Knowing the difference between basic and supplemental life insurance is fundamental in choosing a suitable coverage plan for you. However, this will be impossible to achieve if you have little or no knowledge about life insurance.

Let’s cover the basics before we progress to more complex topics like supplemental life insurance.

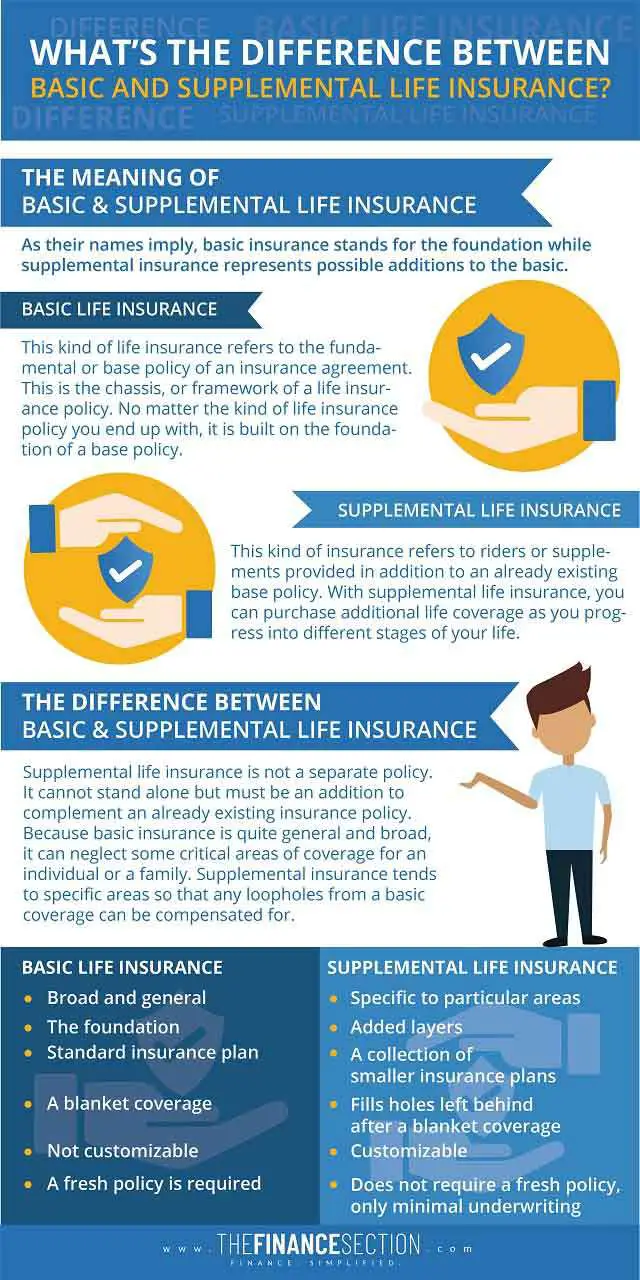

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/the-difference-between-basic-and-supplemental-life-insurance/

Key Points

- Life insurance is a great way to cover financial loss in the case of death. There are different types of life insurance policies that can be useful in different circumstances.

- Supplemental life insurance is an addition to basic life insurance. both types of life insurance work hand-in-hand but are very different.

- There are different categories of supplemental insurance, also called riders, that you can use to upgrade a basic life insurance policy.

- The cost of any kind of life insurance depends on several factors including your age, health, and income.

- Since supplemental life insurance is very flexible, you can determine how much of it you need to buy depending on your financial status and your need for coverage.

Life Insurance, Its Uses And How It Works

Life insurance is a private agreement between a policyholder (a person or group taking out an insurance policy) and an insurer (a company or person giving out the insurance policy). The policyholder will pay periodic premiums to the insurer. In exchange for this, the insurer will pay death benefits to the beneficiaries of the policy on the event of the insured’s death.

There are two main categories of life insurance from which others emerge:

- Term life insurance: this simple type of insurance covers a specific period, e.g. 25 years. Death benefits will only be paid if demise happens within this specified time.

- Whole or permanent life insurance: unlike term insurance, this type covers an unlimited period. Many whole life insurance policies also have living benefits. Whole insurance is more expensive than term insurance but also has varied benefits.

