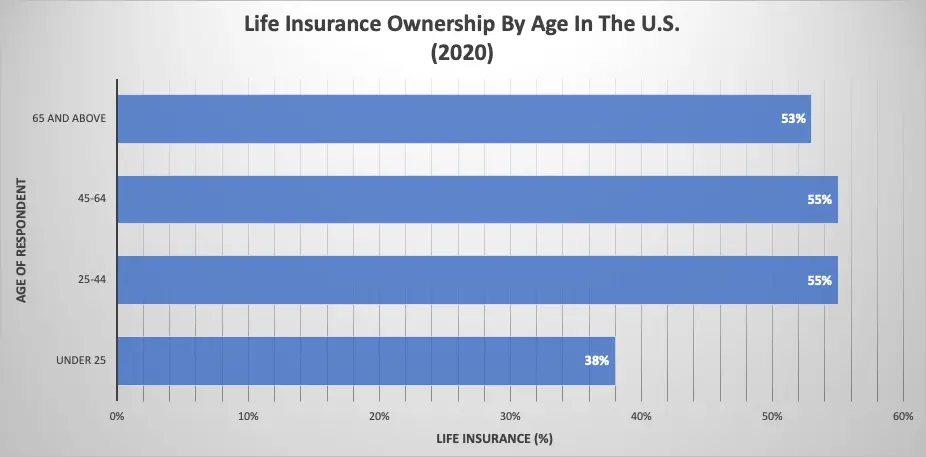

Source: 2020 Insurance Barometer Study, LIMRA

Whoever be the owner of a life insurance policy, he or she has complete control and responsibility of that policy. It means the following:

- Whether the frequency of premium payments is monthly, quarterly, half-yearly, or yearly, the policy owner is in charge of paying them.

- The policy owner decides the coverage. For example, it can be a term policy or something that provides lifelong coverage.

- It’s the policy owner who decides and changes (if necessary) the beneficiaries and how they should get the death benefit.

- The policy owner has the right to transfer a life insurance policy’s ownership.

- In the case of permanent insurance, the policy owner has the right to withdraw from or borrow against the life insurance policy.

- A policy owner has the right to cancel or surrender a policy anytime.

- When it is about reviewing the life insurance policy, a policy owner can evaluate it from time to time and take necessary action.

Importance of Ownership of a Life Insurance Policy

Ownership of a life insurance policy is crucial to handle major life events such as death and divorce. When the insured person dies, the beneficiaries are not obliged to pay any income tax on the death benefit.

In case the insured and owner are the same individual, the death benefit proceeds will add to the owner’s estate. And if the sum of all assets falling under the owner’s estate is taxable, the death benefit proceeds will also be taxable. Respective authorities set the minimum net worth to be eligible for the estate tax.

Should the Insured Person be also the Policy Owner?

The most common type of ownership is the insured person owning the life insurance policy. Everything remains in the policyholder’s hands, such as paying premiums, deciding or changing beneficiaries, and transferring the ownership.

Sometimes, being the owner doesn’t go in the insured person’s favor. When you own a life insurance policy, the death benefit proceeds get added to your taxable estate if it exceeds the exclusion limit.

Do you know about the tax immunity in the estate tax law?

Of course, it does not apply to all. It applies when you are the insured as well as owner and have appointed your spouse as the beneficiary. According to marital deduction law, the proceeds of your policy will get excluded from the estate. This exclusion leads many people to transfer a lot of property to their spouse and avoid estate tax.

Another common practice spouses are involved in is the cross-ownership. It means a husband is the owner of that life insurance policy where the insured person is his wife and vice-versa. As they are in charge of their spouse’s insurance policy, they can provide all the information required to get the proceeds.

How to Change the Ownership of a Life Insurance Policy?

When an insured person is also the owner of a policy, he has the right to transfer the ownership. The transfer procedure is simple; all you have to do is fill a form and submit it to the respective life insurance company.

Most insurance companies make this form available on this website. If not, you can contact them, and they’ll send it to you. While changing the ownership, you have to provide new owner’s information, such as:

- Full name

- Relationship with the insured

- Social Security Number

- Contact Number

- Address

While transferring the ownership to a company or trust, you should provide some additional information. For example, names of trustees, name of the business, type of business, etc. Whatever information you need to provide, remember the form and information required are always simple.

