If your loved ones rely on the income you bring in, then life insurance is a critical part of their financial future that you shouldn’t ignore. I know the topic is grim to ponder on. Although no one likes to think or talk about death, the short inconvenience of considering life insurance today will save your loved ones a long road of financial hardship when you’re gone.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/what-to-know-before-buying-term-life-insurance/

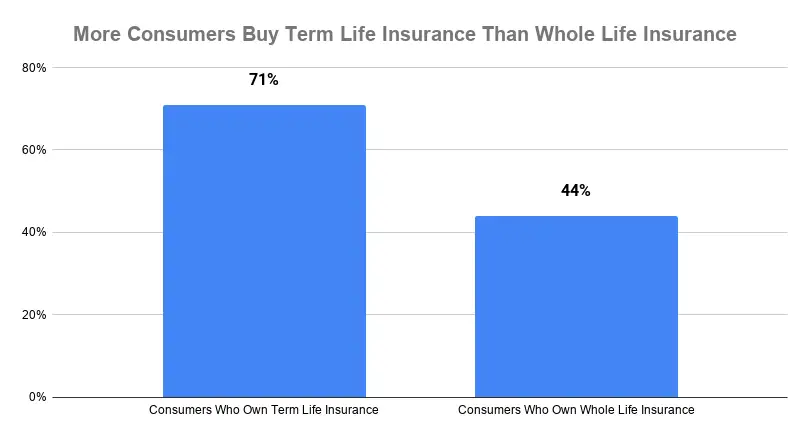

Term life insurance is more popular than whole life insurance policies. If you have done your research and are sure you also want to purchase a term life insurance plan, keep reading for what to know before buying term life insurance.

Source: Best Life Rates

Key Points

- Term life insurance is a popular choice amongst life insurance consumers. It offers insurance coverage for a limited tenure and will provide financial ease for your family if you die.

- Term life insurance is simple, flexible, and cheaper than whole life insurance.

Before you buy term life insurance, you should consider how much coverage you need, when to buy term life insurance, the future of your plan, and other factors. - Depending on your current situation and future needs, you need to answer the question ‘How long does term life insurance last?’ for yourself.

- There are some common mistakes people make when buying life insurance. you can avoid them by following simple rules.

Meaning Of Term Life Insurance

If you’re just starting to consider life insurance, you need to understand what it is. The two major types of life insurance are whole and term life insurance. While whole life insurance covers for the whole life of the insured, term insurance only covers for a specific amount of years. Whether it is 10, 20 0r 30 years, a death benefit is paid to the insured’s beneficiaries if they die within the term of the contracts.

Term life insurance used to be much simpler. The policyholder will be given a certain figure as the assured amount, coverage will be guaranteed until age 65 and premium could only be paid annually. Today, there are different types of term life insurance apart from traditional term including:

- Convertible term: allows the policyholder to convert a term life insurance to a whole life insurance a few years before expiry.

- Increasing term: the death benefit increases as the years go by. The policyholder gets to pay less premium earlier in life and more later on.

- Decreasing term: the death benefit decreases each year even though the premiums remain the same. The premium payment for this type is considerably lower than others.

- Annual renewable term: the coverage is renewed annually for a higher premium each year.

Advantages Of Term Life Insurance

Term life insurance offers some juicy benefits for policyholders. If you need some convincing to pick this option, here are some benefits to persuade you.

- Cost-saving: because term life insurance offers coverage for a fixed period, it is generally less expensive than whole life insurance. Life insurance companies pray for your good health and sustenance because they hope you outlive your term so they don’t have to pay out the death benefit. When compared to whole life insurance where you will receive a payout whether the contract matures or not, term life insurance is a good bargain for both parties.

- Flexibility: there are so many options with term life insurance. if you need to cover a short term obligation, you can lock in premium rates for a single year or five years. If you have longer-term demands like the tuition of your young children, you can opt for 20 or 30-year plans. With this level of flexibility, you can arrange for your contract to end when your need also disappears.

- Simplicity: I until the contract expires. f you don’t want to deal with overly complicated offers, term life insurance is the simplest cover to go for when you’re shopping. When you find a suitable insurance company, you only need to figure out the term length and coverage amount you want to get a contract up and running. After that, you only need to keep up with your premium payments.

- Perfect for a young family: because term life insurance is flexible and cost-effective, it is the ideal choice for many young families. Nobody wants to bear the weight of expensive premiums while paying a mortgage, saving for college, repaying an auto loan, and caring for young children. With term life insurance, you can have peace of mind that your family is financially secure without breaking the bank.

- Confidentiality: beneficiaries of a term life insurance policy enjoy added confidentiality. The amount of the death benefit is never disclosed as a public record. The beneficiary to whom the death benefit will be paid is also not public knowledge. This means the beneficiary of this policy can remain anonymous for protection.