Apart from providing financial relief in the event of death, life insurance is also used for:

- Tax avoidance: Life insurance death benefits are tax-free. A permanent life insurance policy can be used to pay certain taxes to minimize tax liability. Tax avoidance is legal but and should not be confused with illegal tax evasion.

- Financing retirement: By taking advantage of the investment component of some life insurance policies, retirees can enjoy an income. However, the death benefit of such a policy would be lower than usual and the premium more expensive.

- Borrowing: Many whole life insurance policies accumulate a cash value which the policyholder might borrow against. A credit score is inconsequential in these cases and repayment terms are usually very flexible.

The financial support that life insurance provides can be very helpful to dependents of the policyholder or insured. You should consider buying life insurance if you are:

- A parent with minor or special-needs children

- A rich family with unpaid estate taxes

- A married pensioner

- A business with vital employees

- A young adult with student loans or who wants to take advantage of low premium rates as a result of young age

- An adult who co-owns a property

- A family who cannot afford burial expenses

With this background information, knowing the difference between basic and supplemental life insurance will help you make the right coverage decision.

The Meaning And Difference Between Basic And Supplemental Life Insurance

As their names imply, basic insurance stands for the foundation while supplemental insurance represents possible additions to the basic.

Basic Life Insurance

This kind of life insurance refers to the fundamental or base policy of an insurance agreement. This is the chassis, or framework of a life insurance policy. No matter the kind of life insurance policy you end up with, it is built on the foundation of a base policy.

Supplemental Life Insurance

This kind of insurance refers to riders or supplements provided in addition to an already existing base policy. With supplemental life insurance, you can purchase additional life coverage as you progress into different stages of your life.

The Difference

Supplemental life insurance is not a separate policy. It cannot stand alone but must be an addition to complement an already existing insurance policy. Because basic insurance is quite general and broad, it can neglect some critical areas of coverage for an individual or a family. Supplemental insurance tends to specific areas so that any loopholes from a basic coverage can be compensated for.

Since one individual’s supplemental needs will vary from the next, there is no general supplemental insurance plan but a bouquet of available options. Some people can even decide to go without the extra coverage from these supplemental plans and rely on the power of the basic plan alone.

| Basic Life Insurance |

Supplemental Life Insurance |

| Broad and general | Specific to particular areas |

| The foundation | Added layers |

| Standard insurance plan | A collection of smaller insurance plans |

| A blanket coverage | Fills holes left behind after a blanket coverage |

| Not customizable | Customizable |

| A fresh policy is required | Does not require a fresh policy, only minimal underwriting |

Do I Need Supplemental Life Insurance?

One major difference between basic and supplemental life insurance is that the former is a complete policy while the latter is only an upgrade. This means basic life insurance is somewhat necessary but supplemental life insurance is a choice. Supplemental life insurance is not required but highly desirable and extremely helpful in many situations. The good value of supplemental insurance varies depending on different factors. The type of policy, your health, your age, and the amount of coverage you need are some of the factors to consider.

Supplemental life insurance policies allow you to be very flexible with your coverage plan. You can pick and drop different riders or supplemental policies without abandoning your basic life insurance cover. For example, if you upgraded your insurance coverage through a rider because you started earning money, you can drop the same policy if your financial situation experiences a setback. All the while, your basic life insurance will maintain intact and you might only make a small loss from paying premiums for the rider. In some cases, insurers even provide supplemental policies that are transferable within their company.

Employer-Provided VS. Private Life Insurance

Many employers and private companies provide free basic life insurance for their employees. Since term insurance covers a specific period and is cheaper, this is a common option employees get from their employers. This type of coverage is not usually sufficient, especially if the employer has huge financial obligations or a big family. Employees can also obtain supplemental life insurance through their employers. There might be no medical exam required for this but this offer is usually very restrictive.

The solution seems to lie in privately purchased supplemental life insurance. it is a highly cost-effective way for employees to increase their coverage at a low cost with no stipulations. This option also puts the employee in charge. They can purchase the exact amount of extra coverage they need without the employer’s input. An employee can even leave their company and still keep their supplemental coverage.

