Hello, finance enthusiasts! Today, we’re embarking on a journey into the world of budgeting. You’ll learn the budgeting activities for college students. It’s like sailing, but the waves are your expense.

Budgeting: The Financial Compass

Budgeting is like that trusty compass you’d need on an adventurous trek in the wilderness of finances. In the simplest terms, budgeting is your financial game plan. It’s the blueprint of your money house, detailing where and how to lay each brick (spend each dollar). Now, isn’t that a neat concept?

Imagine you’re on an expedition with a backpack of $100. With a compass, you could avoid getting lost, maybe even tangled with a bear (debt!). But with a compass (read: budget), you know exactly where you’re headed.

Often underestimated, budgeting doesn’t get the limelight like investing or trading, but it’s the backbone that keeps your financial body upright.

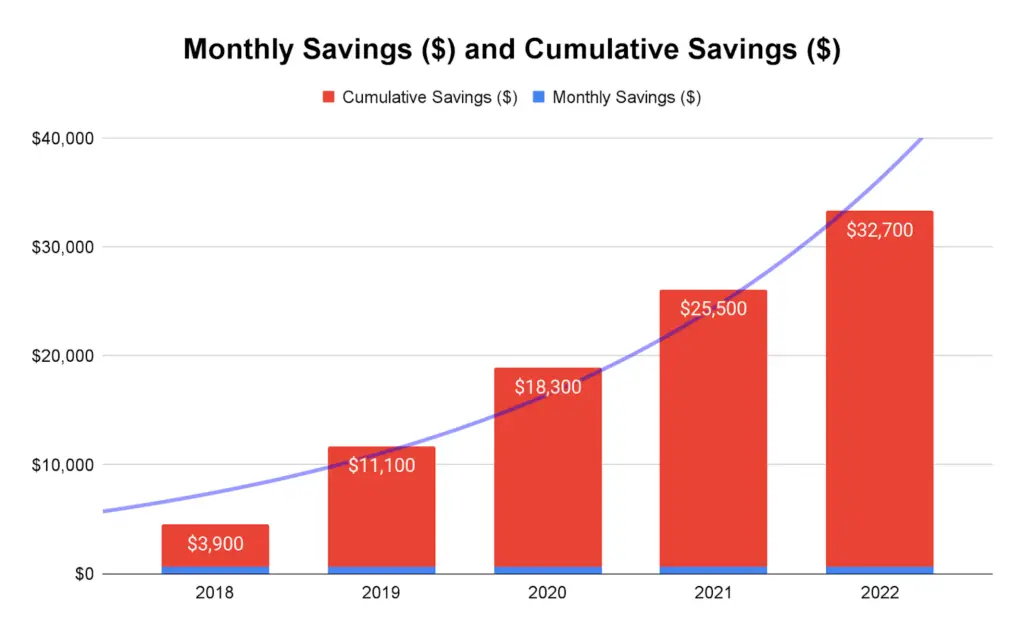

Let’s play the ‘What if’ game. What if you had budgeted and saved $50 each month since 2018? By now, you’d have a sweet little nest egg of $3000, enough for a decent vacation or emergency fund.

Budgeting is the first line of defense against most financial challenges. Overspending? Budget. Debt? Budget. Saving for retirement? Again, budget. It’s the Swiss Army knife of personal finance tools.

Start tracking your expenses, create a realistic budget, stick to it, and review it regularly. Remember, a budget is a living document adapting to your financial changes.

Building the Budget: The ABCs

Building a budget isn’t rocket science; it’s just ABC. Literally! ‘A’ for Account for income, ‘B’ for Budget expenses, and ‘C’ for Calculate the balance. The mission? To ensure your income has a lovely dance with your expenses.

Imagine you’re a magician with a magic hat of $500 a month, but your rabbit tricks cost $600. Your budget is waving a red flag, signaling, “Cut back on those rabbits!”

Account for Income (A)

The first stop on our ABC journey is ‘A’, which accounts for your income. It’s all about understanding how much money you have to play with. It’s like knowing the size of your sandbox before you start building sandcastles.

Picture yourself as a treasure hunter. Your income is your discovered treasure; you must count it before planning your next expedition.

