When people learn about health insurers paying for a gym membership, they usually ask the question – what health insurance pays for gym membership? When a health insurer pays for gym memberships, it attracts many people.

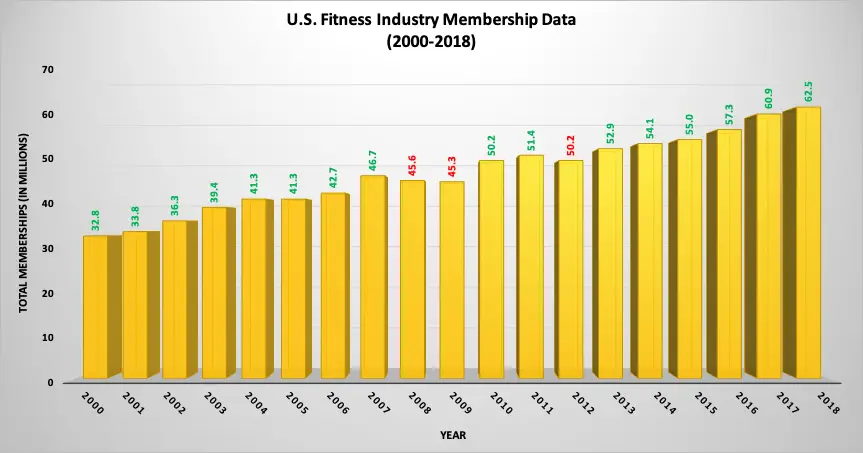

Whether someone is already a member or planning to become a member of any gym, this kind of offering is a bonus for them. Many people often end up buying such policies. The trend also shows that more and more people are getting gym memberships every year.

Source: IHRSA, World Bank

But before buying health insurance that pays for a gym membership, don’t you think getting more information about it would be a good idea. For example, do such policies exist, why do they pay, do they pay wholly or partially for the membership, is there any catch, and other things.

The answers to such questions and much more information about health insurance covering the gym membership is available in this article.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/what-health-insurance-pays-for-gym-membership/

What Health Insurance Pays For A Gym Membership?

Some health insurance companies in the market indeed pay for gym memberships. However, If you think that they will straightaway pay your gym membership fee, they won’t. Insurers often market their health insurance products by saying such things.

Health insurers don’t pay a gym membership fee directly. They usually reimburse a fixed amount saying that it is towards the membership of a gym, health club, or any other activity intended to improve your health.

The reimbursed amount can be $100, $250, $400, or any percentage of your gym membership fee, depending upon your insurance provider and policy. If you are a member of an expensive gym, this amount will not help you much.

But, if you are a member of a health club whose annual fee is around $250, the health insurance plan reimbursing $250 will look most attractive to you.

Experts suggest that you should discuss the reimbursement amount with your health insurer because each health insurance company is different and offers different kinds of plans. The discussion makes it clear whether the gym membership payment reimbursed by your health insurer will be advantageous to you or not.

Why do Health Insurers Pay for Gym Memberships?

It is quite simple to understand. Compared to the hefty medical bills, gym memberships cost less. So, instead of paying your medical expenses, health insurance companies think it is better to keep you healthy. Thus, they pay for your gym membership.

The chances of getting ill diminish if you exercise regularly and remain active, even when you grow older. This kind of offering (gym membership) puts policyholders as well as insurance companies in a win-win situation.

There is another reason for covering your gym membership. When you remain healthy, your medical expenses decrease or become nil. Also, the number of claims insurance companies get decreases significantly.

As they have to settle fewer claims, the larger part of premiums you pay stays with them only. It leads to a significant increase in the income of insurance companies. So they make more money by keeping you fit.

How Health Insurance Pays A Gym Membership?

Reimbursement is one of the many ways health insurance companies cover your gym membership. Here are the most common ways insurers cover gym membership.

1. Fixed Reimbursement

Most health insurers prefer reimbursing a fixed amount, between $100-$500, every year for the gym membership fee. The company will ask you to provide the documents proving gym membership costs. If you are already an active member, you’ll have to prove that also.

As more and more people are showing interest in this kind of health insurance, insurers are also expanding their offerings. Most of them are also providing reimbursements for fitness classes, yoga classes, studios, and others.

2. Incentive Programs

Many health insurance providers nowadays are offering incentive-based reimbursements or rewards. For example, suppose that you have joined a weight loss program. Your insurance provider will track your progress, and based on that, will issue a reimbursement.

Or, the insurer might payback for just joining and completing a fitness program. Of course, it should be in line with their requirements. If you are serious about any fitness program and work towards it, your insurance provider might cover your expenses.

3. Discounts for Seniors

Some health insurance providers offer special discounts and incentives for health and wellness programs meant for people above 60 years of age. Whether a senior person joins the workout classes or accesses the fitness material available online, some insurance companies pay them for it. These discounts benefit seniors physically as well as mentally.

4. Exclusive Discounts for Members

There are several gyms and health clubs in the country that advertise on online platforms. Some insurance companies tie-up with them and offer exclusive discounts to policyholders buying a health or fitness membership plan via online marketplaces.

If you research the online marketplace, you may clinch exclusive deals on Apple Watch, FitBit devices, and bargains or discounts on athletic gear. Such offers usually depend on the place you live, your insurer, and the type of insurance plan. So, regularly check what your insurance provider is offering.

5. Reimbursement for Purchasing Equipment

This one is the least common, but some health insurers reimburse for purchasing exercise equipment for home. It can be the reimbursement for a treadmill, dumbbells, weight lifting machine, or anything else.

