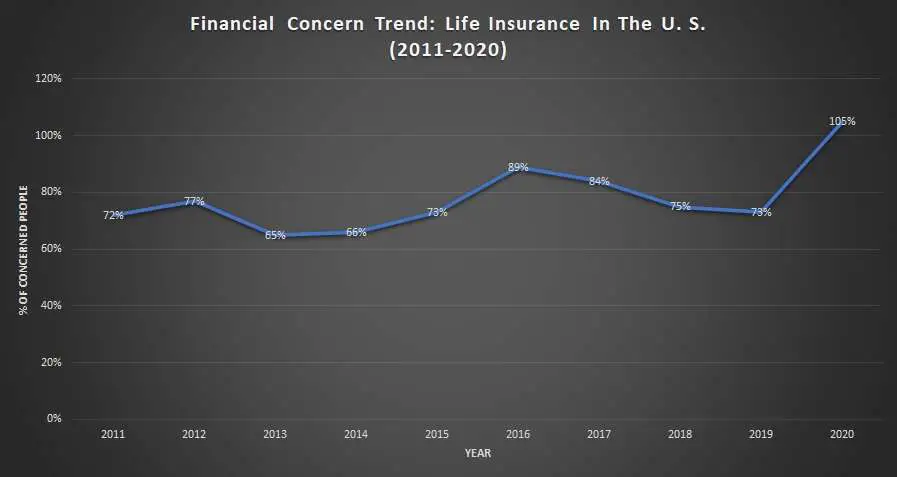

The study of financial concern trends of the past decade shows that people’s interest in life insurance products has increased significantly.

Source: 2020 Insurance Barometer Study, LIMRA

When people want to give financial protection to their family members, they often prefer life insurance over any other financial instrument. They get one and regularly pay the premium. But, one mistake many people make is overlooking the need to talk about the policy with their loved ones.

This mistake hurts their loved ones, beneficiaries, the most. When people die without informing anyone about their life insurance policy, the death benefit remains unclaimed. The purpose – providing financial protection – of buying a life insurance policy remains unfulfilled. Today, in the US only, hundreds of thousands of unclaimed life insurance policies are waiting to be discovered.

Do you think, or doubt, that some deceased family member or known person had appointed you as the beneficiary on his/ her life insurance policy? You can find the LI (Life Insurance) policy of that individual, confirm that you are the beneficiary, and claim the death benefit.

Sometimes the problem occurs when people know they are beneficiary but cannot find the LI policy of the deceased person to prove it. This article contains all the methods to discover the life insurance policy of a dead person.

Use this graphic for free, just source us with this link:

Source Link: https://thefinancesection.com/how-to-find-a-deceased-persons-life-insurance-policy/

Death Benefits on a Life Insurance Goes Unclaimed. Why?

There can be many reasons because of which the death benefits on a life insurance policy go unclaimed. Below are five of them:

- The insurance company not being aware of the death of the insured. In such cases, the beneficiary (if the person knows that he or she is a beneficiary) should inform the insurance company about the same and file a claim for the death benefit.

- The policy owner and insurance company are no longer in contact with each other. This situation is avoidable if the policy owner keeps the life insurer updated about any changes in his/ her contact details.

- The life insurance company no longer exists either because some other company overtook or it has shifted to a new location. To avoid such situations, the policyholder needs to document every change made to the name, contact, location and other things of the life insurance company. Doing so will also make things easier for the beneficiary while applying for a claim.

- The insurance company fails to locate the beneficiary nominated by the policyholder. The policy owner needs to provide comprehensive information along with the personal ID number of the beneficiary. It will simplify the verification process at the time of settling the claim.

- The beneficiary is unaware that the policy owner has appointed him/ her as the beneficiary. To prevent such instances, the policy owner must inform the beneficiary that he or she will receive the death benefits if the policy owner dies. The owner should also give the policy number as well as contact details of the insurance company to the beneficiary.

11 Ways to Find the Life Insurance Policy of a Deceased Person

It is essential to find the life insurance policy of a dead person. One should not waste time else the insurance company may use its cash value for premium payments.

There are several ways to find the life insurance policy of a dead person and claim the death benefit if you are the beneficiary. Below are some of them:

1. Search For The Policy Or Relevant Documents Of The Deceased Person

The first thing you can do is search for his/ her insurance policy. Try to find it in files, bank lockers, and other places you think it can be. You can also look for contact books and see if it contains information about any insurance company, attorney, or insurance advisor/ agent/ professional.

2. Get In Touch With The Life Insurance Company Or Financial Advisor

Whether you are aware of the insurer or found about it after following the above point, you should contact the life insurance company directly. The insurer keeps details about every policy. Officials over there may ask you to prove that the insured person is dead, and you are the listed beneficiary. So, be ready with the necessary IDs and documents.

If you find the details of any present or past attorney, financial advisor, accountant, banker, insurance agent/ broker, or any other professional, contact them. Try to find if they are aware of any life insurance policy on the deceased.

3. Search Online

Many websites over the internet have search tools that help people search for unclaimed death benefits. You can Google them, and when found, provide the name of the deceased person. These tools will search online and provide you the relevant information (if found).

