When people decide to buy a car, they usually discuss it with their friends and family members. They receive many suggestions and pieces of advice like which one to buy, which ones to avoid, why to buy/avoid a specific model, how to pay for your car, should you get it financed or leased, and several others.

You might also be experiencing the same. In payment suggestions, your well-wishers might suggest you two options the most – financing and leasing a car.

If you are buying a car for the first time, these terms require your attention. You can say that both these options, on monthly payments, give a car in your hands. Then, what is the difference?

Well, both are quite different from each other. The decision to lease or finance a car may either hurt your financial life or let it sail smoothly.

Today, you are going to learn many vital things about leasing and financing a car. After gaining this knowledge, you can easily decide whether leasing or borrowing will be advantageous for your financial health.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/difference-between-lease-and-finance-car/

Understanding Financing and Leasing A Car

To buy a car without hurting your financial life, you must understand the difference between lease and finance car.

Financing A Car

Financing a car is taking a loan from someone to buy a car. This someone can be a person or institution, depending upon your approach.

You repay this borrowed amount along with interest in Equated Monthly Installments (EMI) or as decided with your creditor.

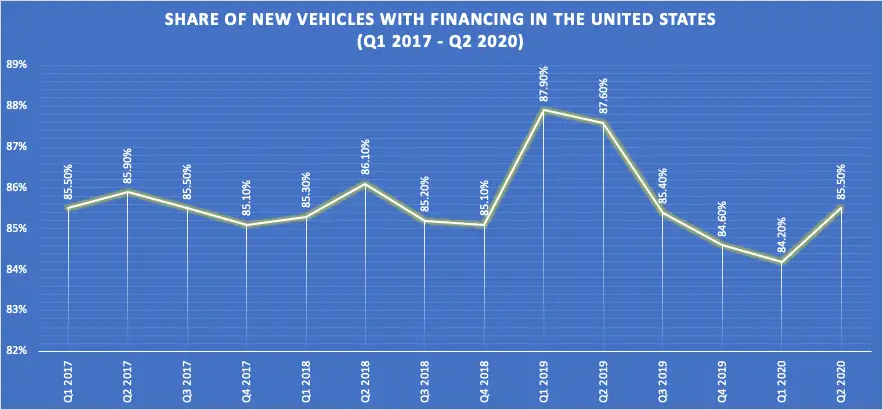

Source: https://www.statista.com/statistics/453000/share-of-new-vehicles-with-financing-usa/

With financing, you are the owner of your car but can’t enjoy all the ownership rights until you repay the whole borrowed amount. After clearing the loan, you are free to keep driving this car or resell it to someone else.

In case you fail to repay, the lender will repossess your car and try to sell it to recover the remaining borrowed money and interest.

Leasing A Car

Leasing a car means you do not own a car but make monthly payments to use it for a pre-determined time. There are leasing companies who regularly take a fee for allowing you to use a car.

Yes, the ownership of the car remains with the leasing company. When the leased term is over, the company expects to get the car back in good condition.

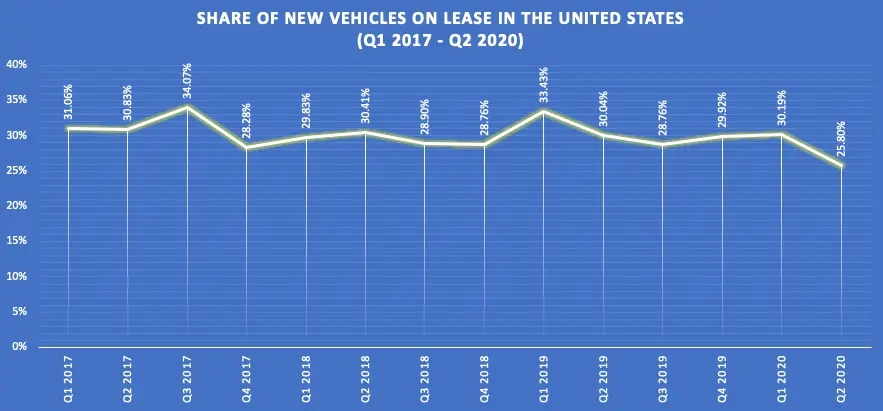

Source: https://www.statista.com/statistics/453122/share-of-new-vehicles-on-lease-usa/

Leasing a car might look attractive to many people because they need to pay only a small amount per month for driving a first-hand car. Moreover, it frees them from worries about selling it at the end of the lease period.