Supplemental Life Insurance Policies You May Need

The great thing about riders is that they are 100% customizable. You can buy and add these supplemental life insurance packages to your basic life insurance for different levels of protection. You will be paying extra for this service, but the premium is fairly low as only a little underwriting is needed. Here are some common supplemental life insurance or riders you should consider:

• Accelerated Death Benefit: If you have this rider and are diagnosed with a terminal illness that gives you a short time to live, you have the right to receive your death benefits. Upon your death, the amount you received plus interest will be deducted from the final death benefits paid to your beneficiaries. This rider usually comes with little or no premium costs. Terminal illness is interpreted differently from one insurer to the other. Because of this, ensure you check the conditions before purchasing this supplemental life insurance.

• Accidental Death: This supplemental life insurance requires the insurer to pay more death benefits if the insured dies in an accident. This means you might get double death benefits if the cause of death is an accident. Because of this, many people refer to this rider as the double indemnity policy. This is an excellent additional policy for people who are the sole providers of their families.

• Guaranteed Insurability: This rider is only available as a supplement for whole or permanent life insurance policies. It allows you to increase and upgrade your coverage without requiring a fresh application for a new plan. With this rider, you don’t need a new medical exam to upgrade your plan. This supplemental life insurance is beneficial when significant life changes occur. Examples include marriage, the birth of a child, or increased income. With some insurers, this rider also lets you renew basic life insurance upon expiry without needing a new medical exam.

• Waiver of Premium: This rider permits you to stop paying premiums for your life insurance plan if you become permanently disabled. It also applies if you lose your job due to illness or injury before a specified age. The premium waiver is relevant to basic and supplemental life insurance policies. Ensure that you properly read the definition of disability before taking this supplemental policy because different insurers interpret disability in different ways.

• Family Income Benefit: In the event of the insureds death, this rider provides a steady income for the beneficiaries in the family. The policyholder has to decide how many years the beneficiaries will receive income benefits. This is a great way of ensuring your family members face fewer financial challenges because they will receive a monthly salary after you die.

• Long Term Care: Instead of buying a long-term care policy, you can use this rider to take money from your death benefits for long-term care. This means your beneficiaries will receive a lower amount upon your passing but it is more cost-effective than paying for a separate care plan.

• Child Term: This rider gives a death benefit if a child dies before a certain age. If the child reaches maturity, this rider can be converted to whole life insurance without requiring medical exams. Because children are highly unlikely to die, this supplemental life insurance can be very expensive but it helps cover burial expenses in the case of death.

• Spouse Life Insurance: This rider lets you add a limited insurance amount to your existing policy to cover your partner. The advantage is the lower cost. This type of coverage will not be as expensive as taking out a fresh insurance policy for your spouse. Because of the cheapness, this option might not provide adequate coverage for your spouse.

• Return of Premium: This rider allows you to pay a tiny amount as premium and have it all returned to you after the specified period. If you die before that specific period, your beneficiaries will be paid the premium amount. There are different variations of this rider, so make sure you understand the conditions before buying from any insurer.

• Term Conversion: This rider allows you to convert a term life insurance policy into a permanent life insurance policy. It is useful for people who develop health issues but are worried about the high cost of permanent life insurance. Most insurers allow you to seamlessly convert many parts of a term life insurance or this and will give you a reasonable cost for doing so.

What Factors Will Affect My Life Insurance Rates?

Apart from the likelihood of death, some other factors are considered to determine the amount of premium you will pay on a life insurance policy.

• Age: Your age will determine the cost of your policy and how much coverage is available to you. Younger people get better insurance rates because the risk of death is considered lower for them than older adults.

• Gender: Statistics show that women have a longer life expectancy than men. Insurers also consider that men have more dangerous jobs and hobbies and are more likely to drink and do drugs than women. Because of this, men are required to pay higher premium rates in most cases.

• Health: You will enjoy lower premium rates if your general health is sound. A medically underwritten policy will cost less than a simple policy because the insurer knows the risks of insurance in the latter.

• Family Health History: Insurers usually examine the general health of your family to get a better picture of your health. if sicknesses like cancer, heart disease, and diabetes are persistent in your family, your insurer can better understand the risk of covering you over time.

• Use of Tobacco: Because tobacco is harmful to your lung and presents extra dangers to your other organs, insurance takes greater risk of covering you if you use tobacco. If you want to quit tobacco usage before applying for a life insurance policy, make sure you have been tobacco-free for the required time.

• Driving Record: Especially in the case of an accidental death rider, insurers want to know your driving record. If you’ve had many recent cases of speeding infractions and at-fault collisions, your premium will be considerably higher.