There are certain things you should know while changing the ownership of a life insurance policy. They are:

- If the purpose of transferring the ownership is to avoid the estate tax, the problem arises when the current owner dies before the completion of three years of this change. In this case, the death benefit will still add to the owner’s estate.

- According to IRS (Internal Revenue Services), the current owner should forfeit the policy’s all legal rights.

Many people do not consider or don’t know about these things. As a result, the policy loses certain tax benefits. The process of transferring ownership is simple. However, you should consult your insurance advisor to avoid any tax consequences.

Life Insurance Policy Owners Should Review Their Policies. When and Why?

There are certain life events when life insurance policy owners should review their policies. They are:

- When you separate from your partner (get a divorce) and marry someone else

- When you purchase a new home

- When you change a job

- When you adopt a kid or have your baby

Let’s understand them briefly one by one:

Divorce and Marriage

When people give divorce to their spouse and marry someone else, most of them forget to review their life insurance policies. They marry someone else, but their ex-spouse remains as the beneficiary. In case the insured person dies, their current spouse doesn’t get anything. This condition is unfortunate, and laws also can’t help the current spouse.

New House

After marriage and children, your family grows. You may feel the need to purchase a new house. It’s a sign of progress, and you should move forward. However, it is also the time to renew your LI policy. Make sure to get the coverage increased according to the new mortgage. Your spouse will remain worry-free about mortgage even if you die.

New Job

When you are working somewhere and also have a family, it’s better not to rely only on the group life insurance offered by your employee. If you change the job, that policy will no longer cover you. If you are changing the company, experts suggest getting an individual LI policy. This policy will provide you coverage irrespective of your employment condition.

Baby or Adopting a Child

You might have purchased a life insurance policy before getting married or having children. That policy won’t be enough when members of your family increase, especially with the arrival of a baby or you adopt a child. You should review your current life insurance policy so that it can cover the mortgage and other costs incurred while raising a child.

Depending upon the circumstances in your life, there can be other reasons to review your life insurance policy. The best you can do in those situations is to consult your insurance advisor.

Frequently Asked Questions

Though this article is much like a question and answers session, some of your questions might still be unanswered. Let’s see if the following FAQs settle the queries in your mind.

1. Is it mandatory for a policy owner to have an insurable interest in the insured person?

Yes, laws say that the policy owner must have an insurable interest in the insured person. The owner can be a family member or someone with a financial interest in the insured individual.

2. What is a Viatical Settlement?

A Viatical Settlement is a kind of deal where the owner of a life insurance policy sells the policy to a third party before the insured person’s demise. The selling amount is more than the policy’s cash surrender value and less than its net death value. The owner has the right to do so, and he doesn’t even need the permission of the insured individual or beneficiaries.

3. Can a policy owner appoint more than one beneficiary?

Yes, the policy owner has the right to appoint multiple beneficiaries to a life insurance policy. He can also decide which beneficiary will get what percent from the death benefit. In addition to this, a policy owner can appoint contingent beneficiaries. They will receive the death benefit in case the primary beneficiary dies.

4. If the owner decides to change beneficiaries, will he need to take permission from old beneficiaries?

The owner of a life insurance policy gets many rights. He can introduce several changes, such as changing the beneficiaries, in the insurance policy. For this, the policy owner doesn’t need to take permission from beneficiaries, neither new nor old.

However, it is different in the case of irrevocable beneficiaries. These types of beneficiaries have additional powers. It means the policy owner can’t make changes in a life insurance policy individually. Signatures of the policy owner, as well as the beneficiary, are necessary to make changes.

5. Who is eligible to receive the death benefit of a life insurance policy?

Only the beneficiary or beneficiaries mentioned on the life insurance policy are eligible to collect the death benefit. Sometimes, because of negligence, the deserving person is not appointed as the beneficiary and doesn’t get the death benefit. That’s why it is crucial for policy owners to review their life insurance policies regularly.

Bottom Line

In the case of life insurance policy, the policy owner and the insured individual can be two different people or the same person. A policy owner has complete control over an insurance policy. The owner of a life insurance policy can decide the beneficiaries, access the cash value, and decide whether to keep the insurance policy active or not.