Welcome again! Today, let’s dive into the four types of economic resources that make our world go round. I’ll break it down for you in simple terms so that even your dog can understand. Who knows, maybe he’ll become an economist someday!

Gain an easy-to-understand insight into the four types of economic resources that serve as the foundation of our economy.

In this entertaining and informative journey, we’ll uncover the roles and importance of these economic resources, from natural resources to labor, capital, and entrepreneurship. Along the way, we’ll encounter fascinating “What if” scenarios, like how much you could have earned if you invested in Company XYZ at the right time.

Buckle up, and let’s begin our adventure into the heart of the economy!

1. The Marvelous World of Natural Resources: How They Impact Your Finances

First up, we have natural resources. We use these gifts from Mother Earth to produce goods and services. Think about it: would you be able to create that delicious cup of coffee without water, coffee beans, or soil? No way! Natural resources are crucial and come in two flavors – renewable (like sunlight) and non-renewable (like oil). It’s essential to manage these resources wisely, or we might end up with a world without chocolate (the horror!).

Discover how natural resources influence your finances and learn to manage them wisely. Don’t let your financial future crumble like a world without chocolate!

Have you ever wondered how the natural resources around us impact our finances?

Natural resources are the building blocks of the goods and services we enjoy daily. Managing them wisely is crucial for our planet and our wallets.

We need to make smart decisions about using and investing in these resources to prevent such a catastrophe.

