Enjoy watching videos? This video explains everything in this article, check it out!

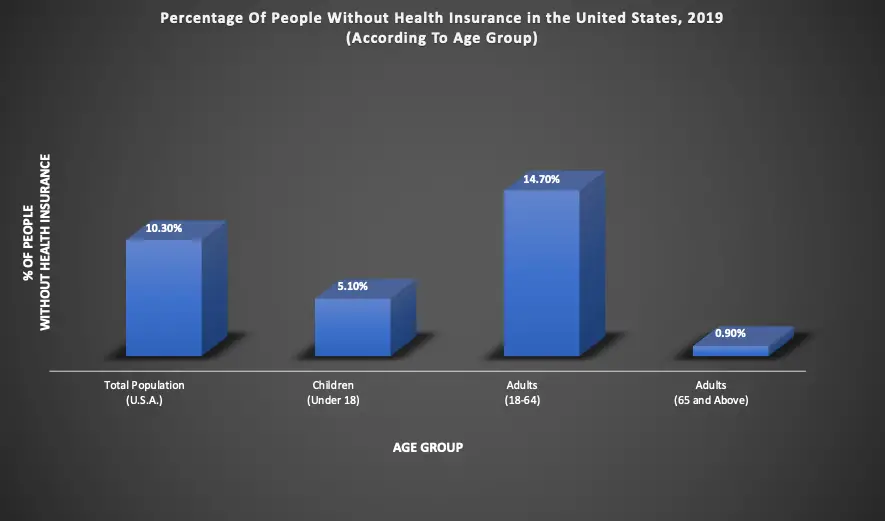

The Health Insurance Coverage Data provided by the National Health Interview Survey of 2019 shows that many people in the United States are without a health insurance policy.

Source: National Center for Health Statistics, National Health Interview Survey, 2019

We buy a health insurance policy to keep ourselves free from financial worries or financially safe during any unexpected medical emergencies. Sometimes, the same health insurance policy fills us with stress when we want it the least.

Do you know why it happens?

It happens when we do not know all about our health insurance policy or when we do not go through all its terms and conditions.

There are a few components of health insurance policies that, if not understood in advance, may affect you emotionally and financially while making a claim. One of them is the deductible in health insurance.

Today, this article is going to cover crucial information regarding health insurance deductibles. Being aware of deductibles in your health insurance policy will help you a lot not only in selecting the health insurance plan best for you but also in settling a claim.

What Is a Deductible In Health Insurance?

A deductible in health insurance is the pre-determined amount a policyholder should pay before making a claim. Out of the whole claim amount, a part is borne by the policyholder and the rest by the insurer.

Though a deductible is just a fraction of the insurance claim, it can still hurt the policyholder financially during the claim-making process. The deductible amount depends upon the limits and terms & conditions of the policy.

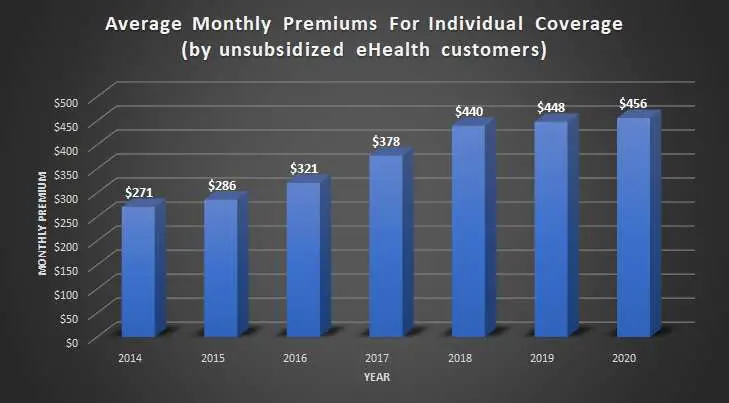

You might be knowing that to keep a health insurance policy in force or active, the policyholder has to pay premiums regularly. But most people don’t realize that those premiums are inversely proportional to the deductible (often).

It means when the premium is higher, the insured person has to pay a lower amount of the deductible before settling the claim. And in the case of low premium, the insured needs to pay a higher amount of deductibles.

How a Deductible in Health Insurance Works?