10 Things To Consider Before Buying Term Life Insurance

Because there are so many options in the market, picking the right term life insurance coverage could become a daunting task. However, this should not be an excuse for you to give up. I have aligned 10 important points for you to note before you purchase a term life insurance plan. When you understand these things, it will become easy for you to choose the right fit. Here is what to know before buying term life insurance.

1. Why term insurance

Depending on your insurance needs and current life situation, you should consider the reasons for selecting term life insurance over options before moving forward with buying a plan. Although there is no saving component on term life insurance, it offers the best coverage for the lowest cost. The other benefits of term life insurance mentioned earlier can also serve as justification for your choice.

2. Who to insure

If you don’t have enough money to pay for your funereal, settle your debts, and replace your income for your family when you die, you need life insurance. this product isn’t only designed for active career chasing adults, stay at home parents that care for children should also have life insurance coverage.

3. Calculate how much coverage you need

How much coverage you should pay for is an important thing to know before buying term life insurance. Ideally, the value of your term life insurance coverage should be an amount that can cover your family upon your untimely death. To broadly assess this amount, you can use the following points for a quick calculation:

Firstly, estimate the monthly expenses of your loved ones and multiply the total amount by 150. That multiplication is to factor in inflation in the future.

Secondly, add all your liabilities together. This includes your loans, credit cards, home loans, etc.

Thirdly, subtract all your liquid assets including mutual funds, stocks, and the likes.

Fourthly, add the cost for planned expenses on achieving life goals within 15 years. Your child’s wedding or college degree is a good example of such a planned expense.

Lastly, add the retirement sum you would want your partner to have when he or she retires.

After considering all of these elements, you should have a good general figure to work with.

4. Determine the term of your contract

When you know how much coverage you need, you should move on to ask how long should your term life insurance lasts. The tenure for term life insurance is very flexible so you don’t have to be afraid about getting boxed in. however, take care not to buy too short or too long a term. If the tenure you choose isn’t long enough, it will elapse before your financial obligations pass. If it is too long, your premium rates could increase leaving you paying a lot for a product you don’t need.

As a rule of thumb, calculate the year that your liquid assets will equal or surpass your life insurance cover. That year, you will be the perfect age to not require term life insurance anymore.

5. Target high coverage value

Every consumer has a different underlying need when buying term life insurance. A key intangible factor for you could be the reputation of the insurer or the amount of premium while your neighbor might value the premium amount more. Whatever you consider valuable in a term life insurance contract, make sure your insurance provider has this. You’re going to be spending some years together in business. Those years should be rewarding, not unbearable.

6. Choose policy riders

If a traditional term insurance policy doesn’t cut it for you, there are many riders or add-ons you can utilize to get more coverage in your plan. Here are some popular choices to consider:

- Accidental death: if the insured dies in an accident, the insurer will pay an additional benefit in addition to the assured death benefit.

- Return of premium: the policyholder pays a more expensive premium but gets the full amount reimbursed if they are still alive when the contract expires.

- Waiver of premium: if the insured gets very sick or become disabled, further premiums will be waived.

- Guaranteed insurability: this allows the policyholder to buy more coverage within their plan without needing another medical exam.

- Accelerated death benefit: if the insured is diagnosed with a terminal sickness, they can take some of their death benefits.

7. Examine the claim-settlement ratio

The claim-settlement ratio indicates an insurance company’s efficiency in settling policy claims. If one company’s claim-settlement ratio is 89, it means they settle 89 out of 100 life insurance claims made to the company. It is always good when a company’s claim-settlement ratio is above 95. You can go ahead to search for an insurance company with a higher number than that but this isn’t necessary. There won’t be much difference between company A with 98 claim-settlement ratios and company B with a 98.5 claim-settlement ratio.

8. When to purchase

Life insurance usually becomes the most important every time someone hits a big milestone. Life-changing events like getting married, having a child, buying a home, or starting a business are some examples of these milestones. Although these are the times when people stop to think about life insurance, it shouldn’t be so. The right time to purchase your term life insurance plan is right now. Death doesn’t consider big milestones before coming up so you also shouldn’t. Secure adequate financial protection for your family now and not when something big happens.