Most leasing companies provide you with the option to buy the car when your leasing term is over.

Financing and Leasing A Car: The Difference

Before getting into a car, it is essential to understand the difference between financing and leasing a vehicle. Some key differences between the two are:

• Ownership

When you finance a car, you are its owner. It is yours, use it for as long as you want. Also, no one can stop you from doing any number of modifications or customization to it.

It is not the same when you lease a car. You are not the owner, but you pay for using it for a fixed duration and return it after that. Sometimes, the leasing company may offer you to buy the car when the lease period expires. Also, you need to follow a set of instructions, which means no customization of your choice.

• Down Payment

You should pay a down payment while financing a car. In addition to this, you should also bear registration fees, taxes, and other hidden expenses (if any).

When you lease a car, you need to pay the first monthly payment, security deposit (refundable), down payment (depends on your preference), registration fees, taxes, and hidden expenses (if any).

• Monthly Payment

In financing, you need to repay the borrowed amount in Equated Monthly Installments (EMI). The monthly installment amount will be higher because you pay for the absolute value of that car.

The monthly leasing payments are mostly lower than those of financing a car. It is because you pay only for the car’s depreciation along with rent charges, interest, fees, and taxes at the time of getting it on lease.

• Discontinuation

If you have got your car financed and want to discontinue, you can. In financing, the buyer can always trade-in or sell a car whenever he/she wants. You can use the amount received after making this deal to repay the remaining loan amount.

In the case of a leased vehicle, the leasing company will ask you to pay the early termination/discontinuation fees. If you calculate, it will come almost equal to the sum of the remaining payments.

• Depreciation

When you finance a car, its value will depreciate with time. However, the equity you get is yours, and you are free to use it your way.

When you lease a car, its future value won’t affect you much. Remember that if you are expecting to get any sort of equity from your car, you won’t.

• Returning A Car

As getting a car financed also makes you the owner of that car, it is your responsibility and choice to trade-in or sells that car. In short, you are the decision-maker.

Leasing does not give you so much freedom as financing. When the lease term ends, you must return the car and clear any necessary fees. In this case, most dealers give you the option to purchase the car or walk away freely.

• Customization

Financing a car gives you the freedom to do any kind of customization to your vehicle. Here, you must know that any new customization may affect the resale value of your car.

In leasing, you have to return the car after a fixed term. The leasing company expects that you return it in an optimal condition, without customization. It is because modifications/ changes often affect the resell procedure.

If you want to purchase it after the lease period, your customization will be acceptable. If not, make sure you remove all the customization by the time the lease period ends. If there are some permanent alterations or damages, get ready to pay for them.

Which Is Better – Financing or Leasing?

It is a big question. Some people don’t get help from the difference between financing and leasing a car. They keep on asking which is better – financing or leasing.

Priorities of every person might vary in the case of life, finance, and cars. What holds importance for you might not be so important for another person.

Based on individual preferences, the following information will help you understand which of the two is better for you.

Financing is better if:

- You want full ownership rights of the car.

- You want to build up the resale or trade-in value of your car.

- You are the person who likes to keep using a car for years and years.

- You like customizing your car whenever you want.

- You don’t want any financial burden after clearing the loan.

- You don’t mind driving extra miles.

- You are comfortable with higher monthly installments.

- You can bear high repair expenses after the warranty period expires.

If the above points describe you, then financing may be the best way to satisfy your need for a car.

Leasing is better if:

- You like driving new cars every 2-3 years.

- You are interested in paying lower monthly installments.

- You are living a stable and predictable lifestyle.