• Type and Cost of the Policy: Whole life insurance will always be more expensive than a term life insurance. A $500,000 policy will also attract lower premiums than a $5 million policy.

• Occupation: You will surely pay more premium amounts if your occupation is considered dangerous. Some of the most dangerous jobs include deep-sea fishing, garbage collecting, truck drivers, and pilots.

• Hobbies: The thrill of being adventurous is exhilarating but it will attract a higher premium when you want to take out life insurance. If you regularly engage in dangerous hobbies like scuba diving, hunting, rock climbing, and motorcycle riding, expect to pay over $1000 extra in premiums per year.

• Credit Attributes: Your credit attributes are records that speak generally about your responsibility and responsiveness towards paying loans and making good financial decisions. This record can reveal if you want to purchase life insurance for legal or illegal purposes.

Supplemental Life Insurance Cost

The cost of supplemental life insurance typically depends on the type of coverage you want and how old you are. If the amount of coverage you have increases, your premium will also increase. When you’re older, your premium will also increase. The cost of employer-provided supplemental life insurance differs from private supplemental insurance in the following ways:

- Employer-provided coverage is usually cheaper for mature adults and less healthy people. If you are less likely to use such a policy, the extra cost might not be worth it even though it is cheaper than usual.

- Young, healthy adults might get cheaper and better supplemental coverage from a private policy than an employer-provided policy. This coverage will be more expensive but the flexible coverage that will last a lifetime makes it worth the cost.

The price difference between basic and supplemental life insurance might not vary widely in monthly cost but the cumulative payment will reflect the significant difference. For example, your basic policy could cost $20 a month while an accidental death rider costs $29 a month. The $9 difference might seem inconsequential for a month but the total value adds up to $108 at the end of the year

What Is A Good Amount Of Supplemental Life Insurance?

To determine how much supplemental life insurance you should buy, you must first consider your current financial situation. This will help you determine how much money is needed to cover the cost for which you are taking out the policy. Secondly, you must weight if the cost of the rider is worth the potential benefit. Answering the following questions will help you make a decision:

- Do you practically require the coverage of this supplemental now or in the near future?

- Can you do without it mentally and monetarily or will it keep you up at night?

The most ideal time to purchase supplemental life insurance is right after you take a basic life insurance policy. This will help you avoid any additional underwriting and potential extra medical tests when adding such riders in the future. However, in the event of a financial change or other life changes like a divorce, you should contact an insurance agent to advise you on how to go.

If the idea of shopping for life insurance has become more appealing to you, we advise that you compare insurance rates from different provides before making a purchase. Different employers and insurance companies will have different offers based on certain factors.

