Life insurance is a contract or policy a person enters with an insurance company. The scheme was initially designed to cater for widows, orphans and to take care of burial costs. Today, life insurance is a powerful and flexible financial product. It is important as it allows people to leave behind non-taxable amounts of money for their families after they die. Life insurance has many other benefits for policyholders to enjoy.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/complete-guide-to-us-life-insurance/

Key Points

- Apart from providing an income for dependents, life insurance can be used for other needs like giving to charity, protecting a business or paying for expensive health care.

- There are different types of life insurance policies available. The one you get will depend on your current needs and financial capacity.

- If you act promptly and provide complete documentation, you can receive a life insurance payout in 7 to 30 days. You can receive this money in different methods including as a lump sum or as a regular salary.

- If an insured dies from suicide, the insurance company may pay some of the premium to the beneficiary as benefits. This depends on the circumstances surrounding death and the suicide clause.

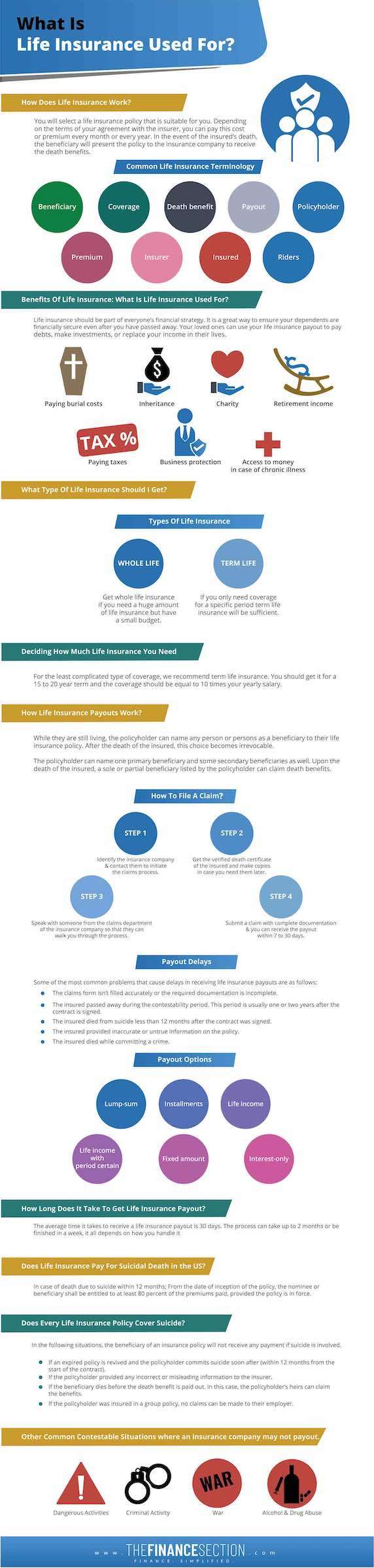

How Does Life Insurance Work?

First of all, you will select a life insurance policy that is suitable for you. For example, if you are married with kids, your foremost priority will be quality education and a smooth upbringing for your kids. This kind of coverage is above the basic life insurance coverage, and so, will surely cost you more. Depending on the terms of your agreement with the insurer, you can pay this cost or premium every month or every year.

In the event of the insured’s death, the beneficiary will present the policy to the insurance company to receive the death benefits. A death certificate, proof of identity, and other important documents will be submitted when making a claim. After ensuring everything is in order, the insurance company will payout the insured amount to the beneficiary.

Common Life Insurance Terminology

In explaining how life insurance works, we’ve used some technical terms that might be new to you. The jargon of the industry makes the concept seem very technical but life insurance is quite easy to understand. To better understand how life insurance works, you should familiarize yourself with some basic terminology.

- Beneficiary: is the individual or group that receives payment if the insured passes away. A beneficiary can be a partner, parent, child, or other loved one.

- Coverage: is the total amount of money assured to the policyholder for the insurance they buy. If the insured passes away during the tenure of the policy, the insurance company will be required to pay this amount to the beneficiary of that policy.

- Death benefit: this is the total assured amount that your beneficiaries will receive if you pass away with an active life insurance policy in effect.

- Payout: the lump sum of money credited to beneficiaries of an insurance policy when the insured passes away.

- Policyholder: the individual or group whose name appears on the insurance policy. The policyholder is usually responsible for taking out and maintaining the insurance contract.

- Premium: is a regular payment the policyholder makes to the insurance company for the duration of the policy. This covers administrative and insurance costs.

- Insurer: the person or company that sells an insurance contract to a policyholder.

- Insured: this is the individual or company covered by the insurance policy. In most cases, the insured and policyholder are the same person. However, they may be different people in some cases. For example, if a company takes out an insurance policy on one of their key personnel, the employee is the insured while the company is the policyholder.

- Riders: these are options or extras you can add to an existing insurance policy. Riders are a great way to increase the benefits you enjoy without paying a hefty sum of taking out a new policy.

Benefits Of Life Insurance: What Is Life Insurance Used For?

