When it comes to securing the financial future of loved ones, the first thing an individual thinks about is getting a life insurance policy.

In the world of life insurance, numerous types of policies are available. Some of them provide real benefits, and some of them leave people guessing whether it will be right to go for this type or not.

A kind of life insurance always on the radar of potential investors is Universal Life Insurance or UL Policy or Cash Value Life Insurance. However, all investors do not put their money into this type of policy.

Today, this article is going to help you learn not only the crucial things about Universal Life Insurance but also its disadvantages. After going through all this information, you will realize why many people prefer avoiding it.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/disadvantages-of-universal-life-insurance/

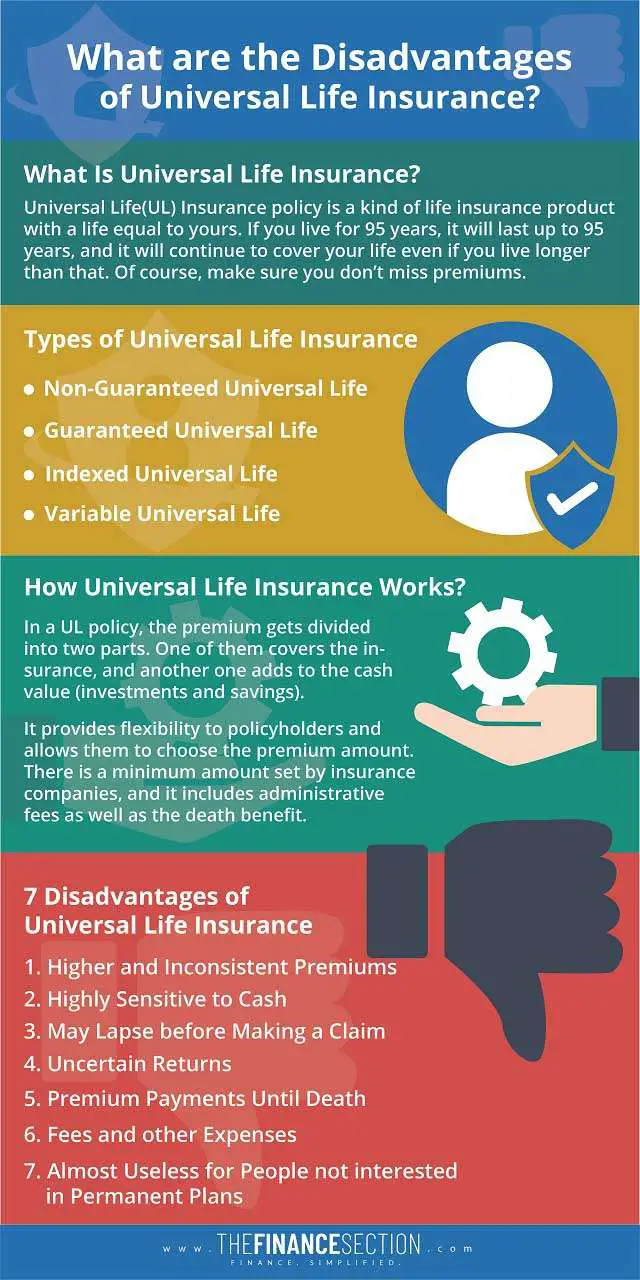

What Is Universal Life Insurance?

UL (Universal Life Insurance) policy is a kind of life insurance product with a life equal to yours. If you live for 95 years, it will last up to 95 years, and it will continue to cover your life even if you live longer than that. Of course, make sure you don’t miss premiums.

Universal Life Insurance is like the traditional term life insurance policy that gains cash value like a regular life policy. Unlike conventional whole life insurance policies, UL policy divides the cash value accumulation and payout into two different components.

Lifelong coverage is not the only quality of this type of life insurance. There are many more, such as:

- UL policy also has a savings account associated with it.

- The payout (death benefit) beneficiaries get is tax-free.

- They form cash value with time whose gains are also tax-free.

- Depending on the policy’s features, an individual can anytime modify the death benefit and premium payments.

