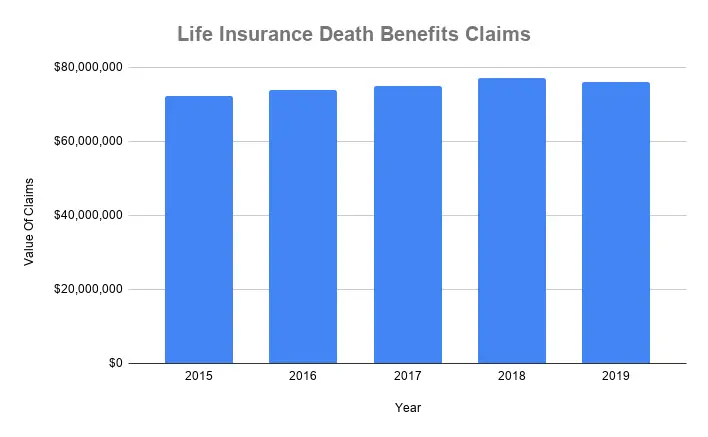

More beneficiaries are receiving life insurance death benefit payouts now than before. If you are listed as a beneficiary on a life insurance policy, knowing what is best to do with life insurance payout when you receive it is a very important topic to consider.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/what-is-best-to-do-with-life-insurance-payout/

You don’t have to wait until the insured passes away to learn how to handle the proceeds from a life insurance payment. You have to start early and have a game plan in place so you don’t squander the money when it comes in.

Source: Insurance Information Institute

Key Points

- To get life insurance policy payouts as beneficiary, you have to get the death certificate, contact the insurance company, and file a claim.

- There are different methods for receiving life insurance payouts. You have to select your preferred way.

- Your life insurance claim can be delayed or denied for different reasons. Just make sure to correctly submit all requirements to avoid this.

- Once you get paid, it is important to not make hasty decisions, to involve a professional, and to deal with the most pressing issues first.

- You can use a life insurance payout for investments, to pay debts or plan for the future. You alone can determine what is best to do with life insurance payout when you receive it.

How Beneficiaries Can Make A Claim

Upon the death of an insured, the life insurance company is obligated to pay death benefits to the beneficiary or beneficiaries of the policy.

However, this doesn’t happen automatically. It is the responsibility of the beneficiary or beneficiaries to initiate the process. The beneficiary must do the following things to receive a life insurance payout.

1. Get the death certificate

As a beneficiary, you will need to show proof of the insured’s death. Make sure you have multiple certified copies of the death certificate on hand for this. The funeral director, department of state vital records, or nursing home can help you out with this.

2. Contact the insurance company or agent

If you know the particular agent that sold the life insurance policy, contact them to file a claim. If you don’t know the agent but can identify the insurance company, contact them with the same request. You can easily contact the agent or insurance company through the information made available on the policy. When you let the insurance company know you’re filing a claim, they will send a claims form for you to fill. If there is more than one beneficiary, they can send a separate form for each person to fill out.

A lot of processes can be finished online these days. Some insurance companies still follow traditional methods where a life insurance claim must be made in writing or through a phone call. However, many other companies allow the entire process to be conducted online. No matter the method you chose, make sure to submit all the required information to avoid delays in processing the payout.

3. Decide how to receive death benefits

There are different ways a beneficiary can receive life insurance proceeds. In most cases, the insurance agent or company will ask the beneficiary to choose their preferred method of receiving life insurance proceeds.

How Will You Receive Life Insurance Payouts

The beginning of determining what is best to do with life insurance payout starts from deciding how to receive life insurance proceeds. The amount of money and frequency with which you receive it will greatly influence how you spend.

- Lump-sum payment: the beneficiary receives the full death benefit in one single payment. This payment is usually free of income tax and the beneficiary can use it as they please. If the insured took out a loan on the cash value of the life insurance policy, the remaining debt amount will be subtracted from the lump sum payment.

- Specific income: the beneficiary gives the life insurance company-specific instructions for paying the death benefits. The insurance company follows the specified schedule and will continue to pay a named secondary beneficiary even after the original beneficiary dies.

- Joint last survivor income: the beneficiary can decide to spread the payments over two or more lives. This method ensures that the secondary beneficiary continues to receive payments even after the original beneficiary passes away.

Interest income: the beneficiary decides to be paid only interests from the death benefit amount. The death benefit can remain intact and be paid to the beneficiary’s secondary beneficiary upon his or her death. The full death benefits can also be released when the beneficiary reaches a certain age. - Life income: the beneficiary chooses to receive guaranteed payments spread over the remaining part of their lives. The insurance company will calculate the guaranteed amount based on the beneficiary’s gender and age. If the beneficiary passes away earlier than the stipulated age, the insurance company isn’t required to keep making payments and will keep the remaining amount.

Why Was A Claim Delayed Or Denied?

Typically, an insurance company has 30 days to review your life insurance claim before paying. However, this time isn’t set in stone and does vary for many reasons. If your life insurance claim is delayed or denied, it could be for one of the following reasons.

- The beneficiary doesn’t reply to additional or supplemental payout requests.

- The beneficiary is suspected when the insured dies in a homicide.

- Fraud is suspected in the life insurance case.

- A contestability clause goes into effect. The insurance company is allowed to investigate for fraud if the insured dies less than two years from when the life insurance contract was initiated.

- If the policyholder or insured lied on the life insurance application form.

- The insured omitted dangerous hobbies or health issues during the application.

- The insured died while carrying out illegal activity.

How Long Does It Take For Life Insurance To Be Distributed?

