Are you an investor or entrepreneur scratching your head over the question, “What is a fair percentage for an investor?” Worry no more! In this informative article, we’ll simplify the complexities of equity sharing into bite-sized, easy-to-understand pieces. So, buckle up, and let’s unravel the secrets to a fair investor percentage!

Welcome to the World of Fair Investor Percentages!

In this blog, we’ll explore the crucial aspects of equity sharing, including understanding the basics of equity and valuation, factors affecting investor percentages, and the art of negotiation.

Along the way, we’ll spice things up with “What if” scenarios, like the outcomes of company mergers or hypothetical investment returns. These intriguing examples will add a touch of fun and creativity to our exploration.

Rest assured, this blog will provide well-researched, accurate, and reliable information, supported by relevant statistics and figures to enhance authenticity. Our mission is to keep you engaged, informed, and entertained as we embark on this journey toward mastering the world of equity sharing.

So, let’s dive in and unlock the mysteries of fair investor percentages together! Happy reading!

1. Understanding Equity and Valuation

First, let’s clarify what we mean by equity. In simple terms, equity is the ownership stake that an investor receives in a company in exchange for funding. In other terms, equity is the slice of ownership you, as an investor, get in a company when you provide funding. Think of it as your piece of the pie.

Valuation, on the other hand, is the estimated worth of the business. It is like the price tag of the entire pie, representing the estimated worth of the business.

Together, these two concepts lay the foundation for determining a fair percentage for investors.

Now, imagine you invest in a promising startup, Company X. What if Company X gets acquired by Company Y? Your equity stake could skyrocket in value!

An example of a real-life scenario where an equity stake could skyrocket in value is the acquisition of Instagram by Facebook in 2012. At the time of the acquisition, Instagram was a fast-growing startup with a popular social media platform.

Facebook recognized the potential of Instagram’s platform and acquired the company for $1 billion. This acquisition led to a significant increase in the value of Instagram’s equity, resulting in substantial returns for the company’s early investors.

For example, venture capital firm Benchmark Capital, which had invested $500,000 in Instagram’s seed funding round, saw its stake in the company increase in value to over $500 million after the acquisition.

This is a prime example of how an acquisition can lead to a significant increase in the value of an equity stake and provide substantial returns for early investors.

But let’s not get ahead of ourselves. First, let’s explore how these two elements – equity and valuation – intertwine to shape the investor’s fair share in a company. With this understanding, you’ll be better equipped to make smart, informed investment decisions.

2. Factors to Consider When Determining a Fair Percentage

Several factors play a role in deciding a fair percentage for investors. These include the company’s stage, the investor’s contribution, risk, and overall market conditions.

By evaluating these factors, we can determine an appropriate equity share for both parties.

There’s no one-size-fits-all answer to determining a fair percentage for investors. Instead, it depends on several factors, such as the company’s stage, the investor’s contribution, the risks involved, and the current market conditions.

By examining these aspects, we can strike a fair balance for the investor and the company.

First up is the company’s stage. A startup in its infancy may require a more significant investment; thus, the investor may receive a larger equity stake. In contrast, a well-established company might need less funding, resulting in a smaller percentage for the investor.

Next, consider the investor’s contribution. If you bring unique expertise or resources to the table, you might be entitled to a larger share. Remember, it’s not just about the money – it’s about the value you add!

The risk involved is another crucial aspect. High-risk investments often demand higher equity stakes to compensate for the potential loss. Imagine if you had invested in Company XYZ back in the day. How much would you have earned if you took the plunge despite the risks?