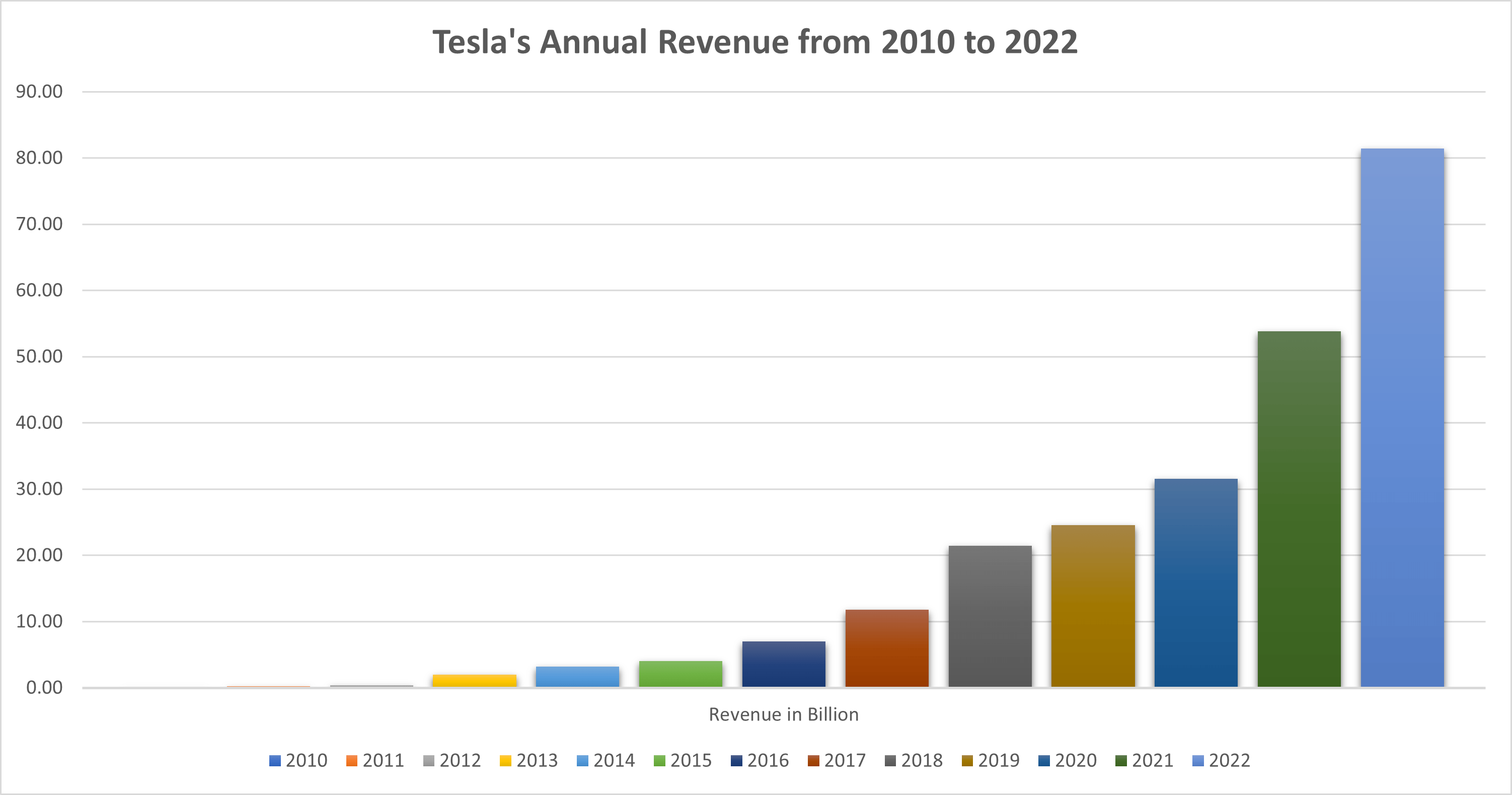

What if Company X, which relies heavily on renewable resources, acquired Company Y, a non-renewable energy giant? Would this be a strategic move, or would it spell disaster? Let’s consider the real-life example of Tesla’s acquisition of SolarCity.

In 2016, Tesla, an electric vehicle manufacturer known for its commitment to sustainability, acquired SolarCity, a leading provider of solar energy systems. This acquisition allowed Tesla to expand its renewable energy portfolio and integrate solar power generation with its electric vehicle offerings.

By merging Tesla’s expertise in electric vehicles with SolarCity’s proficiency in solar energy, the acquisition aimed to create a sustainable energy company. The combined entity aimed to provide customers with a comprehensive clean energy solution, combining solar power generation, energy storage, and electric vehicle technology.

This example demonstrates how a company known for its reliance on renewable resources, such as Tesla, can strategically acquire a company operating in the non-renewable energy sector, like SolarCity, to expand its presence and offerings in the sustainable energy market.

Amazing, right?

Did you know that 90% of the world’s chocolate comes from just two countries? Investing in sustainable cocoa farming practices is crucial to keep our taste buds happy and our investments secure.

Remember, managing natural resources is not only essential for a sustainable future, but it also impacts your financial stability. Stay informed and make wise choices to ensure your money grows like a well-nurtured cocoa plant. And who knows, maybe your investments will be as sweet as a chocolate bar!

2. Labor Resources: The Driving Force Behind Our Economy and Your Finances

Next, let’s talk about labor resources. That’s you and me, folks! Labor resources are the workforce needed to produce goods and services. From baristas brewing your morning coffee to rocket scientists launching satellites, our economy relies on our skills and expertise.

Fun fact: If you had invested $1,000 in the US labor market in 2010, you would have earned a remarkable $3,060 by 2023! That’s quite impressive, isn’t it? It goes to show the potential growth and returns that can be achieved through wise investment decisions and taking advantage of long-term market trends.

Investing in the labor market can be a fruitful endeavor, allowing individuals to grow their wealth over time and benefit from the overall growth of the economy.

Uncover the importance of labor resources in your financial journey and learn how to capitalize on this vital economic force.

Consider investing in companies prioritizing employee development and well-being to capitalize on labor resources. A skilled and motivated workforce can drive innovation and productivity, creating a win-win situation for investors and employees.