Budget Expenses (B)

Next, we hit ‘B,’ and budget your expenses. This is about deciding where your money should go. It’s like being a traffic cop, directing your money cars down the right roads.

Imagine you’re a movie director, your expenses are your actors, and you must direct them to play their parts right.

Calculate the Balance (C)

Finally, we reach ‘C’, and calculate the balance. This is checking if your income covers your expenses. Think of it as a seesaw; you want it balanced, not one side touching the ground.

It’s like a baking recipe. If you need two eggs but only have 1, you’ve got an egg problem. Similarly, if your income is $1000, but your expenses are $1200, you’ve got a budget problem.

So, there you have it, folks, the ABCs of budgeting. It’s a simple tune to sing once you get the hang of it.

Money Hacks: Budgeting Tips

Budgeting isn’t about being a penny-pincher; it’s more like being a financial Sherlock Holmes. It’s about making smart, informed decisions – like a chess master, but the board is your bank account.

Imagine you’re a master chef. Budgeting isn’t about never using your expensive saffron; it’s about knowing the perfect dish to use it in.

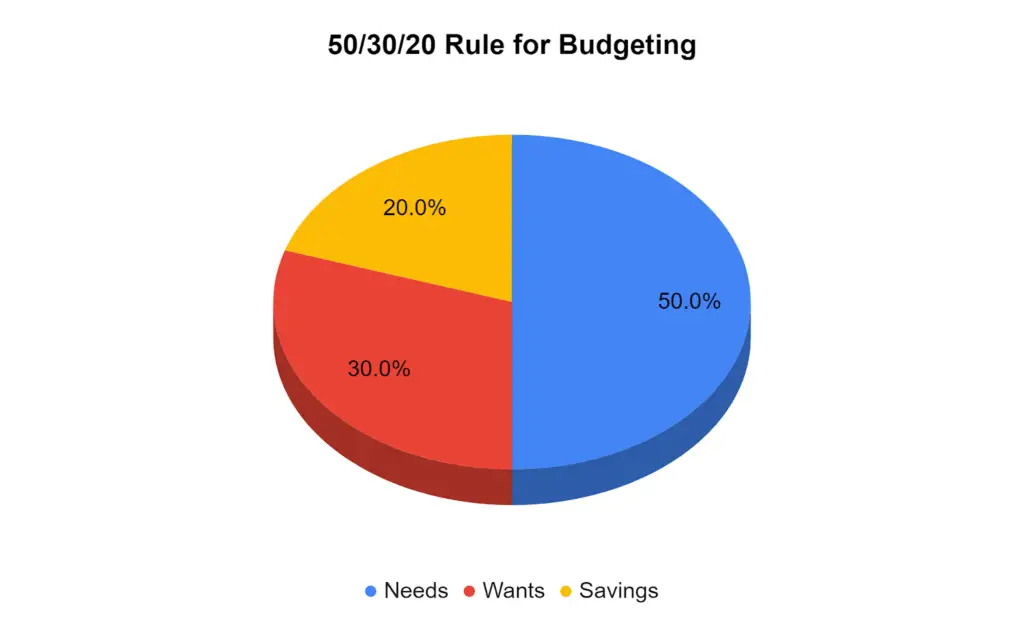

- The 50/30/20 Rule: A Pie Chart for Your Money

Let’s dive into a little hack called the 50/30/20 rule. Picture your income as a pie (money pie, yum!). The rule suggests you should slice this pie into three parts – 50% for needs, 30% for wants, and a solid 20% slice for savings.

Think of it as a pizza. Half of it is for necessary nutrition (cheese, tomato, base), 30% is for your favorite toppings (olives, peppers), and 20% is to share or save for later.

What if you used the 50/30/20 rule and managed to save $200 a month? In a year, you’d have saved $2400. Now imagine you invested that money in company X back in 2022, and it grew 10% each year. By 2023, you’d have $2640. How about that for a money hack?

Here are some additional tips on investing in various portfolios.

The Budgeting Tip Takeaway

So, remember, budgeting isn’t about being stingy or denying yourself pleasures. It’s about making informed decisions, like a general leading their army of dollars to a prosperous victory. Until next time, keep those dollars marching in the right direction!