- You drive a limited number of miles every month.

- You are not interested in building the ownership equity of the car.

- You are comfortable with maintaining a car.

- You want your car should always remain under warranty.

- You want your car to have the latest and advanced safety features.

If you think the above points are describing your nature, then think about leasing a car.

Impact of Car Financing or Leasing on Insurance

Car financing or leasing doesn’t affect your insurance costs. The insurance company doesn’t care if your car is financed or leased.

If you think that leasing or financing lowers the insurance cost, you might have some misleading information. The insurance cost comes down because of factors like:

- The region you are living in or driving the car.

- Your driving records.

- The type of car you are driving.

- For how much time you are driving a car.

There isn’t an issue if your financier/leaser and insurer don’t know about each other. But you are required to mention the name of the financial source (financier or leaser) in the insurance policy.

It is because when you purchase a car, your financier or leaser has a financial interest in it. This process keeps their investment protected.

In case your car meets an accident, the result will remain the same irrespective of financing or leasing. While settling the claim, the insurance company will pay to the financier or leaser first. If you are eligible for any remainder, the insurer will pay you after them.

In the opposite situation, when you must clear the dues, the concept of “gap insurance” will apply. If required, you will be covering those costs.

Things to Consider Before Financing or Leasing Car

Though financing and leasing are two different processes of getting a car, some considerations are common in both.

• Determine Your Financial State

As you know that, in financing as well as leasing, you should be paying monthly installments. It will be an addition to your monthly expenses.

Evaluate your income and prepare a monthly budget. Do this to be 100% sure that you can easily afford car installments.

• Check Your Credit Score

Whether you are about to finance or lease a car, you should check your credit score first and then proceed. It will not only make you aware of your credit status but also give you time to make financial arrangements (if required).

Note that your finance or lease approval also depends on your credit score. It’s better to get it in advance and prepare accordingly.

• Do You Need A Co-signer?

It can be in continuation with the above point if your credit history doesn’t exist or is not good. If it is the case, you might require someone to co-sign your lease agreement or finance contract.

When a co-signer signs your documents, he or she becomes equally accountable for your borrowings. Not only this, the payment history will appear in the credit report of both. It also means the late payments are going to hurt both person’s credit score.

Frequently Asked Questions

Are you still confused? Let’s see if the following FAQs can help in removing your confusion:

1. Can I get a car financed irrespective of my bad credit history?

You may face some difficulties because of bad credit history, but eventually, you might be able to get your car financed. In addition to your credit history and credit score, the lender will look at your age, income, employment status, and other personal circumstances.

The lending company will evaluate these things, and after being satisfied, will sanction your car loan.

2. How quickly can I get my car financed?

The money usually comes into the bank account of the borrower within 3-5 days. However, the exact answer to this question may vary from one lender to another. Some may sanction the loan in just one day, and some might take 2-3 days.

If the loan gets delayed, common reasons can be your incomplete documents and poor credit history.

3. Some dealers provide zero-down lease offers. What is it?

As the name suggests, there is no down payment in a zero-down lease offer. Your eligibility or ineligibility for a zero-down lease depends on several factors, such as your credit repayment history, credit score, etc.

One thing you should always remember before considering such offers is that lower or no down payment means higher monthly installments.

4. What’s the least duration for which I can lease a car?

Usually, people lease a car for 36 months. You can get a lease for 24 months or less than that also, but you may not find the terms of such leases favorable. Experts suggest a thorough evaluation of all terms and conditions before leasing for the short-term.

5. What will happen when my lease ends?

If the car’s condition is good, and you haven’t exceeded the allotted miles, the lease provider will take it back and ask you to pay the deposition amount. It is usually waived-off if you are leasing another vehicle with the same dealer.

If you are emotionally attached to the car, most dealers will provide you the option to purchase it.

Final Words

Today, with the availability of several financial instruments, you don’t need to wait long to drive a car. The most famous ones are financing and leasing. Just self-evaluate your finances, and find which is the best option to get a car.