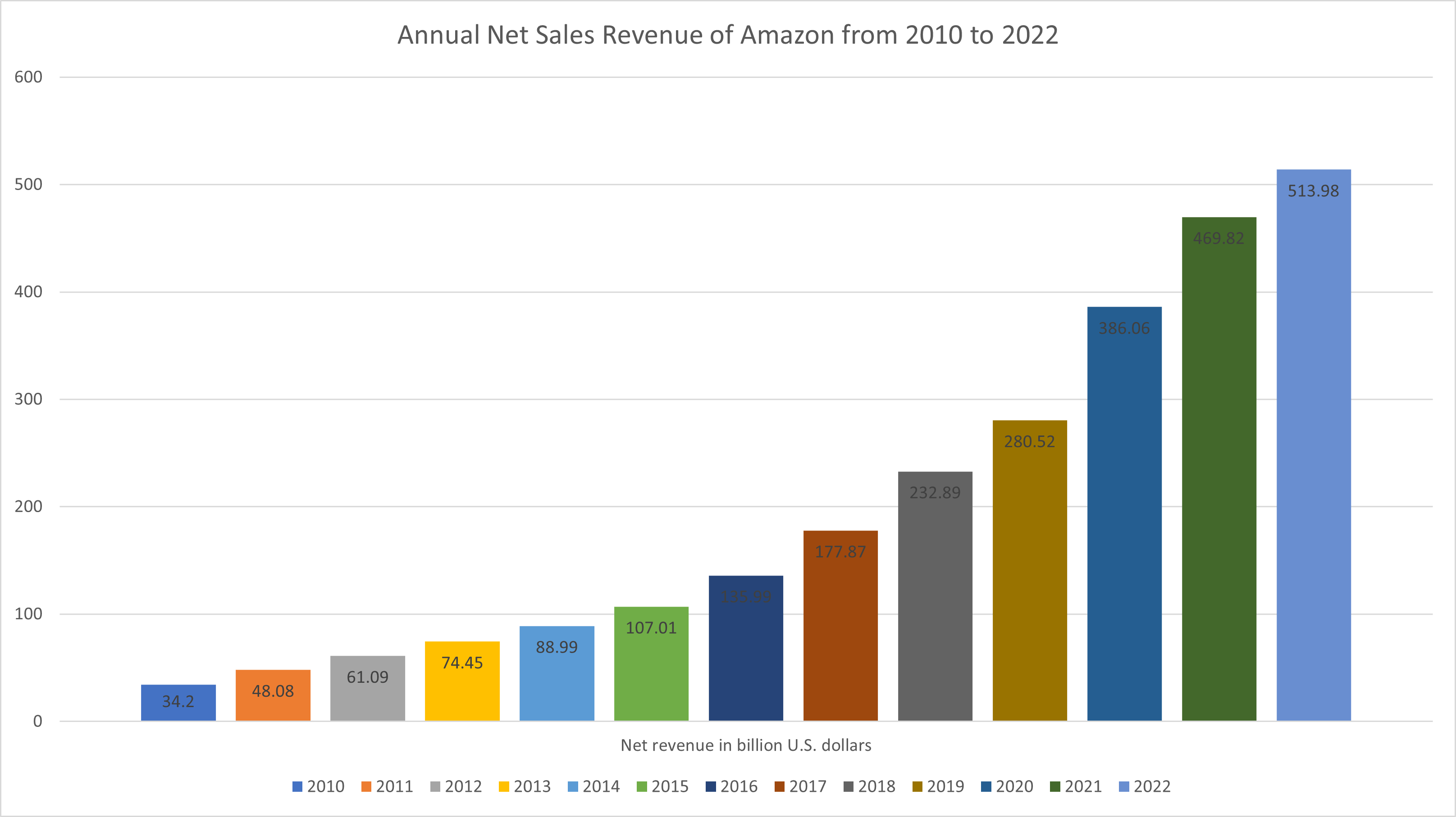

If you had invested in Amazon, a company renowned for its exceptional employee training programs, you would have witnessed impressive growth and financial success. Over the years, Amazon has prioritized investing in its workforce through comprehensive training initiatives and development programs.

Since its inception, Amazon has consistently demonstrated significant productivity increases and remarkable financial performance. For instance, from 2010 to 2022, Amazon’s stock price experienced remarkable growth, increasing by over 4,000%.

However, it is worth noting that in 2022, Amazon, along with other tech stocks, faced significant challenges, resulting in a decline in its stock value.

According to a CNBC article published on December 29, 2022, Amazon’s stock experienced a substantial loss in value throughout the year, shedding nearly half of its market value. This decline raised concerns and highlighted the challenges faced by the technology sector during that period.