Life insurance should be part of everyone’s financial strategy. It is a great way to ensure your dependents are financially secure even after you have passed away. Your loved ones can use your life insurance payout to pay debts, make investments, or replace your income in their lives. Despite this great benefit, life insurance still has many other uses. Let’s answer the question ‘What is life insurance used for?’

- Paying Burial Costs: The expenses of your burial doesn’t have to be a burden to your family and loved ones. The cost of cremation and a funeral can be covered by a life insurance policy. Apart from the actual burial, outstanding medical bills, estate settlements, and other unsettled tasks can also be taken care of.

- Inheritance: The death benefits from your insurance policy can serve as an inheritance to your children when you pass away. You can name your heir as your beneficiary and they will receive the insurance payout after you die.

- Charity: You can name a charity as the beneficiary of your insurance policy. This way, your acts of philanthropy will continue even after you pass away.

- Retirement Income: Your retirement income is a large expense you can supplement with life insurance. Most whole life insurance policies accrue a cash value over a given period. This money can be directed towards your retirement fund.

- Paying Taxes: None of us can run away from taxes but you don’t need to pay more taxes than you have to. Whether you take a term or whole life insurance, your beneficiaries will enjoy tax-free benefits when the payout reaches them.

- Business Protection: When running a business, it is advised to protect your key employees. This will not only attract good talent, but it also ensures business continuity if they pass away or suffer disability from an accident.

- Access to Money in Case of Chronic Illness: Mortality rate is decreasing like never before. Because of this, you should consider a plan to take care of yourself if you need special care in old age or get a chronic disease that requires treatment. You can add a rider to your whole life insurance contract to accelerate your death benefit. This will allow you to take some of your death benefits for health care while you’re still alive.

What Type Of Life Insurance Should I Get?

A variety of different factors determine what kind of life insurance a person should get. Some things you will consider are how much you are willing to spend on the policy, how long you want it to last, and whether you can withdraw money from it or not. To correctly identify the right life insurance policy for you, you must know the different available types.

Types Of Life Insurance

The two main types of life insurance are term and whole. Whole life insurance is also popularly called permanent life insurance and there are different subcategories under these two main types.

- Whole Life Insurance: Even if you live for 200 years, this type of insurance will payout whenever the insured dies. Types of whole life insurance include ordinary life, universal life, traditional whole life, and variable universal life.

- Term Life insurance: This type of insurance is taken for a specific period and only pays out if the insured dies within that time. Term insurance is simple and doesn’t have many extra benefits. Types of term life insurance include level term, renewable term, return of premium, increasing term, decreasing term, convertible term, and term with riders.

So, what Type Of Life Insurance Should I Get?

Although deciding what type of life insurance to get can be confusing, it is an extremely important decision to make. Check out these simple guidelines that will help you narrow down your options.

- Get whole life insurance if you need a huge amount of life insurance but have a small budget. Also, if you only need coverage for a specific period (e.g. the number of years your kids will be in the school system), term life insurance will be sufficient.

- Get term life insurance if you want to have insurance coverage for as long as you live. If you’re interested in accumulating tax-free savings, you can also consider whole life insurance.

Deciding How Much Life Insurance You Need

For the least complicated type of coverage, we recommend term life insurance. You should get it for a 15 to 20-year term and the coverage should be equal to 10 times your yearly salary.

Why 15 to 20 years?

If you have dependents, they should be in and out of college within that time frame. At that time, they will be able to support themselves and won’t need your help anymore.

Why 10 times your salary?

This amount can replace your salary if you pass away. That payout will give your dependents enough financial relief to keep running after you’re gone. If they already have other sources of income, that money could go into investments to provide more income.

How Life Insurance Payouts Work?

While they are still living, the policyholder can name any person or persons as a beneficiary to their life insurance policy. After the death of the insured, this choice becomes irrevocable. The policyholder can name one primary beneficiary and some secondary beneficiaries as well. Upon the death of the insured, a sole or partial beneficiary listed by the policyholder can claim death benefits.

How To File A Claim?

Step 1: Identify the insurance company and contact them to initiate the claims process.

Step 2: Get the verified death certificate of the insured and make copies in case you need them later.

Step 3: Speak with someone from the claims department of the insurance company so that they can walk you through the process.

Step 4: Submit a claim with complete documentation and you can receive the payout within 7 to 30 days.

Payout Delays

Some of the most common problems that cause delays in receiving life insurance payouts are as follows:

- The claims form isn’t filled accurately or the required documentation is incomplete.

- The insured passed away during the contestability period. This period is usually one or two years after the contract is signed.

- The insured died from suicide less than 12 months after the contract was signed.

- The insured provided inaccurate or untrue information on the policy.

- The insured died while committing a crime.

Payout Options

There are different ways in which an insurance company can indemnify the death benefits of a policy.

- Lump-sum: This is the simplest payout option. The entire assured sum is paid to the beneficiary in a single payment.

- Installments: The beneficiary will withdraw parts of the death benefits over several years. The beneficiary also receives interest on the balance paid by the insurer.

- Life Income: The beneficiary receives monthly, quarterly or annual payments from the insurance company for the rest of their life.

- Life Income with Period Certain: This is similar to life income but the beneficiary receives payments for a specified time like 20 years. If the beneficiary dies before this time elapses, a contingent beneficiary can receive the rest of the payments for the remaining duration.