9. Where to purchase from

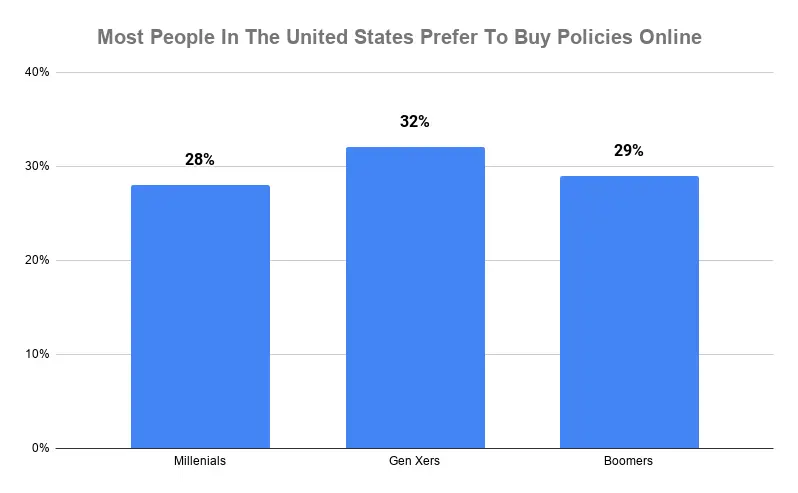

Source: No Exam

The best place to begin your search for the right term life insurance plan for your family is online. Most Americans already prefer to shop and purchase their life insurance policies online. There are many insurance providers available online providing awesome benefits and making it easier than ever to operate online. Also, many insurance companies offer lower life insurance rates online than they do in their offices and through their agents.

10. The future of your plan

When it comes to life insurance, you shouldn’t only listen to advisors and other third parties. It is important that need to understand the terms of your policy and check on it every year. You should know what is included in your policy, what cases are not covered, and any other special circumstances that have many interpretations. When you’re aware of all the fine points, you and your dependents will not be rudely shocked later on.

How Long Does Term Life Insurance Last?

Term life insurance can last from as little as five years to as much as 30 years. Some insurance companies offer up to 50 years. The flexibility of choice is an advantage but how then can you determine how long your plan should last? In number 4 above, I’ve given a general rule of thumb to follow when determining how long your term life insurance should last. However, this answer might be too general for everyone to follow. This list of the most common term lengths and who might need them will help you decide. Simply determine what category you fall into and you can decide from there.

10 years: this tenure might not seem long enough but it is surely the cheapest of them all. Apart from the cost consideration, you want to go for this plan if

- You are retiring within 10 years.

- Your mortgage took longer to pay than anticipated.

15 years: longer isn’t always better. When it comes to term life insurance, you might want to stick to a 1-year tenure if you are

- A homeowner with a mortgage.

- A parent.

- A caregiver for your old parent.

- Close to retirement.

20 years: this is the perfect choice for people who want longer coverage but don’t have a big budget to pay for it. This plan is great for

- Money conscious buyers.

- Parents with young children.

- A person who plans to retire in 20 years.

- A person with co-signed debts.

30 years: this long term life insurance plan offers customers the opportunity to lock in a good premium for an extended period. Although it is more expensive than the rest, it covers for long term needs. You should buy a 30-year term life insurance plan if you are

- A new homeowner.

- A newlywed couple.

- The breadwinner of your family.

- The parent of young children or a special needs child.

Mistakes To Avoid When Buying Term Life Insurance

Now that you understand what to know before buying term life insurance and how long term life insurance lasts, it’s time we educate you on some common mistakes to avoid when buying your plan.

- Waiting too long: the time you sent waiting to get adequate coverage leaves your family unprotected and vulnerable. In addition to that, the premium for term life insurance becomes more expensive as you grow older. Insurers generally believe that you’re more at risk of illnesses when you’re older.

- Not buying enough: your life insurance coverage should be 8 to 15 times your annual salary. The small life insurance coverage your office may provide is just not going to be enough. You need to properly secure your family’s financial future so they do not lack food, shelter, and other necessary amenities when you’re gone.

- Buying too short: you might think you’re saving money by purchasing a shorter term but discover you need longer coverage down the line and have to pay an increased premium rate in the future. Carefully consider the observations on the topic of how long does term life insurance last above before picking a tenure for your contract.

- Adding unnecessary riders: policy riders are a great way to add value to your traditional term life insurance contract. However, you don’t need a gazillion of them to meet your needs. Check that your term life insurance plan doesn’t automatically include necessary riders before considering them. Even at that, you should only buy what is necessary.

- Not reviewing your policy: it is a good practice to review your term life insurance contract periodically. Your needs 10 years ago might not be your needs today. You must review your contract against your current situation to ensure you’re still adequately covered.

Conclusion

Life insurance is not a fun topic but it is necessary. Although you may not fancy discussing your death, you owe it to your family to protect their financial lives even after you’re dead. By all means, you should get educated on what to know before buying term life insurance. this post has everything you need to properly understand term life insurance and all its perks before making the choice to purchase. Many questions including how much coverage do I need, how long does term life insurance last, and where should I buy term life insurance has been answered for added clarity. Make sure to share this with a friend who is in the middle of decision making to help them make the right choice.