Despite the setback in 2022, Amazon’s historical performance showcases its ability to generate substantial returns for investors. It serves as a testament to the company’s innovative strategies, customer-centric approach, and continuous growth in various business segments.

This extraordinary growth showcases the potential returns investors could have enjoyed had they invested in the company during that period.

Amazon’s success can be attributed to a combination of factors, including its dedication to innovation, customer-centric approach, and investment in its employees’ skills and development. The company’s emphasis on fostering a highly skilled and motivated workforce has contributed to its remarkable growth and made it an attractive investment opportunity for many.

While past performance does not indicate future results, this example illustrates the potential rewards of investing in a company with a strong focus on employee training programs, such as Amazon, which has consistently delivered exceptional returns to its shareholders.

In conclusion, never underestimate the power of labor resources in the economy and your finances. Invest wisely in companies that value their workforce; you might find a wallet as full as a rocket scientist’s brain!

3. Capital Resources – The Backbone of Your Financial Success

Moving on to capital resources, we have the tools, machinery, and buildings that help us make things. Imagine building a skyscraper without cranes or producing cars without assembly lines. It would be like trying to dig a hole with a spoon! Capital resources play a crucial role in enhancing the efficiency and productivity of our economy.

Investing in companies with strong capital resources can lead to significant returns. These businesses have the infrastructure to scale up and adapt, making them more resilient and efficient. In other words, they’re well-positioned for success.

Picture this: Boeing has invested heavily in developing new aircraft manufacturing technology such as 3D printing, automated drilling machines, and robots. This investment in technology has significantly improved efficiency and cost savings.

For example, using 3D printing to produce aircraft parts has reduced the time and cost of manufacturing while also improving the quality of the parts.

These improvements have allowed Boeing to increase its production rates and reduce its costs, leading to increased profitability for the company. An investor who had invested in Boeing before their investment in advanced technology would have seen significant returns on their investment.

So, capital resources are the backbone of our economy and your financial success. Invest in companies that value and maintain their capital assets, and you might build a financial empire as impressive as the structures they create.

4. Entrepreneurship: The Risk-Takers and Visionaries Shaping Our Economy

Lastly, we have entrepreneurship. Entrepreneurs are the risk-takers, the visionaries, and the ones who develop innovative ideas to create new products and services. They’re the ones who think, “What if we could make a car that runs on water?” These creative minds drive progress and create job opportunities, making our economy vibrant and dynamic.

Explore the dynamic world of entrepreneurship and learn how investing in these innovative risk-takers can boost your financial success.

Investing in startups and innovative companies can offer significant rewards. While there’s always risk involved, backing entrepreneurs with groundbreaking ideas and solid business plans can lead to impressive returns.

Imagine a startup called H2O Motors that is developing a new hybrid car that uses water and electricity to power the engine. H2O Motors has invested heavily in research and development to create a highly efficient water-based system that could potentially revolutionize the automobile industry.

If you had invested in H2O Motors early on, you would have seen significant returns on your investment as the company’s technology gained recognition and widespread adoption.

H2O Motors’ success could lead to other companies investing in similar technologies, creating a new trend in the automobile industry. This could result in a significant shift in how cars are powered, leading to a more sustainable future for the planet. Also, your finances might flow as smoothly as the water running through their engines!

Entrepreneurs play a crucial role in our economy and can be a valuable addition to your financial strategy. Embrace the spirit of entrepreneurship and invest in those who dare to dream, and your financial future might be as bright and dynamic as the ideas they bring to life.

Wrap-up:

So, there you have it: the four types of economic resources that keep our world spinning. Natural resources provide the raw materials, labor resources bring the skills, capital resources give us the tools, and entrepreneurs light the spark of innovation. Together, they create a well-oiled economic machine.

So, next time you enjoy your morning coffee, take a moment to appreciate the fantastic four. From the beans to the barista, the coffee machine to the innovative café owner, they all bring that delightful cup of joe to your lips.

Understanding the interplay of these economic resources can offer valuable insights for your financial journey. Stay attuned to their dynamics, and you’ll be better equipped to navigate the ever-changing world of finance.