FAQs

What are budgeting activities?

Budgeting activities refer to the specific actions and processes involved in creating, managing, and monitoring a budget. Budgeting is an essential financial management practice that allows individuals and organizations to plan and allocate their financial resources effectively. Here are some key budgeting activities:

1. Setting Financial Goals: Budgeting begins with establishing clear financial goals. This involves defining objectives, such as saving for a major purchase, reducing debt, or increasing investments.

2. Estimating Income: To create an accurate budget, it’s important to determine the expected income from all sources. This includes salaries, wages, investments, rental income, and any other revenue streams.

3. Identifying Expenses: A crucial step in budgeting is identifying and categorizing expenses. This involves listing all regular and discretionary expenditures, such as rent or mortgage payments, utilities, groceries, transportation, entertainment, and debt payments.

4. Prioritizing Expenses: Once expenses are identified, it’s necessary to prioritize them based on importance and urgency. This helps ensure that essential needs are met before allocating funds to discretionary items.

5. Creating a Budget Plan: A budget plan is developed using the information gathered. This plan outlines how income will be allocated to various expense categories, savings, investments, and debt repayment.

6. Monitoring and Tracking: Regularly monitoring and tracking expenses against the budget plan is essential to meet financial goals. This can be done manually or by using budgeting software or apps that help categorize expenses and provide visual representations of spending patterns.

7. Adjusting and Revising: As circumstances change, reviewing and adjusting the budget plan is important. This might involve revising income estimates, reallocating funds between expense categories, or making changes to financial goals.

8. Saving and Investing: Budgeting activities also involve setting aside funds for savings and investments. This includes creating an emergency fund, saving for retirement, and exploring opportunities for growth through investments.

9. Seeking Professional Advice: In more complex financial situations, seeking the guidance of a financial advisor or accountant can provide valuable insights and help optimize budgeting strategies.

Remember, effective budgeting requires discipline, regular review, and a willingness to make adjustments as necessary. By actively engaging in these budgeting activities, individuals and organizations can gain better control over their finances and work towards achieving their financial goals.

How to do budgeting as a student?

To do budgeting as a student, follow these simple steps:

1. Track Your Income: Make a note of all your income sources, such as part-time jobs, scholarships, allowances, or financial aid. This will help you determine the total amount you have available to allocate towards expenses and savings.

2. Identify Your Expenses: List all expenses, including rent, utilities, groceries, transportation, textbooks, school supplies, and entertainment. Categorize them into fixed expenses (e.g., rent) and variable expenses (e.g., dining out).

3. Differentiate Between Needs and Wants: Differentiate between essential needs and discretionary wants. Prioritize your needs to ensure they are covered before allocating funds to wants.

4. Create a Budget Plan: Allocate your income to various expense categories based on their priority. Set limits for discretionary spending and aim to save a portion of your income. Consider using budgeting apps or spreadsheets to track your expenses and monitor your progress.

5. Cut Costs: Consider ways to reduce expenses without compromising your essential needs. Consider buying used textbooks, cooking meals at home, using public transportation, or sharing expenses with roommates.

6. Plan for Unexpected Expenses: Set aside a small portion of your income for unexpected expenses or emergencies. This will help you refrain from relying on credit cards or loans when unforeseen costs arise.

7. Explore Student Discounts: Take advantage of student discounts offered by retailers, restaurants, and entertainment venues. This can help you save money on everyday expenses and leisure activities.

8. Increase Your Income: Look for opportunities to increase your income, such as taking on additional part-time work during holidays or finding freelance gigs related to your skills or interests.

9. Review and Adjust Regularly: Review your budget to track your progress and identify areas where you can improve. Adjust your budget as needed to accommodate changes in income or expenses.

10. Seek Financial Education: Consider attending workshops or courses on personal finance and budgeting specifically designed for students. This can provide you with valuable tips and insights to enhance your financial management skills.

Remember, budgeting as a student requires discipline and proactive decision-making. By closely managing your income and expenses, you can make the most of your resources and develop healthy financial habits that will serve you well beyond your student years.

How do you teach budget skills?

Teaching budget skills can be done effectively by following these steps:

1. Start with Basic Financial Concepts:

– Introduce key financial terms and concepts, such as income, expenses, savings, and budgeting. Use simple language to ensure understanding.