- Interest-only: In this case, the insurance company keeps the assured amount and only pays interests to the beneficiary.

- Fixed Amount: The insurer pays the beneficiary a specific amount regularly until all the money has been paid.

How Long Does It Take To Get Life Insurance Payout?

The average time it takes to receive a life insurance payout is 30 days. The process can take up to 2 months or be finished in a week, it all depends on how you handle it. How quickly you submit a claim can affect the speed of payout. How promptly and accurately you provide the required documentation for the release of funds will also affect the payout time. Thankfully, many life insurance companies make provision for these processes to be completed online. This will help move things along faster but there are no guarantees on how long your claim will take to be processed.

Does Life Insurance Pay for Suicidal Death in the US?

Studies show that suicide rates in the United States keep growing at an astonishing rate. In 2018, it was recorded that suicide rates had grown by about 35% over 20 years. This act of death by self-imposed injury does not only affect the deceased but also, the family left behind is dazed by this incident and they are still forced to settle the deceased estate while dealing with the devastating loss.

Suicide as a cause of death has serious implications on life insurance policies. The most prevalent questions in this situation include: Does an individual’s policy remain valid if suicide is involved? Does life insurance pay for suicidal death in the US? Will beneficiaries still receive benefits from such an insurance policy?

What Is Covered And What Is Not?

Many people believe that death benefits are not paid in the case of suicide but that information is not accurate. Many insurance companies will provide a payout even when the insured dies from suicide. However, there is usually a suicide clause that specifies the time frame suicide death is permitted in a life insurance policy and the amount payable to beneficiaries. Depending on which area the insured lives and what is included or not included in the suicide clause of the contract, beneficiaries can receive the full assured amount or part of the premium payments for the policy.

Before 2014, the suicide clause stated that:

“If the life assured commits suicide, whether sane or insane at that time, within 12 months from the date of commencement of risk or date of revival if revived, the policy will become invalid and no claim will be payable”

However, this policy changed from the first of January 2014. The new guidelines for suicidal death in life insurance states that:

“In case of death due to suicide within 12 months; From the date of inception of the policy, the nominee or beneficiary shall be entitled to at least 80 percent of the premiums paid, provided the policy is in force”

Why Do Insurers Cover Suicidal Death?

The family members of the deceased will surely be devastated after their demise. Even if the insurer will not pay the full assured amount, they might give a part of the premiums paid to the beneficiary if the insured dies by suicide. Insurance companies usually do this because the reason for suicide might be financial pressures or emotional distress brought on by debt. Such a loss weighs heavily on the family of the insured and the financial support from the insurance company is very welcome.

Many insurance companies use the suicide exclusion clause to control moral hazard risks. This clause absolves the insurer from paying any benefits to the beneficiary if the policyholder or insured dies by suicide within 12 months of buying the life insurance policy. Restricting payment of death benefits before the expiry of these 12 months helps to prevent insurance fraud. Some people have huge debts they desperately want to get out of. So they get a life insurance policy and commit suicide soon afterward so they can escape the situation.

Does Every Life Insurance Policy Cover Suicide?

Most life insurance plans cover suicide conditions. However, this coverage is always subject to certain terms and conditions. The suicide clause mentioned earlier applies to every type of life insurance policy. This means no benefits or premiums will be paid if the policyholder or insurer dies in suicide before 12 months since the start of the policy.

In the following situations, the beneficiary of an insurance policy will not receive any payment if suicide is involved.

- If an expired policy is revived and the policyholder commits suicide soon after (within 12 months from the start of the contract).

- If the policyholder provided any incorrect or misleading information to the insurer.

- If the beneficiary dies before the death benefit is paid out. In this case, the policyholder’s heirs can claim the benefits.

- If the policyholder was insured in a group policy, no claims can be made to their employer.

Other Common Contestable Situations

Suicide is not the only situation where life insurance payments are contestable. Here are some other instances where an insurance company may not payout.

- Dangerous Activities: An insurance company might not bother if you always skydive on your birthday. However, if this is an activity you participate in often, the behaviors are termed risky.

- Criminal Activity: An insurer might deny a claim if the insured died during an illegal activity. Armed robbery and car theft are obvious crimes but some misdemeanors might also qualify.

- War: Whether declared or not, if the insured dies during a war, the insurance company can deny a payout. Note that warlike activities are often included in this agreement. That means riots and protests also qualify.

- Alcohol and Drug Abuse: If the insurance company finds out the insured died from abuse of unprescribed drugs, they can deny a payout. If the insured died due to injuries incurred while under the influence of drugs or alcohol, their insurance company has the right to deny a payout.

Takeaway

Life insurance is an important financial tool that should not be neglected. Although people don’t like talking about death, it is important to put your house in order for the inevitable. This is especially true for adults with dependents. Life insurance can be utilized for its many benefits. Many people think it is only used to settle family members of the deceased but life insurance is useful in many areas including business and charity.

After reading this detailed post, you should know how to file a claim for life insurance benefits as a beneficiary. This money can be used for investments, to pay off debts, or to support your lifestyle.