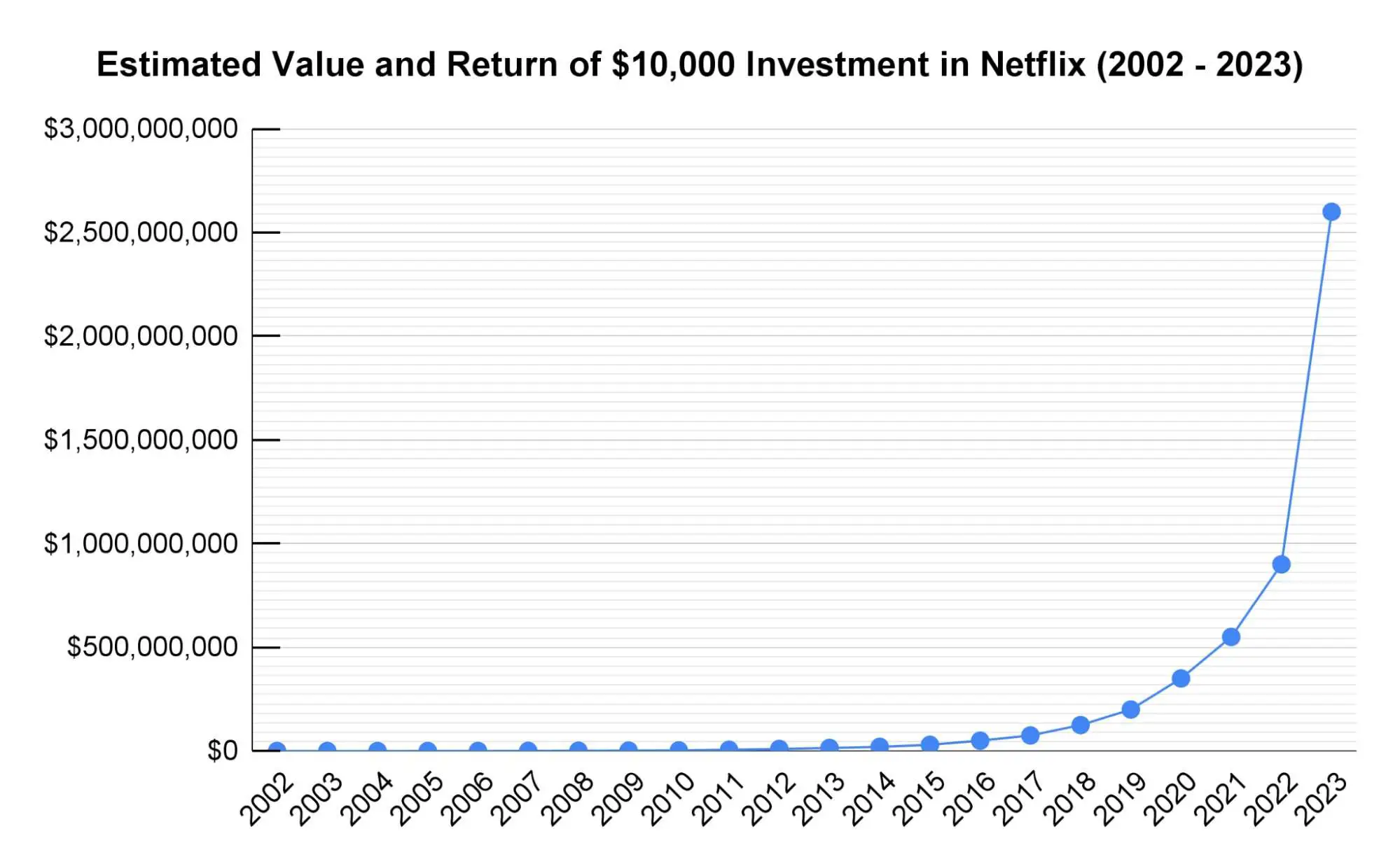

Suppose you had invested $10,000 in Netflix in 2002, shortly after the company went public.

At the time, Netflix was a relatively unknown DVD-by-mail rental service. Over the next few years, Netflix disrupted the traditional video rental industry by introducing a new business model allowing customers to stream online content.

As a result, the company’s revenue and stock price soared, providing substantial returns for its early investors.

If you had invested $10,000 in Netflix in 2002, your investment would be worth approximately $2.6 million as of September 2021, representing a return of over 26,000%.

Despite the risks, this highlights the potential for substantial returns when investing in a promising startup. Of course, investing in a startup is risky, and there is no guarantee of success, but as the example of Netflix shows, taking the plunge can lead to significant rewards.

Finally, remember the overall market conditions. A booming market may lead to lower equity percentages, while a sluggish market might call for higher stakes.

So, consider these factors the next time you’re negotiating your share. And who knows, you might find yourself sipping champagne on your yacht, reminiscing about that wise investment you made!

3. The Art of Negotiation

Negotiation is a crucial aspect of determining a fair investor percentage. Engage in open dialogue and remember that both sides should walk away feeling satisfied with the deal.

Here’s a “What if” scenario: What if Company X acquired Company Y? Would the investor’s percentage increase or decrease in value? These hypothetical situations can help guide negotiations.