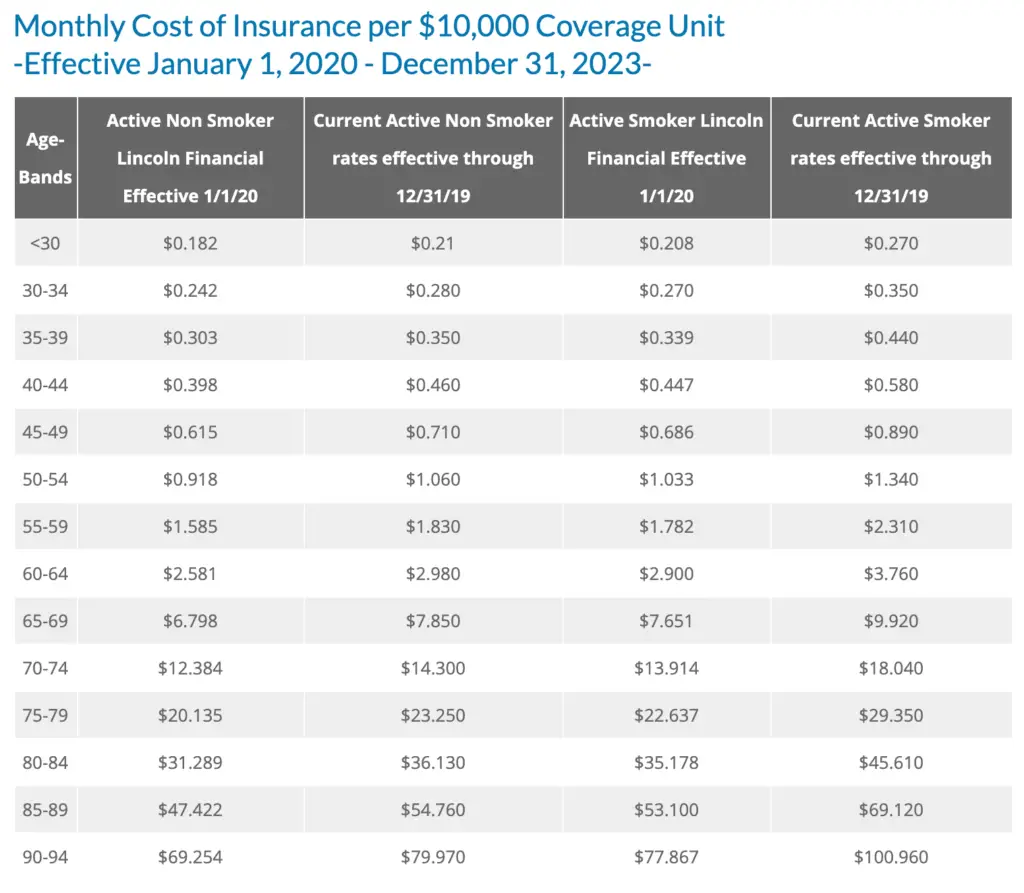

Cost Of Employee Life Insurance From Duke University

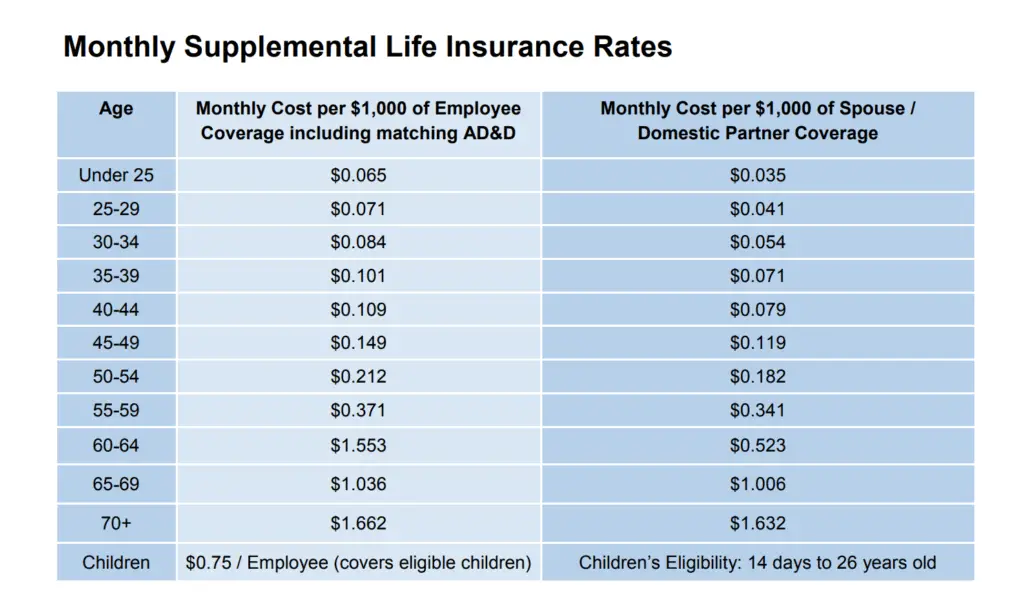

Supplemental Life Insurance Rates From UNC Medical Center

Policy Genius is a great tool for conducting online comparisons when shopping for the best life insurance policy. You can find out the difference between basic and supplemental life insurance costs as you compare costs.

The Bottom Line

Nobody looks forward to their death, but preparing a relief for your family in the event of your death is a very smart choice to make. Having the right type of life insurance has never been more important than it is now in a post-COVID-19 world. No matter your age or stage of life, you should consider a suitable life insurance plan for yourself and your loved ones. Basic life insurance is great because little coverage is better than no coverage at all.

However, supplemental life insurance is better as it gives you varied opportunities to boost your basic insurance with little or no financial implications. Make sure you understand your needs and adequately weigh the risk to reward before purchasing any life insurance policy. You can compare quotes online or employ the help of an insurance adviser to help you make the most befitting decision.