2. Demonstrate the Importance of Budgeting:

– Explain why budgeting is crucial for managing personal finances and achieving financial goals. Provide real-life examples to illustrate the benefits.

3. Set Clear Goals:

– Help individuals identify their financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund. Encourage them to set realistic and measurable goals.

4. Track Income and Expenses:

– Teach individuals to track their income and expenses. Show them how to gather information from pay stubs, bank statements, and receipts. Use tools like spreadsheets or budgeting apps to simplify the process.

5. Categorize Expenses:

– Help individuals categorize their expenses into fixed (e.g., rent, utilities) and variable (e.g., dining out, entertainment). Explain the importance of prioritizing needs over wants.

6. Create a Budget:

– Guide individuals in creating a budget plan based on their income and expenses. Show them how to allocate funds to different categories while leaving room for savings and unexpected expenses.

7. Develop Spending Strategies:

– Teach individuals strategies to manage their spending, such as the 50/30/20 rule (50% for needs, 30% for wants, 20% for savings), or the envelope system where cash is allocated to specific categories.

8. Encourage Saving Habits:

– Emphasize the importance of saving and guide individuals on setting aside a portion of their income for short-term and long-term goals. Explain the benefits of compound interest and the power of consistent saving.

9. Provide Resources and Tools:

– Share educational resources, budgeting apps, or online tools that can help individuals track their expenses, set financial goals, and manage their budget effectively.

10. Ongoing Support and Review:

– Offer ongoing support and encourage regular reviews of the budget. Provide guidance on adjusting the budget as circumstances change or new financial goals arise.

Remember, teaching budget skills requires patience, repetition, and practical examples. By simplifying complex financial concepts and providing individuals with the necessary tools and knowledge, they can develop the skills and confidence needed to manage their finances successfully.

What are some fun budgeting activities for college students?

Engaging in fun budgeting activities can make the process enjoyable and help students develop good financial habits. Here are some ideas for fun budgeting activities:

1. Budgeting Challenges:

– Set up budgeting challenges among friends or classmates. See who can save the most money or stick to their budget for a specific period. Offer small rewards or incentives to make it more exciting.

2. Savings Jars:

– Use clear jars or containers to create visual representations of savings goals. Decorate the jars and label them with specific objectives, such as a new gadget, concert tickets, or a weekend getaway. Fill the jars with money as you make progress toward your goals.

3. Budgeting Games:

– Explore budgeting-themed board games or online games that simulate financial decision-making. These games can make learning about budgeting more interactive and enjoyable.

4. Budgeting Simulations:

– Organize budgeting simulations or role-playing activities where students take on different financial scenarios and make budgeting decisions based on limited resources. This can help them understand the impact of their choices.

5. Budget-Friendly Cooking:

– Host cooking sessions or potluck events where participants are encouraged to prepare meals on a budget. Share budget-friendly recipes and tips for grocery shopping on a tight budget.

6. Financial Literacy Workshops:

– Collaborate with financial experts or organizations to conduct interactive workshops or presentations on budgeting for students. These workshops can include interactive activities, case studies, and discussions to make learning about budgeting more engaging.

7. Personal Finance Challenges:

– Create personal finance challenges that focus on specific aspects of budgeting, such as reducing discretionary spending, finding creative ways to save money, or exploring opportunities to earn extra income.

8. Budgeting Apps and Tools:

– Introduce students to budgeting apps or online tools that make budgeting more interactive and enjoyable. These tools often include features like goal tracking, expense categorization, and progress visualization.

9. Budgeting Contests:

– Organize budgeting contests or competitions where students can showcase their budgeting skills. Set specific criteria, such as the most innovative budgeting strategy or the best savings plan, and offer prizes to the winners.

10. Budgeting Workshops with Real-Life Scenarios:

– Present real-life budgeting scenarios to students and have them work in groups to develop budget plans. This can include scenarios like planning a trip, managing expenses during a semester, or starting a small business.

Remember, these activities aim to make budgeting engaging and relatable for students. By incorporating fun and interactive elements, students can develop a positive mindset toward budgeting and build essential financial skills for their future.