Types of Universal Life Insurance

The qualities of Universal Life Insurance can attract anyone. However, there are many things you need to be aware of before investing in UL policy.

Let’s start with the types of UL policies. There are primarily four types of Universal Life Insurance policies:

Non-Guaranteed Universal Life

It is a type of permanent life insurance that provides life coverage and the opportunity to grow your money.

A non-guaranteed Universal Life Insurance policy can cost a lot if dropped (canceled or lapsed) because of insufficient cash value. The major drawback of this policy is the phantom income tax charged after canceling it.

Guaranteed Universal Life

It is better than the non-guaranteed Universal Life Insurance because this policy won’t lapse as long as you pay the premium.

If you have this policy, your premium will remain the same no matter how well or worst index performs. It is because of interest rates being fixed right from the time policy starts.

As it is not affected by market performance, you can say that Guaranteed Universal Life is a non-risky insurance product. But, this is also the drawback of this policy. Not being associated with the market performance means it misses cash value.

Indexed Universal Life

The word ‘index’ reveals all about this kind of insurance product. Whether your UL policy is guaranteed or non-guaranteed, it can provide the option to bond your returns with a market index. And that index can be Dow Jones, S&P 500, or any other national/ international market.

In indexed policies also the guaranteed plans are better than the non-guaranteed ones. The guaranteed indexed UL policy is better because it provides you with an opportunity to earn a higher interest rate along with some guarantees.

Variable Universal Life

This insurance product is quite similar to conventional Universal Life Insurance. This kind of policy allows direct investment in the stock market (usually mutual funds) instead of bonding with market exchanges.

This policy allows not only investment in different types of mutual funds but also the chance to manage them. The performance of your variable Universal Life Insurance policy depends upon the performance of mutual funds in it.

How Universal Life Insurance Works?

In a UL policy, the premium gets divided into two parts. One of them covers the insurance, and another one adds to the cash value (investments and savings).

It provides flexibility to policyholders and allows them to choose the premium amount. There is a minimum amount set by insurance companies, and it includes administrative fees as well as the death benefit.

Whatever you pay above this set amount adds to the cash value and grows with time. The guaranteed UL policy grows according to the annual interest rate set by the insurance company. However, your policy can get higher returns if it is associated with the high-performing market.

7 Disadvantages of Universal Life Insurance

You have just learned about the qualities, types, and working of UL policies. Before you decide to go for a Universal Life Insurance policy, it’s time to look at the other side of the coin also. Here are the top 7 disadvantages of Universal Life Insurance:

1. Higher and Inconsistent Premiums

You need to pay a higher premium for policies falling under this category. It is because UL policies offer the option of cash value, and that needs regular funding.

Premiums of UL policies are not only higher but inconsistent as well. As you grow older, they’ll become even higher. This increased premium may spoil your mood at an age when you want peace of mind the most.

2. Highly Sensitive to Cash

The cash component of this insurance product is different from that in whole life insurance. In UL policies, there is no guarantee that the cash will grow over time.

It’s cash value declines with time. If you pull out some cash from your policy and delay in repaying that amount along with interest, your insurance policy loses stability. Its cash value declines faster than expected.

3. May Lapse before Making a Claim

It is somewhat in continuation with the above point. If the cash value diminishes or exhausts, let’s say because of loans, it may lapse even before making a claim.

Another cause can be taking the policy from a non-reputable insurance company. If that company’s portfolio under-performs for a long time, it will not back your UL policy. In this case, your policy may lapse even if you haven’t taken the loan.

4. Uncertain Returns

UL policies also gain attention because of the returns they provide on the cash value. However, the interest rate your Universal Life Insurance policy will generate with time is not fixed or guaranteed.

Your insurance agent might show that returns are somewhat similar to what you get in a savings bank account. For some of you, this information is enough to go for a UL policy. What you are missing here is the fact that interest rates are revised frequently (three times a year or more/less than that).

Some UL policies offer a guaranteed interest rate on the cash value. It is the minimum amount of interest cash value generates. Here, note that the interest rate on savings account rarely goes above the guaranteed rate.