When you purchase health insurance, you seek protection against the unexpected expenses appearing in the form of medical bills.

Let’s understand it this way.

By buying a health insurance policy, you ask for the financial support from a health insurance company in times of need. In reply to this, the insurance company agrees to provide you the essential support (claim amount). However, it puts a condition that you have to pay a small first part (the deductible) of that financial support.

Most consumers agree to pay the smaller part before getting the big financial help from the insurer. Depending upon your health insurance plan and coverage, the insurer will calculate and tell you the deductible amount you are entitled to pay before making a claim.

Examples of Health Insurance Deductibles

To better understand what is a deductible in health insurance, you can go through the following examples.

Example 1: Suppose that Chris purchased a health insurance policy covering medical expenses of up to $50,000. According to the terms and conditions of this policy, the deductible amount is $10,000.

It means the insurance company will pay $10,000 less from the claim made by Chris. Yes, he has to pay this amount.

Last month, Chris had a major accident and was in the hospital for 23 days. His medical bill is $45,000, so he files a claim for the same.

Since the deductible amount is $10,000, the insurer will deduct this amount while clearing the claim. So, the amount Chris gets is:

$45,000 – $10,000 = $35,000

In other words, Chris will be paying $10,000 from his wallet. Every health insurance policyholder should understand that the claim amount for the insurer is exclusive of the deductible.

Example 2: Let’s understand it the other way. Chris purchased a health insurance plan that covers medical expenses up to $50,000. The deductible amount under this plan is $10,000.

Chris had a small accident and was in hospital for eight days. He received a medical bill of $6,000. So, he filed a claim for the same.

In this case, Chris will not receive any amount from the insurance company. It is because the claim asked ($6,000) is less than the deductible amount ($10,000). It means Chris will be paying the whole medical bill of $6,000 from his wallet.

Why is it so?

You might be having the same question. Why do health insurance companies refuse to settle the claim below the deductible amount?

It is a common practice by almost all health insurance companies, and the motive behind doing it is to prevent policyholders from making minor claims. It is also a way to ensure that claims made are genuine.

The information about deductibles is available in T&C (Terms & Conditions) or other relevant sections of the policy. Despite this, every policyholder does not know about deductibles in health insurance.

It happens because they do not read the policy documents properly. Another reason for this can be not getting correct information from their insurance advisor/ agent.

When you buy or plan to buy a health insurance plan, make sure you thoroughly read and understand its deductibles structure. Doing so will prevent you from undesired circumstances in the future.

Advantages of Health Insurance Deductibles

When people learn about health insurance deductibles, they often start thinking that it is beneficial only for the insurer. Well, it is not 100% true.

The following points prove that deductibles are beneficial for health insurance policyholders as well.

- It helps you avail the No Claim Bonus. With a deductible present in your health insurance policy, you make only essential claims, and sometimes they are zero. In this case, you become eligible to get the no claim bonus.

- It helps you practice the Responsible Filing of health insurance claims. The presence of deductibles in a health insurance plan means the policyholder will have to pay bills before the insurance company. So, you’ll file a claim only when the medical bill is more than deductibles.

- It helps you Save Money in the long run. The health insurance policies with higher deductibles have low premiums. As people don’t remain ill all the time, they might not require a health insurance policy with low deductibles. If you also own such a health insurance policy, your savings can increase in the long run.

The only thing most policyholders concern about is that they have to pay for the treatment if it is lower than or equal to the deductible amount.

Cost Sharing in Health Insurance

By now, you might have understood that a deductible is the fixed amount a policyholder pays every year for healthcare services. It is payable before the health insurance company starts sharing the expenses of covered healthcare services.

When you buy health insurance, you should properly understand the details of cost-sharing in the health insurance plan you consider to buy. Experts say it is mandatory to go through these details if you frequently use prescribed medicines or services.

One more thing you should note is that all these are out-of-pocket expenses. It means they are in addition to your premium amount and costs of services not included in your insurance plan.

Let’s try to understand the two most common types of cost-sharing in a health insurance policy:

• Co-payment

Co-payment, or co-pay, is a fixed and flat amount of fee set for prescription drugs, clinic visits, urgent care facilities, emergency room visits, and others. If you avail any of the services mentioned in your plan, you should pay this flat fee. The co-payment applies irrespective of meeting the deductibles.