Availing the reimbursement facility on exercise equipment becomes easy if, based on your medical condition, a doctor has recommended it. For instance, a health insurance company might reimburse money to its policyholders for buying a treadmill recommended by their doctor to control hypertension, obesity, or a specific disease.

Health Insurance Don’t Pay A Gym Membership If

Health insurance paying gym membership is an exciting offer. There are also times when health insurers paying for gym memberships deny paying for it. Let’s find out what are those circumstances or exclusions.

- Some health insurers do not consider the services of 24-hour fitness centers eligible for reimbursement.

- When you hire the services of a personal trainer to remain fit, some health insurance companies won’t reimburse you anything. They don’t cover the cost of services provided by a personal trainer because most of them miss a proper registration. Even if trainers are qualified, they need to register with relevant bodies.

- Many insurance companies offer reimbursements only if your gym membership is a medical necessity or any certified healthcare professional has asked you to join. In simple words, your insurer might not pay for the gym membership if you don’t have a reference from some qualified chiropractor, physiotherapist, or general physician.

- Some insurance companies reimburse gym membership fees only if the policyholder becomes a member of the fitness center or gym approved by them. If you don’t have the membership of a facility your health insurer is in agreement with, you won’t get the reimbursement.

Things to Consider Before Purchasing Health Insurance

When people come across a health insurance plan that covers gym membership, they often forget to consider crucial things related to health insurance. Make sure you consider the following before buying health insurance:

- The total sum insured.

- Terms and conditions related to co-payment.

- The claim settlement ratio.

- Are there any sub-limits or waiting period?

- The premium amount.

- The network hospitals.

Frequently Asked Questions

Gym membership offered by health insurance companies leads to an interesting discussion. You might be having a lot of questions in your mind. Let’s see if the following FAQs answer your questions as well.

1. Can I remain healthy without a gym membership?

Exercising in the gym will only enhance your health. But if you maintain a healthy lifestyle, you won’t need to visit any gym. You can practice the following:

- Avoid consuming sugary foods and drinks.

- Involve exercises in your daily activities. For example, cover short distances by walking.

- Breathe slowly and deeper so that your body gets more oxygen and you feel energized.

- When you eat outside, don’t just pick anything. Make sure it is healthy and doesn’t harm your body in any way.

There are numerous other healthy lifestyle activities you can practice every day and remain fit.

2. How can I shop for health insurance that pays for a gym membership?

To find a health insurance policy that covers your gym membership, you should first research online. When you find an insurer offering what you need, get in touch with its representative, and have all your doubts cleared. If you’re satisfied, then only purchase that policy.

3. How and when will my health insurance company reimburse?

The reimbursement of a gym membership depends on the insurer and your insurance plan. Some insurers may reimburse monthly, whereas others yearly. However, all of them follow the same reimbursement method – automatic deposit in your bank account.

4. If I cancel my existing gym membership, will the insurance company still reimburse a fixed amount?

In this case, you’ll become ineligible for reimbursements. Your health insurance provider will stop your payments. In case you get a new membership, contact your insurer for its fee reimbursement.

5. Will the reimbursement program work for my family?

If your health insurance plan covers your family members, they are eligible for reimbursement. However, the reimbursement amount and frequency depend on the health insurance provider and plan.

6. I am a senior. Can I get health insurance that pays for a gym membership?

Yes, you can get it. As every senior person can’t hit a gym, some health insurers offer reimbursement for wellness programs or yoga classes for seniors.

7. Can I get a free gym membership without buying any health insurance plan?

Getting a free gym membership without buying a health insurance plan is possible (not always) when:

- You are a college student.

- You work part-time in the gym.

- Some gym gifts you a membership.

- You win a gym membership in some competition.

8. If health insurance companies pay for gym memberships, how do they make money?

Remember that health insurers do not reimburse 100% of your gym membership. In some cases, where the gym membership fee is significantly less, the reimbursement amount can be 100% of the membership cost. Usually, the reimbursement comes to around 30% of the membership fee.

On the other hand, regularly visiting the gym and exercising diminishes your risks of getting ill. When you remain healthy, your medical expenses become almost nil, and you do not make any claims to the insurer.

This way, health insurance companies also settle fewer claims, and the majority of premium you pay remains with them only. Moreover, they invest the premium in high return-generating assets.

9. In health insurance policies that pay for a gym membership, who is the policyholder?

The person owing that policy is the policyholder, and only that person will be eligible to receive a gym membership. However, depending upon your policy and insurance provider, you can get your family members added to that policy.

To get exact details, consult with your insurance advisor or get in touch with your health insurance provider.

10. I do not have a job. Can I get health insurance that covers gym membership at a subsidized rate?

It is an insurer-specific question. Whether you can get health insurance at a subsidized rate or not depends on your health insurance provider. Get in touch with a health insurer that you think can satisfy your needs, and get your query resolved.

Final Words

A gym membership is nothing compared to the expensive medical bills. Health insurance companies, realizing this, offer its policyholders a reimbursement for their gym membership. If you are a regular member of any gym and looking forward to buying a health insurance plan, then go for a policy that covers your gym membership as well.

If you can’t get a health insurance policy that pays for a gym membership, don’t be disappointed. Consume healthy foods and engage in physical activities like walking, jogging, cycling, etc. In short, start living a healthy lifestyle and reduce the risks of getting ill.