Generally, there is no specific time frame in which insurance companies pay for a filed claim. However, most companies pay within 30 to 60 days from when a beneficiary makes an insurance claim. Although insurance companies conduct a thorough investigation before paying out, they like to pay as soon as possible. As long as they have indisputable proof of a valid claim, they pay promptly to avoid incurring heavy interest charges for holding your payout for too long.

Now That You Have Received It, What Is Best To Do With Life Insurance Payout

If you have a finance expert for a friend or family member, they can help you figure out the key decisions you have to make and the best way to handle a life insurance payout. You will most likely be traumatized by the recent loss and won’t be able to think clearly to make good decisions.

Moreover, you’re not a financial expert to properly handle that much cash rolling in. It’s great if you’re lucky enough to have someone explain what debts should be paid off first, how to set up a budget, and what you should have in liquid assets. If not, take the following steps to know what is best to do with life insurance payout after the death of a loved one.

First Things First

Before you start making any moves, consider the following things first.

- Don’t rush any big financial decisions: before you make any decision on a life insurance payout, especially if you received a lump sum, wait for several months. Yes! We mean do nothing. Put that cash in your account and just watch it sit there for many months. You must make rational, educated decisions on these funds or you will squander it as quickly as you got it. You can keep some of the money in cash to pay for pressing needs and bills, but make sure it’s not a checking account.

- Contact a professional: especially because you don’t know what you’re doing, figuring out how to invest a life insurance payout can be hard on your own. Because of this, it’s smart that your first action should be to consult with a professional. A rational third party who is also skilled and experienced in handling life insurance payouts when people are in the transitioning phase will be a tremendous help. We strongly advise that this be your first step so you don’t make financial mistakes before getting help. It is easier to get it right from the onset rather than make mistakes first and then get help to try and salvage the situation.

- Focus on the here and now: assess your present situation and begin to tackle your current needs. Consider bills that must be paid immediately, shortly, or later. These might include medical bills, living expenses, and funeral arrangements. Your other needs can probably wait. If you have dependents under 18 years, you will also want to do some social security investigation to see if you’re due for a survivor’s benefits payment.

- Research your tax liability: life insurance payouts are usually exempted from taxes. It is very rare for this payment to be subject to any income tax. Nevertheless, when you get this money in your account, you must note that it will be subject to taxes when you start making profits or income from it. For example, if you put the money in an interest-bearing account, the interest earned in the account may be taxed.

What Is Best To Do With Life Insurance Payout

Any family struggling to cope with the pain of losing a loved one and financial burdens at the same time will find that life insurance payouts are a great relief. Although there are different methods of receiving a payout, the default and most common is a lump sum payment. Whether you receive life insurance proceeds as a huge one-time payment or in another form, the following tips from financial experts will help you with proper management.

- Consider your housing reality: if you don’t have enough money to sustain the former lifestyle you lived before your family member passed away, you might have to sell your house. Many people in the same situation quickly pay off their house loans before considering if they have enough cash for it.

- Pay off credit card debts: all credit cards and high-interest debts you have can be eliminated with proceeds from a life insurance payment. When you’re able to pay off such debts, you will have more cash in your monthly budget to handle other bills for better financial comfort. Note that you may not have to pay off credit card debts that are solely in your deceased family member’s name.

- Review college and retirement funds: if you still have kids in college or on their way there, you must seriously consider the funds for their education. If you are not yet retired, you should also consider your retirement funds. Both needs are extremely important, so you must carefully consider all options to make good future decisions on them.

- Consider a savings account: after settling immediate needs you need to start building a cash reserve to handle emergencies. You can earn interest on your money if it’s in a high-yield savings account. Note that you may have to spread the money into multiple accounts if it is over $250,000. This is because insured banks cannot cover over that amount per depositor.

Mistakes To Avoid

Suddenly having a lot of money you didn’t plan for can surely be overwhelming. Many people in the same situation have fallen prey to the following mistakes. However, you will know what is best to do with life insurance payout and avoid similar mistakes when you can identify the errors. Here are some common blunders people make when they come into a large life insurance payout and how to avoid it.

- Don’t lock your money in: don’t put your life insurance proceeds into a fund you cannot easily access. Once the dust settles, you will make clearer and decisions so don’t rush yourself into a tight corner too early. An example is locking your funds in an illiquid deal like an oil and gas business. You will have to wait years before getting a return on your investment.

- Don’t make expensive investments: some investments look incredible at face value but have some damning hidden fees under all the glitter. Look out for such investments and ask about fees and commissions where the information isn’t made plain.

- Don’t believe you deserve to have some fun because of your recent ordeal: an extravagant vacation or shopping spree might do you some good at the moment but it’s unhealthy for the long run. Only consider such luxuries after paying off high-interest debts, settling family finances, and preparing a budget. Vacations are not bad, but you must seriously consider your financial position first.

- Don’t rush to pay debts: you should be settling debts with your payout but you should also be shrewd about it. For example, instead of paying off huge mortgage debt, set the money for that aside in a separate account and take some time to consider if you will sell or keep the property. This way, you have time to make a clear decision and you can settle any urgent needs.

Conclusion

A life insurance payout won’t bring a loved one back to life. However, it will help their loved ones to achieve their goals, live their dreams, and carry out the wishes of the deceased. A good way to honor the life of someone who passed away and left some money for you is to spend that money well. After figuring out how to file a life insurance claim and what documents to prepare, take our tips and advice on what is best to do with life insurance payout. Make sure to share this information with your friends so they can also prepare for the inevitable.