For example, the allowable cost in a health insurance policy for a clinic’s visit is $120. Your co-payment is $25. Whether you have met your deductibles or not, you’ll pay $25 for visiting the clinic. If not, you’ll pay the entire fee of $120.

Co-pays can vary from one insurance provider to another. It may also be different for different services, such as $25 for a doctor’s visit, $50 for a pharmacy bill, etc.

• Coinsurance

Coinsurance is the fixed percentage of expenses your health insurance plan will be covering. Whether you visit a doctor or purchase medicines from a pharmacy, you’ll be paying this pre-decided percentage (coinsurance) of the expense.

Coinsurance is sharing the percentage of covered medical expenses. If you have an 80/20 health insurance plan, you will be responsible for 20% of the cost, and your insurer will pay the remaining 80% of the covered expense. Unlike co-payment, coinsurance applies after meeting the deductible amount.

For example, the allowable cost in your insurance plan for a doctor’s visit is $100, and the coinsurance is 25%. If you have reached the deductible limit, you’ll pay $25 to visit the doctor. The insurance provider will take care of the rest. In case you are short of the deductible amount, you’ll pay the entire fee of $100.

The percentage of coinsurance may vary from one health insurance company to another. It may also be different for different services, such as 25% for a doctor’s visit, 15% for pharmacy bills, etc.

Source: ACA Index Report on Unsubsidized Consumers in the 2020 Open Enrollment Period, June 2020

Frequently Asked Questions

Below are answers to some of the most frequently asked questions about deductibles in health insurance:

1. What is the significance of a deductible in health insurance?

There is a deductible in health insurance because it protects the insurance companies from false or small medical insurance claims made by policyholders.

The presence of a deductible is also advantageous for policyholders. It helps them realize to use the policy only for authentic cases. When this happens, there will be fewer fraudulent cases.

2. Can I get health insurance without any deductible?

Yes, you can get health insurance exclusive of any deductible. There are some plans, known as zero-deductible plans, that do not include a deductible.

You should note that zero-deductible plans come with a higher premium. If you often visit a doctor or take medicines regularly, a zero-deductible plan might be suitable for you.

3. My health insurance policy says ‘no charge after the deductible.’ What does it mean?

It means once you are done with the deductible amount for a particular year, the insurance company will not ask you for any other charges. Whatever be the health insurance claims, your insurer will settle them fully.

4. Which factors impact the calculation of health insurance deductibles?

Insurance companies consider certain factors while finalizing the deductible amount of a health insurance policy. They are:

- Policyholder’s current health

- Policyholder’s lifestyle

- Policyholder’s pre-existing medical condition (if any)

- Policyholder’s past health and medical conditions

If you think these factors may affect your health insurance policy’s deductible amount, consult your insurance advisor.

5. What should I consider before buying a health insurance policy?

Finding a suitable health insurance plan for your healthcare needs is often challenging. You can consider the following things before making the final decision.

• Healthcare Costs

Whether you use the covered healthcare services or not, you have to pay regular premiums. It is an out-of-pocket expense. Your health insurer will pay for your covered medical expenses only after the deductibles. So, think about these costs while researching a health insurance policy.

• Category of Health Insurance Plan

Health insurance plans are available in 4 “metal” categories – Bronze, Silver, Gold, and Platinum. These categories give you an idea about monthly premiums, deductibles, and costs involved in a health insurance plan. However, these categories are not the basis of the quality of services a healthcare facility provides.

• Network Types

Some health insurance plans allow its policyholders to use the services of any healthcare facility or doctor. Others limit this usage to a specific number of doctors and facilities. If the policyholder uses healthcare services outside of their network, they charge more.

Bottom Line

A deductible in health insurance is an out-of-pocket cost a policyholder pays before the health insurance coverage becomes active. Being aware of deductibles and other expenses is essential for every person seeking a health insurance policy.

Note that a deductible is different from premium, co-pay, coinsurance, and other expenses connected to a health insurance plan. To get the best policy, you should research thoroughly not only about the features but also about the costs involved.