5. Premium Payments Until Death

Another disadvantage of UL policies is that they are permanent life insurance, and you have to continue paying premiums until your death. Maintaining a UL policy this way becomes quite difficult for many people, especially when they are not working or withdrawing from their retirement fund.

In such conditions, the premium payment becomes an expense. Moreover, failure to pay the premium may put your policy on risk. In this scenario, you should discuss with your advisor that you’ll be going to pay the premium for a fixed period of 10, 20, or 30 years, but want the policy to cover your whole life.

6. Fees and other Expenses

Fees and different types of expenses associated with your UL policy increase its overall cost. Fee primarily includes management and administration fees, whereas expenses often include the mortality costs and commissions.

Suppose that you pull out money from the cash value, the company will charge a cash surrender fee of up to 10%. In another case, when you take a loan on your policy, the company may ask you to pay an interest anywhere between 5% – 9% on loan.

Note that the rate of interest charged as fees and expenses may vary from company to company.

7. Almost Useless for People not interested in Permanent Plans

Some people like UL policies because once taken, it remains active forever (of course, till the time you regularly pay the premium). But this feature doesn’t attract everyone.

It is like a disadvantage for people who want an insurance plan only for a limited period. For example, older people find it almost useless. They do not want a plan that stretches up to 40 or 50 years. An insurance policy that lasts up to 10, 20, or 30 years might be the right fit for them.

Frequently Asked Questions

Universal Life Insurance certainly interests people, but at the same time, it gives rise to many questions in their minds. Some of the frequently asked questions by people attracted towards this product and their answers are:

1. What is the Cash Value in Universal Life Insurance?

You know that Universal Line Insurance provides dual benefits – life insurance and savings accounts. The amount that builds-up in this savings account is the cash value.

Insurance companies set the interest rate in the same way a bank sets on savings accounts. It may vary from policy to policy, but the average return a policyholder gets is around 2%. The rate of return is different when the policy is indexed or variable.

2. What will happen to the cash value when a policyholder dies?

When people find the answer to this question, most decide to change their decision to invest in a UL policy. When the policyholder dies, the beneficiary gets only the sum insured. The cash value, whatever be the amount, remains with the insurance company.

If the policyholder has withdrawn something from the cash value and he or she dies without paying it, the insurance company deducts that amount along with interest from the final payment made to the beneficiary.

A Universal Life Insurance policyholder might build handsome cash value by investing all through his or her life, but what the beneficiary gets when that person dies? Only the face amount. The insurance company keeps everything extra.

3. What is the best alternative to Universal Life Insurance, and why?

The best alternative may vary from person to person, but experts suggest term life insurance as the best alternative. It is because the term life insurance provides only the coverage and that too for a fixed period such as 10, 20, or let’s say 30 years. As there is no cash value, the premium is cheaper for term life insurance policyholders.

You can invest the differential amount in some other product. It makes sense because the wealth created this way won’t go to an insurance company.

4. How can a policyholder get access to cash value?

There are three ways to access the cash value:

- Borrow money in the form of a loan and pay interest on it.

- A policyholder can withdraw a partial amount without surrendering the UL policy. It will certainly reduce or decrease the face amount or death benefit.

- A policyholder can surrender the UL policy and withdraw the complete cash value. The insurance company may levy a surrender charge for withdrawing the insurance policy early.

5. Can a policyholder change the face amount of his or her UL policy?

Yes, a policyholder can change the face amount of the UL policy. In some cases of increasing the face amount, the policyholder needs to undergo a medical examination.

Insurance companies also provide the facility to decrease the death value, but only if it doesn’t fall below a specific amount (often varies from company to company).

Final Thoughts

After learning about the disadvantages, types, and functioning of Universal Life Insurance, you can say that this is not the most attractive insurance product in the market.

Most people aspire for policies offering higher death benefit at a low premium. Cash Value Life Insurance policies are certainly not for them. If you are determined to invest in a UL policy only, go for a guaranteed plan instead of indexed or variable.

Also, people not interested in cash value and aiming for a short-term life insurance plan can avoid Universal Life Insurance.