You may also come across companies promising to search for the life insurance policy of your loved one. There are companies, and they charge for doing this work. However, the price may vary from one service provider to another. If you are hiring a company to find the policy, make sure you have researched thoroughly. Doing so will protect you from scammers.

4. Talk To Family Members, Friends, And Acquaintances

Try this step when you are unsure and want to know whether the deceased owned any life insurance policy or not. Talk to family members and try to pull out some information. Sometimes people avoid discussing finance-related matters with their family members. So, talk with close friends, doctors, spiritual leaders, social group members, and other acquaintances of the deceased person. They might be knowing something useful to you.

5. Contact Former And Current Employers

You can contact the former and current employer of that person. Most people get low-cost insurance when they work somewhere. If your loved one was an employee somewhere, get in touch with his/ her employer. There might still be an active life insurance policy.

6. Review LI Policy Applications

When you buy a life insurance policy, the insurer often asks you to provide information about other policies also. If you find an LI policy of the dead, look for its application. If that person owned other life insurance policies at the time of applying, their details might be available on the application form.

7. Contact The Insurance Commissioner Of Your State

Find and contact the office of the insurance commissioner in your state. When you request them to find about the LI policy of a deceased person, they will make an official inquiry to discover any such life insurance policy.

If the office finds that a policy exists, the officials will make contact. But if you are not the authorized party, they will not contact you. In this case, the beneficiary gets a call.

8. Evaluate Income Tax Returns

The next thing you can do is check the deceased’s income tax returns for the last two years. Find out if any interest income came from insurance companies or any interest expenses shelled out to the insurer.

It is because when a policyholder takes a loan on his/ her life insurance policy, the insurance company charges interest on that loan. Moreover, the insurer pays interest on permanent policies, etc.

9. Evaluate Bank Statements

Find about the bank accounts of the dead, and evaluate the bank statements. If that person had a life insurance policy, you might find traces of premium in those statements. There can be chances of automated payments were made to the LI company in the past. Find out and take the necessary steps.

10. Check mails

Insurance companies often send the dividend or premium notices to the policy owner. If the deceased had a life insurance policy, the insurer might have sent a mail to him/ her. In case no premium is due, there will not be any notice. However, the insurer can still send the annual information about the policy status or dividend. So, it becomes crucial to check the mails.

11. Search MIB Database

The MIB database is not a central database of life insurance policies. But, it can help you to find the individual life insurance applications processed after 1st January 1996. Note that you need to pay for this service. However, there is still no guarantee of getting accurate results. So, these are the 11 ways you can try to find the life insurance policy of a deceased person. By trying these methods, you can find any missing life insurance policy.

Frequently Asked Questions

When it comes to discovering the life insurance policy of someone no longer in this world, people get different types of questions in their minds. The above section answers most queries. Below are answers to some more FAQs about finding the life insurance policy of a deceased person.

1. Why is it necessary to find the life insurance policy of a deceased person?

There can be many reasons to find the life insurance policy of a deceased person. If you think or know that you are a beneficiary, it becomes vital to discover the LI policy.

Another reason makes quite a sense. You might be knowing that when some insured person dies, there is no need to pay the premium. However, the real problem occurs when the policy has an APL (Automatic Premium Loan) feature, and the insurance company is not aware of the death. The premium is regularly deducted from the cash value. It remains in force until the cash value becomes zero, and lapses after that.

In such cases, it becomes essential for beneficiaries to inform the insurance company about the demise of the insured person.

2. I am a relative of the deceased. Can I file a claim for his lost life insurance policy?

Relatives of the deceased can claim for a lost life insurance policy. They have to prove the following two things:

- They are the beneficiaries appointed by the policy owner. Officials may also ask for ID and residential proofs.

- The policy owner is no more in this world. Officials may ask for the death certificate of the deceased person.

If you are the beneficiary but not a relative of the policy owner, then also you can file a claim on the lost life insurance policy.

3. What happens when the death benefit is not claimed by anyone?

When no one claims the death benefits, insurance companies transfer that unclaimed money to the office of the state’s unclaimed property. It is usually the State Treasurer office. You can get the contact information about your state’s office by visiting the website of The National Association of Unclaimed Property Administrators.

4. What information do I need to provide while filing a claim?

When you file a claim, you need to provide the following information about the deceased person and yourself:

- Full name of the dead, inclusive of maiden name

- Identity proof or the Social Security Number (SSN)

- Death certificate of the policy owner

- Document proving that you are the beneficiary

- Your identity proof

These are a few common ones, but the actual requirements may vary from insurer to insurer. The best you can do is get in touch with the life insurance company which issued the policy. It will guide you with the whole process.

5. I know there was a life insurance policy but can’t find out the insurer. What should I do?

In this event, you can contact the office of the insurance commissioner of the state where the policy was bought. Such offices have access to tools that help you find the insurer who issued the life insurance policy. Before contacting the office, be 100% sure that a LI policy exists on the deceased person’s name. You can also get in touch with The National Association of Insurance Commissioners (NAIC).

Final Words

People buy life insurance policies to secure the financial future of their loved ones. But, the same LI policies are of no use if the beneficiaries couldn’t find them. Today, there are several ways to search for the lost life insurance policy of a deceased person. If you are sure or uncertain about the life insurance policy of a deceased person, the methods mentioned above will not disappoint you.