Negotiation is the beating heart of finding a fair investor percentage. It’s all about open dialogue and ensuring both parties feel satisfied.

To help you navigate these talks, let’s dive into a “What if” scenario: What if Company X acquired Company Y? Would the investor’s percentage increase or decrease in value?

Suppose you invested $100,000 in an early-stage biotech startup, BioHealth Inc., giving you a 10% equity stake.

Later, BioHealth Inc. acquired a smaller biotech company called LifePharma Corp. for $20 million in cash and stock.

As part of the acquisition, BioHealth Inc. issues new shares to LifePharma Corp.’s shareholders, including you, diluting existing shareholders’ ownership stake.

Assuming that the acquisition is a cash-and-stock deal and BioHealth Inc. issues 2 million new shares to LifePharma Corp.’s shareholders, the total outstanding shares in BioHealth Inc. increase to 12 million.

As a result, your 10% equity stake in BioHealth Inc. is diluted to 8.3%, reducing the value of your investment.

However, if the acquisition is successful, the increase in BioHealth Inc.’s overall value could still lead to a positive return on your investment, even with diluting your ownership stake.

Pondering such hypothetical situations can offer valuable insights during negotiations.

First, remember that communication is key. Be transparent about your expectations, and don’t shy away from discussing potential challenges. After all, a successful negotiation is like a tango – it takes two!

Next, keep in mind that flexibility goes a long way. Be willing to compromise and explore creative solutions. For instance, what if you invested $10,000 in Company XYZ in 2030? How much would your investment be worth today? By playing around with these scenarios, you’ll be better equipped to strike a deal that benefits both parties.

Lastly, always maintain a sense of humor and positivity. Negotiations can be intense, but a light-hearted approach can help defuse tensions and foster collaboration. Who knows, you might crack a joke that seals the deal!

So, as you embark on your next negotiation, remember these simple yet effective tips. After all, negotiation is about finding that sweet spot where both sides come out as winners. Happy deal-making!

4. Striking a Balance: Finding the Sweet Spot for Investor Happiness

The goal is to find a sweet spot where the investor and the entrepreneur are content with the equity split. This may require some trial and error, but the result should be a mutually beneficial partnership that drives the business toward success.

To achieve this balance, start by keeping an open mind. Be prepared to explore different scenarios and find creative solutions. For instance, what if Company X acquired Company Y? How would this impact the investor’s percentage?

In 2013, Google acquired the mobile navigation app Waze for $1.1 billion. Before the acquisition, Waze had raised $67 million in funding from various investors, including venture capital firms and angel investors.

One of the early investors in Waze was Magma Venture Partners, an Israeli venture capital firm.

When Magma Venture Partners invested in Waze in 2009, they negotiated a 15% equity stake in the company in exchange for their investment.

However, as Waze grew in popularity, its founders realized they needed more capital to expand their operations. Waze agreed to sell some of its equity to additional investors, including Kleiner Perkins Caufield & Byers, to raise the necessary funding.

Magma Venture Partners’ equity stake was diluted to 11.4% in the funding round. However, the firm continued to support Waze’s growth and ultimately received a significant return on its investment when Google acquired the company for $1.1 billion.

This example highlights the importance of finding a sweet spot in the equity split between investors and entrepreneurs. By negotiating a fair equity split, both parties can benefit from the business’s success and achieve a mutually beneficial partnership that drives the business toward success.

By examining these hypothetical situations, you’ll be better positioned to pinpoint that elusive sweet spot.

Next, remember that patience is a virtue. Rome wasn’t built in a day, nor is the perfect equity split. It’s essential to stay committed to the process, even when it gets tough. Keep communication lines open, be flexible, and focus on the bigger picture.

Lastly, remember to have some fun along the way! Injecting humor and creativity into the process can make it more enjoyable and help maintain a positive atmosphere. After all, the best deals are often struck when everyone’s having a good time.

In summary, striking the perfect balance in equity splits is art. By embracing open-mindedness, patience, and a dash of humor, you’ll be well on your way to forging a mutually beneficial partnership that drives your business to new heights. Happy balancing!

Key Takeaways

Determining a fair percentage for investors is both an art and a science. By understanding equity, considering various factors, and engaging in effective negotiation, you can strike a balance that benefits all parties involved.

Remember, the goal is to create a win-win situation that fosters growth and success. Now, go forth and conquer the world of equity sharing!

Now, armed with these insights and tips, conquer the world of equity sharing! Happy investing!